Prepared by Chris

On behalf of Tara, Stephanie, and John at Quad 7 Capital and BAD BEAT Investing I want to wish those of you stateside a very happy Fourth of July weekend. This happens to be my favorite holiday of the year, and we are celebrating by offering a free trade idea from BAD BEAT Investing below, as well as discussing the meaning of the holiday to our service.

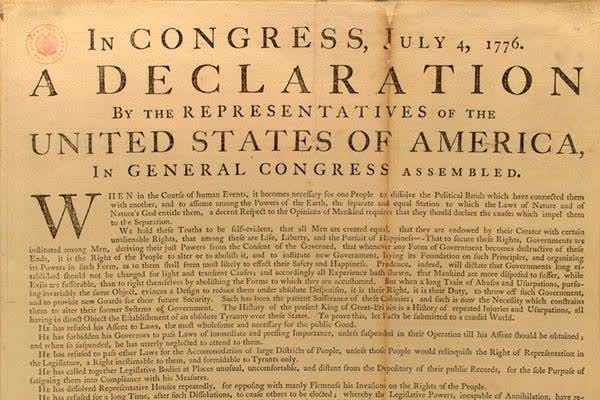

On July 4, 1776, the Continental Congress adopted the Declaration of Independence, "declaring that the thirteen American colonies were no longer part of the British Empire but now the United States of America," the U.S. Government Publishing Office says.

The Library of Congress explains: "The Constitution provides the legal and governmental framework for the United States, however, the Declaration, with its eloquent assertion 'all Men are created equal,' is equally beloved by the American people."

While there are now scores of political divides across the country, one thing remains true, I may not agree with what you say, but I will defend to my death your right to say it.

In the Declaration of Independence, there is one line that stands out to me.

But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.

While this is in reference to the crimes committed by King George and the British empire, the spirit of the language is why I started Quad 7 Capital years ago, and then started an exclusive idea generation trading service with a team of other traders at BAD BEAT Investing. I was tired of the every day, retail investor who is just trying to make a few extra bucks, or save for college, or bolster income in retirement lose their money trying to trade. I share my playbook with members, the one put together of my own beats. You cannot rely on others for your own security. You must do it yourself. We show members how we enter and exit trades, with clear reasons, clear targets, and so much more. If you are interested in joining, we are offering our semi-annual sale, for '76 hours we are taking 15% off the price. You will not see another discount like this again until the holidays. This offer will go live at 1:30PM today and is limited to the first 7 signups. These offers generally run out in the first few hours, do if you are interested, do not delay.

You may recall, we stopped offering free trials some time ago, and began focusing more and more on the service. This is your chance to join the service today well below what others are paying. There is also a money back guarantee from Seeking Alpha if you are unhappy in the first 30 days.

What would you get?

What you get at BAD BEAT Investing is access to our team. DIRECT feedback and suggestions. We do not pump out articles for the sake of articles. That is what the public site is for.

We have six different chat rooms:

The main trading room, BAD BEAT Investing (constantly busy with trader inquiries and ideas)

Speculation and high risk plays (our most profitable and popular room)

Short ideas (a room to discuss short ideas)

Options only (a room for option trades, spreads, condors, butterflies etc)

A catch-all "how do I"? room

The VIP Room---For members who have been with us more than one-year, a room with afterhours attention and extra ideas

In our service, we spot fast moving ideas that generate significant returns in weeks or months, along with great longer-term picks. I am so thrilled to see the growth of the marketplace and BAD BEAT Investing's membership grow into 100s of traders. Most importantly, we are making money for members.

BAD BEAT Investing is a service of Quad 7 Capital that focuses on generating rapid returns, with monthly deep value finds. Once a member has been with us for over a month they are entitled, by request, to an exclusive portfolio review by the team, valued at $1,500 as our team meets and goes over your holdings and detailed feedback is provided on each ticker held.

See what our members have to say:

YES I WILL TRY BAD BEAT Investing

No thank you, please just give me the trade idea.

The trade idea: This is the type of article we send to members once or twice a week as part of the service, on top of our extensive coverage of tickers in our chat rooms.

Renewable energy is energy from sources that are naturally replenishing but flow-limited; renewable resources are virtually inexhaustible in duration but limited in the amount of energy that is available per unit of time.

The major types of renewable energy sources are Biomass, Wood and wood waste, Municipal solid waste, Landfill gas and biogas, Ethanol, Biodiesel, Hydropower, Geothermal, Wind, and Solar.

