To our followers,

Below is a special limited time offer to join BAD BEAT Investing. In addition, we offer you another trade below that went out to our members which is up over 10% in two weeks.The article is located in the middle of this blog, but please consider signing up for free to join our service. 90% stay on, so why not you?

For a limited time you can now get 10% OFF the already 46% discounted annual rate. Instead of paying $924, you can get in for $445 for the YEAR. This offer is available to the next 7 subscribers, or by the end of Labor Day, whichever comes first!

You came to this financial forum to learn and make money right? Well our top performing ideas and rapid-return trades are exclusive to our members only forum, but we are offering our founding members a lifetime locked in rate that equates to $1.18 per day. That is less than a cheap cup of coffee! Lets go!

There is no reason NOT to sign up as for a limited time only, we are ALSO offering a FREE TRIAL (CLICK HERE TO START THE FREE TRIAL). What are you waiting for?

A BAD BEAT?

A bad beat is a poker term for a hand in which a player with very strong cards loses to an opponent who is statistically unlikely to win. In other words, it was not supposed to happen that way. How does this relate to investing?

Sometimes a company is doing everything right and the market hands it a bad beat following an event such as earnings, crushing the stock. Sometimes general sector malaise brings down a stock of a strong competitor unfairly. Occasionally the market is just wrong, causing investors to misplace bets. We've built a brand around these special situations, designed to deliver outsized short-term and medium-term returns.

What do I get?

The service is two-pronged. We offer 2-4 ideas per week after screening hundreds of stocks to identify fast moving trades that can generate sizable returns in days to weeks. These trades are rooted in technical analysis and the fundamentals. We also identify 1-2 DEEP VALUE ideas per month. These are high conviction, top ideas that offer long-term gains and significant alpha. So far, in the first three months of the service, we have a 92% winning rate. That is far and above our own expectations! START WINNING NOW.

The philosophy

Like a quality poker player's bankroll, a quality company’s stock is quick to rebound by continuing to execute effectively while positioning favorably.

We seek to identify special situations. We have identified these opportunities for years, and now seek to leverage our brand to build a profitable community around these situations.

We invest to take advantage of massive market mispriced situations with the goal of producing outsized returns through our BAD BEAT Investing philosophy. We've had hundreds of successful calls that delivered outsized over the past couple years.

--------------------------------------------------------------------------------------

THE TRADE

Today's column highlights Weight Watchers (WTW). Today's selloff is being driven by a 6 million share block trade being shopped by Morgan Stanley at $76 to $77, according to Bloomberg. The shares are being unloaded on behalf of WTW holder Artal Luxembourg. The company won't receive any of the proceeds from the share offering, but this sale, which appears to be profit taking, is creating opportunity here.

Before delving in to the material we want to begin by acknowledging the market is becoming incredibly volatile of late, opening up opportunity but increasing the likelihood that some trades will face stop loss risk at a higher than usual rate. While we aim to pick our spots as best we can, tilting the odds in your favor, remember to be disciplined. It is ok to take some small losses when trading. We will always have winners that more than make up for our tight, strict discipline.

Shifting back to the stock at hand, a plethora of positive items have converged to drive Weight Watcher's best operating results in several years. This is a name we have traded in year's past on pullbacks, and we believe the name is setting up for a possible bounce once again. Take a look at the bull run in just the last two years:

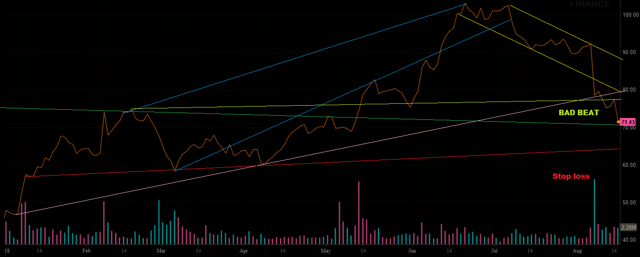

That is a great chart when you own any stock. However, the year-to-date results, while showing the stock is still up, help us identify what appears to be a support line for the stock after a 30% plus pullback in the last 6 weeks, which has been exaggerated by a recent earnings report that we thought was incredibly strong, but just fell short of subscriber growth estimates. More on that in a moment. Take a look at the chart where we have identified our technical zones:

While there is a lot going on and the next few days of action could see the name emerge in a more defined pattern, we think a 30% punishment in the stock is overkill for the growth being displayed by the company. Our target play here, based on the technical zones but backed up by the fundamental discussion below is as follows:

Target entry: $70

Stop loss: <$65

Target exit: $78-82

Estimated time: Two-three weeks

Fundamental discussion

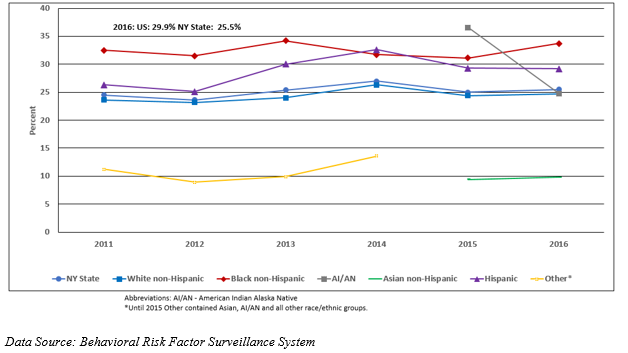

Obesity and related health problems are major reason for concern all over the world, and companies in the business of fighting obesity will be facing abundant demand over the long-term. In the United States, and in New York where we are based, Over 25% of the population is obese, and these trends are only ticking higher in recent years:

Clearly, it is an issue. Couple the health reasons with the vanity aspect (people want to 'look good') and we have a reason to believe that company will continue to grow subscribers.

The company has gotten a pretty big boost in recent years exposure wise with celebrity endorsements. Media personality Oprah Winfrey was the first celebrity to endorse Weight Watchers, and she has a massive stake in the company. This really propelled this company from left-for-dead to growth-engine through huge subscriber growth in the last two years or so. Recently, Weight Watchers has extended its celebrity endorsement net to include rapper DJ Khaled and filmmaker Kevin Smith. The addition of two male celebrity endorsers has grown Weight Watchers' addressable market, and we believe men will continue to be a large source of growth for the company in coming quarters.

There is no doubt that Weight Watchers has an attractive business model, since high-margin monthly subscriptions account for approximately 80% of Weight Watchers’ total revenue.

Most of the company’s members join with a three month or longer commitment and receive a discount for the initial period. On a global basis, average retention rate is over nine months in both meetings and online programs, and retention rates have 16% increased in the past three years.

Valuation attractive at $70

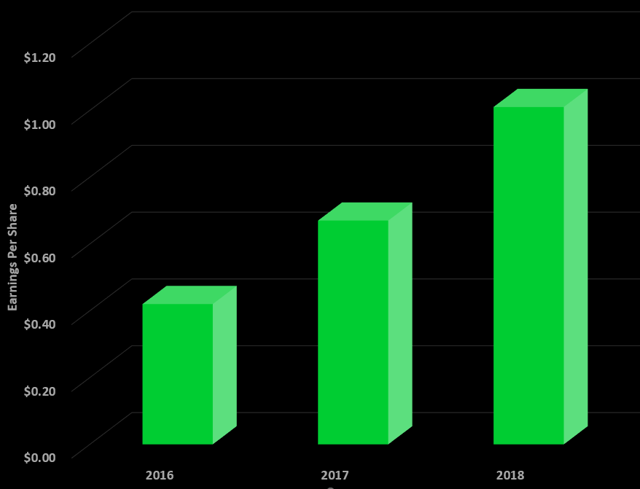

After a 30% plunge, we think there is value at $70, which makes the case not just for a trade, but for a longer-term position if you so choose. Wall Street analysts are on average expecting the company to make $3.00 per share in 2018 and $3.83 in earnings per share during 2019. Under this assumption, the stock is trading at a forward price to earnings ratio around just 18.2 times earnings. This is attractive for a company that is generating revenue growth rates in the neighborhood of 20% in combination with expanding profitability ratio and earnings growth. If earnings expand $0.83 from 2018 to 2019, this would be growth of 27.7%, suggesting the stock is trading at a discount to forward earnings growth.