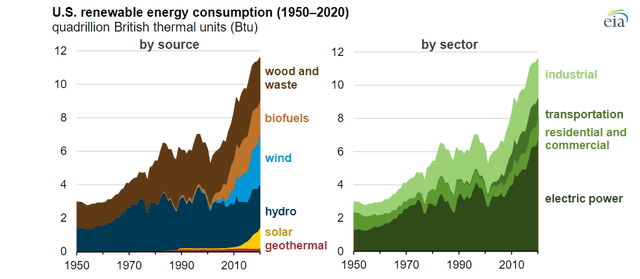

Oddly when many think about renewables, they usually only think of solar and wind, maybe water. With ESG investing catching on, and the continued push for renewable fuels really taking off, you need some exposure. We have traded some of the biofuel names, and solar stocks in the past. However, they generally make for better long-term investments. This is because the worlds energy consumption is drastically changing.

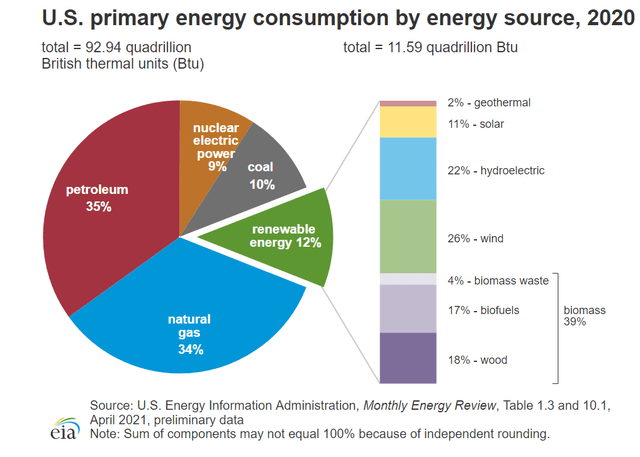

But even after the major push, renewables are still such a small slice of consumption. But that is projected to grow. In 2020, consumption of renewable energy in the United States grew for the fifth year in a row, reaching a record high of 11.6 quadrillion British thermal units, or 12% of total U.S. energy consumption. Renewable energy was the only source of U.S. energy consumption that increased in 2020 from 2019; fossil fuel and nuclear consumption declined.

We are approaching exponential growth on the long-term chart for renewable consumption:

If we dig deeper, we can see the main renewables are still popular, and there are many different stocks and ETFs you can consider.

You should own something long-term.

Wind energy, or electricity generated by wind-powered turbines, is almost exclusively consumed in the electric power sector. Wind energy accounted for about 26% of U.S. renewable energy consumption in 2020. Wind surpassed hydroelectricity in 2019 to become the single most-consumed source of renewable energy on an annual basis. In 2020, U.S. wind energy consumption grew 14% from 2019.

Hydroelectric power, or electricity generated by water-powered turbines, is almost exclusively consumed in the electric power sector. It accounted for about 22% of U.S. renewable energy consumption in 2020. U.S. hydropower consumption has remained relatively flat since the 1970s, but it fluctuates with seasonal rainfall and drought conditions.

Wood and waste energy, including wood, wood pellets, and biomass waste from landfills, accounted for about 22% of U.S. renewable energy consumption in 2020. Industrial, commercial, and electric power facilities use wood and waste as a fuel to generate electricity, produce heat, and manufacture goods.

Biofuels, including fuel ethanol, biodiesel, and other renewable fuels, accounted for about 17% of U.S. renewable energy consumption in 2020. U.S. biofuel consumption fell 11% from 2019 as overall transportation sector energy use declined in the United States during the COVID-19 pandemic.

Solar energy accounted for about 11% of U.S. renewable energy consumption in 2020. Solar photovoltaic cells, including rooftop panels, and solar thermal power plants use sunlight to generate electricity. Some residential and commercial buildings use solar heating systems to heat water and the building. Overall, 2020 U.S. solar consumption increased 22% from 2019.

EIA projects that U.S. renewable energy consumption will continue to increase through 2050. Now that you have a basis for understanding the basic trends, let us turn to a more medium term-trade we want you to consider.

Today, we are looking at a biofuel play.

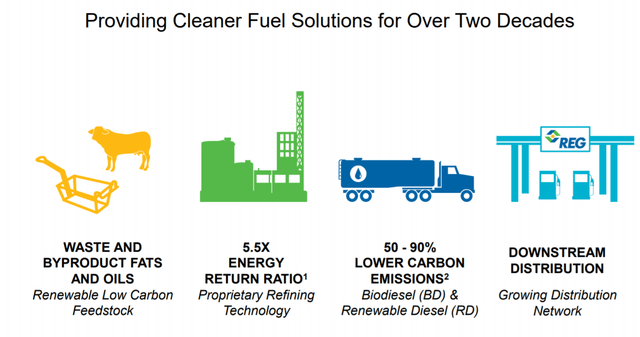

Renewable Energy Group (REGI) is a global player that produces renewable fuels like biodiesel and renewable diesel, renewable chemicals, and other products. We will not go much into the science here but basically they convert natural fats, oils, and greases into advanced biofuels. T

REGI produces biomass-based diesel from various low carbon feedstocks like used vegetable oil, inedible animal fats, as well as soybean and canola oils. They will also purchase and resell biomass-based diesel, petroleum-based diesel, renewable identification numbers.

Bottom line? They are trying to lead the transformation of biofuel into something that helps improve the environment and grow customers’ profits. They currently own and operate 12 biorefineries. 10 of which are stateside, and 2 are located in Europe.

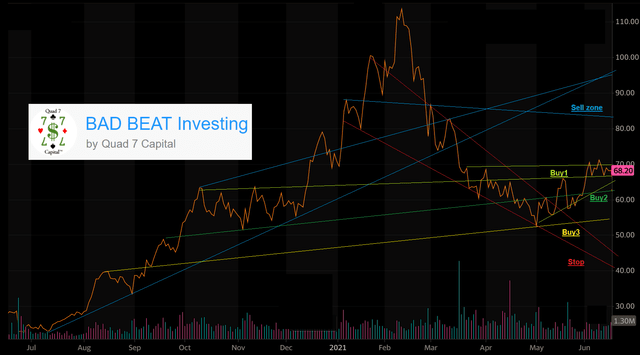

The stock had exploded over $100, but has pulled back, and this stock has come up in our roundtables each week. I (chris) believe it is time to buy, especially on the low 60s but definitely the $50s. Stephanie believes the stock offers 30-50% upside in the next year, and this will be true especially as oil prices are high. Low oil prices tend to be bad for renewables. As oil and gas become expensive, consumers embrace change.

Take a look at the chart:

At $60 this stock will be down 49% from highs. Now here is the thing. This company actually makes good money. Valuation wise it is getting very attractive, and we want to be buying.

The play

Target entry 1: $62 (25% of position)

Target entry 2: $57-$58 (35% of position)

Target entry 3: $52 (40% of position)

Target exit zone: $80-$90

Stop loss? $42

Options play? Sell July $60 puts for $3.00; Aug $55 for $4.00; Call options would go out to January 2022.

Estimated time frame 12-16 weeks

Discussion

The stock is in value territory frankly.

The stock will be boasting a price to sales ratio of 1.0 as shares dips, while the price to earnings on a FWD basis is currently 15, and will be in the low teens as it dips. We like that. Now how is performance?

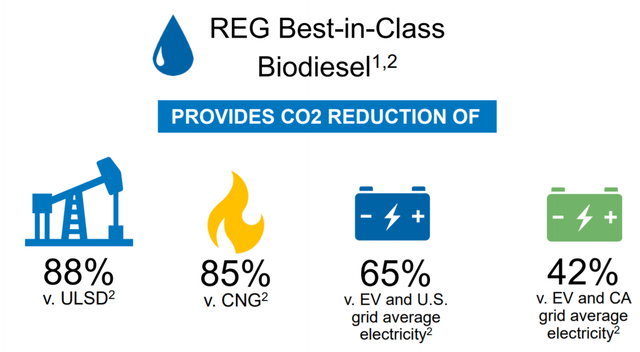

We continue to see signals for growing demand for lower carbon fuels. Year-over-year performance is a bit cloudy as Q1 2020 included some management risk income, but, revenues for the first quarter were $540 million on 134 million gallons of fuel sold. Net income available to common stockholders was $39 million in the first quarter of 2021, compared to $73 million in the first quarter of 2020. Adjusted EBITDA in the first quarter was $56 million, compared to $89 million in the first quarter of 2020 which included that aforementioned $54 million risk management gain. The carbon reduction is key for ESG investors:

Now, do not be alarmed by the volatility in production and gallons sold. You need to watch these, but they are not gospel where. REGI sold 134 million gallons of fuel, a decrease of 4%. Self-produced renewable diesel sales were down 4 million gallons, as a result of the Company's planned 31-day turnaround at the Geismar, Louisiana renewable diesel facility.

Gallons sold of self-produced biodiesel decreased by 4 million, driven by COVID related market disruptions in Europe.

Third party renewable diesel sales increased 6 million gallons while petroleum diesel sales decreased 4 million gallons as they continued to optimize our sales mix.

REGI saw less production too. They produced 99 million gallons of biodiesel and renewable diesel, a decline of 22 million gallons.

Renewable diesel production decreased 8 million gallons as a result of the planned turnaround cited above. European biodiesel production decreased 3 million gallons due to the COVID-related market disruptions as noted above, and North American biodiesel production decreased 11 million gallons, due in part to unplanned downtime caused by extreme cold in Houston and the Midwest, as well as production scheduling choices made to optimize margins.

All that said, pricing was strong and revenues increased from $473 million to $540 million.

The company also did a cash raise. At March 31, 2021, REGI had cash and cash equivalents, restricted cash, and marketable securities (including long-term marketable securities) of $611 million, an increase of $253 million from December 31, 2020.