Performance

As you know, financial performance analyzed in isolation doesn't tell the whole story. The numbers relative to expectations can have a much stronger impact on stock prices, and this 30% pullback is evident of that. The company wasn't priced for perfection, but was priced for strong performance. In the most recent quarter, the company If the company is doing better than expected, chances are that this will push the stock price higher over time

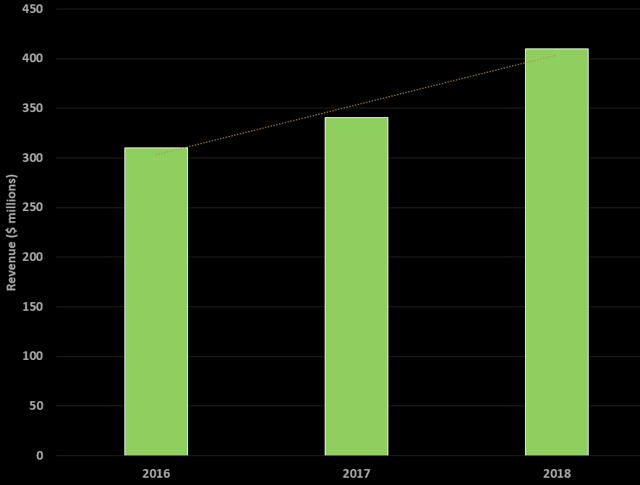

Take a look at the revenue and earnings growth in just the last few second quarters alone:

Lets talk about the details a bit more. Overall the market wanted a little more growth, 4.6 million subs. The company delivered 4.5 million subs. It also BEAT on revenue AND earnings expectations! End of period subscribers in Q2 2018 were up 27.6% versus the prior year period, driven by growth in all major geographic markets. Q2 2018 end of period meeting dubscribers were up 11.1% and end of Period online subscribers were up 38.8% versus the prior year period.

It gets better. Total paid weeks in Q2 2018 were up 27.3% versus the prior year period, driven by growth in all major geographic markets. Q2 2018 Meeting paid weeks increased 10.3% and Online Paid Weeks increased 39.8% versus the prior year period.

As you saw above, revenues in Q2 2018 were $409.7 million. On a constant currency basis, Q2 2018 revenues increased 17.6% versus the prior year period, and beat estimates. Going into this we saw service revenues of $343.7 million. On a constant currency basis, these revenues increased 19.2% versus the prior year period. This increase was driven by growth in all major geographic markets. Product sales were $66.0 million. On a constant currency basis, these revenues increased 10.0% versus the prior year period.

Overall operating income in Q2 2018 was $127.7 million. On a constant currency basis, operating income increased 29.7% versus the prior year period.

The company ALSO RAISED EXPECTATIONS. It raised its full year fiscal 2018 earnings guidance to between $3.10 and $3.25 per fully diluted share. Prior earnings guidance was between $3.00 and $3.20 per fully diluted share. This guidance increase reflects the operating strength of the company's business and expected continued global momentum through the year.

Overall, the selloff is overdone.

-------

THESE ARE THE KINDS OF TRADES YOU WILL GET SEVERAL TIMES A WEEK!!!

CLICK TO SIGN UP NOW--> YES I LIKE WINNING I'M IN

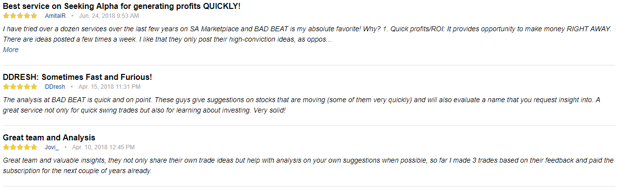

Still not convinced? Even for a $1.18 a day? Well, here are some reviews:

The latest review:

Here are just a few of the WINNERS we have pegged for medium-term holdings

- Tiffany & Co (TIF) 53% return in 6 months

- Planet Fitness (PLNT) 150% return in 18 months

- Thor Industries (THO) 159% return in 18 months

- Vail Resorts (MTN) 107% return in 18 months

- Boeing (BA) 116% return in 24 months

- Exelixis (EXEL) 625% return in 36 months

Want even more rapid returns, take a look at some trading gains

- Plug Power (PLUG), 221% return in 3 months

- Madrigal Pharmaceuticals (MDGL), 163% return in 10 weeks

- Planet Fitness (PLNT) 50% return in 3 months

- Prospect Capital (PSEC) 43% return in 3 weeks

- Abercrombie & Fitch (ANF) 27% return in 4 weeks

- The Meet Group (MEET) 65% return in 5 weeks

- Cal-Maine Foods (CALM) 59% return in 6 weeks

- Express Inc. (EXPR) 86% return in 15 weeks

We also protect you on the downside when we see traps

- Frontier Communications (FTR) 86% decline in 12 months following our unsustainable call.

- Windstream Holdings (WIN) 44% decline in 6 months following our warning

- Bed, Bath and Beyond (BBBY) 35% decline in 6 months following our weakness warning

- Prospect Capital (PSEC) 23% decline in AFTER accounting for distributions in 6 months.

Top ideas ahead of time

Our top 2016 idea was Dave and Busters (PLAY), returning 70%through 18 months

Our top 2017 idea was Bank of America (BAC) returning 54% through 13 months

And note, these are not cherry picked as our best results...but they were identified as top plays ahead of and during the year!

We have several 'Top Ideas' for 2018, both for trades and long-term investments, and just ONE of which has been publicly revealed, and another which return 25% in 3 days after suffering a BAD BEAT that we identified as a conviction buy for both a swing trade AND deep value investment.

But wait, there's more!

Each week, we will also offer exclusive earnings coverage and analysis to identify both rapid-return speculative opportunities, and misplaced bets. We dig into earnings and fundamentals to extract value, identify patterns, and spot strength (or weakness)- similar to a poker player maximizing his returns in every pot while minimizing potential losses. Our best ideas come in the form of deep long value opportunities while leveraging data at hand to spot special situations for rapid-returns.

We've built the BAD BEAT Investing philosophy and the Quad 7 Capital brand around TIMELY coverage of key events. Not just 'what happened,' but how and why it happened. Most critical, we discuss how to approach the situation.

We have provided the best earnings coverage in the world in the past for a single shop, and have made some of the most profitable calls in Seeking Alpha's history. In fact, we delivered the second highest three month return of ANY SA financial opinion maker in 2014, with our call on Plug Power (PLUG) rising 221% in three months.

Our BAD BEAT coverage is not limited to any one sector, but we have particular expertise in:

- Telecoms

- Industrials

- Retail

- Restaurants

- Oil and gas

- Financials, with a focus on regional banking

- REITS and BDCs

- Biotech

- Precious metals and mining

When you join BAD BEAT Investing, you adopt a community philosophy that incorporates strategic planning and quality improvement.

In a perfect world, we would maximize returns, and minimize losses. Well we strive for perfection. But we recognize that "we can't win em all." Not every idea will work out. That is why you have to "know when to Hold'em, and know when to Fold'em." We translate this poker analogy into recommendations for stop losses, entry points, reversion to the mean plays, exit targets, and more. So while we are going to take short-term risk to enhance our long-term gains from our value plays, we are going to know when to get away and move on. Knowing when to fold a hand, or in this case sell at a loss, and move on, is the greatest sign of a winning player/investor.

Participate in the live chat, and get questions answered immediately via chat, text, or email. Peruse ideas, until you find something that works for you. Employ our strategy, and know when to Hold'em, and when to Fold'em.

Tuition at a discount

Our membership dues are substantially lower than other longstanding top contributors. We believe that our WINNING philosophy should be shared by as many as possible. It takes a single trade to pay for our service. But its not just about returns.

What you will learn, and the community that builds around the philosophy, has value beyond annual returns. It will help you begin to identify these situations and put your hard earned money to work, for YOU.