The increase in cash and cash equivalents is primarily due to the $365 million in funding, net of fees, from their Q1 equity raise.

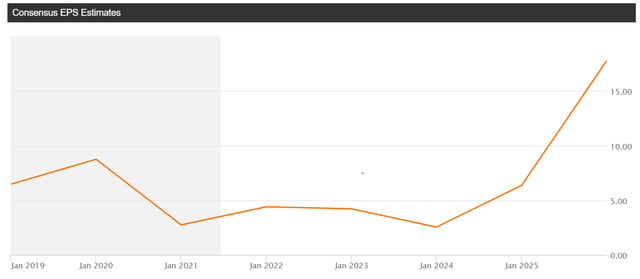

But analyst ranges are WIDE.

For year end 2021, the estimates range from 2.44 to $5.28. At the high end, we are at just over 11X earnings at our high end.

Because pricing is unclear, estimates are flat in the next few years. Do not let that deter you, It is a good investment.

What are some risks to be aware of?

Well competition from the big players going green is a big one.

One negative came from the Biden Admin recently. After pressure from labor unions and U.S. senators including from his home state of Delaware, the admin sought to provide relief to U.S. oil refiners from biofuel blending mandates. The administration had been rolling President Donald Trump's dramatic expansion of waivers for U.S. refiners from the Renewable Fuel Standard.

The law requires them to blend billions of gallons of ethanol and other biofuels into their fuel each year or buy credits from those that do.

By doing this, it potentially hurt REGIs business, as there could be lower demand. In other words, they were going to be forced to buy and blend with biofuels. That is a reason the stock has been falling. Biofuel advocates say fuel makers should have invested in biofuel blending facilities years ago and can pass through added costs for buying credits. Renewable fuel credits fell on this news, which hit short-term possible revenues.

Most risks are regulatory in nature.

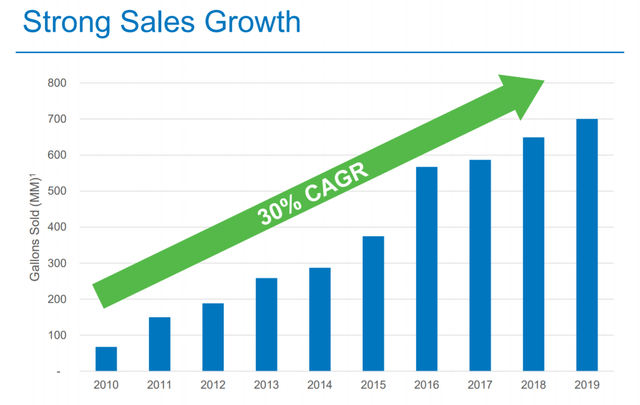

As far as 2021 estimates go, the company is expecting to see 650-700 gallons sold while producing 480 million to 520 million gallons. This would put them back where they were in 2019, but it really depends on how long COVID-19 continues to impact consumer's daily lives. It seems like the impacts are waning, though in Europe there are still issues.

Long-term, the desire for renewable fuel is only going to grow from here and REGI is in a position to benefit.

The biofuel market will bounce back as general fuel demand returns to full capacity. Keep an eye on actions for blending rules. Beyond that, the shift towards greener energy will grow this business in the years to come.

While it is structured as a trade, it may be best served as a long-term investment.

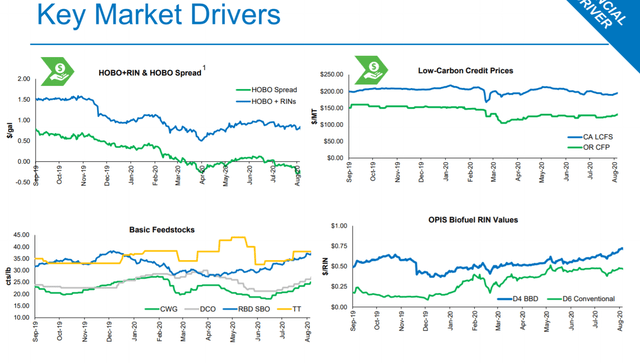

If you want to do more research, please look into the following items that impact pricing.

Overall, things look solid.

We turn losers into winners. Take 15% OFF

Like our thought process? Stop wasting time and join the community of 100's of traders at BAD BEAT Investing.

We're available all day during market hours for investment assistance. We no longer publish regularly on the public site. We are instead focused on helping you make money

- You get access to a dedicated team, available all day during market hours

- Rapid-return trade ideas each week, with 6 different chat rooms

- Crystal clear target entry prices, profit targets, and stop losses

- Unlock immense reward opportunity through lower risk with our system

- Stocks, options, trades, dividends and portfolio reviews

Disclosure: I am/we are long REGI.