This week only take 50% OFF the annual membership price at BAD BEAT Investing

If you enjoyed reading this column and our thought process you should immediately join our community of traders at BAD BEAT Investing.

We are available all day during market hours to answer questions, and help you learn and grow. Learn how how to catch rapid-return trades.

- 2-3 rapid-return trade ideas each week

- Monthly deep value plays

- Access to a dedicated team, available all day during market hours.

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

The precious metals sector is once again under siege in the last few months, and it has led to the start of some really great sales in the precious metal miners and streamers. While we are not quite "bullish" yet, we definitely believe it is time to consider doing some longer-term position initiation once again. Even our more short-term traders should be watching the action in this space. John recently highlighted it in his "words from the chartist piece". You,may recall that two of our most rewarding plays were in this sector last year, both with Endeavour Silver (EXK) and Hecla Mining (HL). These trades garnered us 30-40% returns in just a few weeks. Then we pyramided into HL again and sold as the stock approached $3. Well, we believe gains like this, or more, will be had again in coming months. We are at the height of risk on, and precious metal prices have suffered, leading to quality miners being crushed.

Today we want to highlight Hecla Mining once again. We were once again buyers at $1.50 and now again at $1.75 here. Sure, if things deteriorate, we could get a better price. We are prepped to ride this from $2 back to $3 (that would be a 50% gain). Let us build a nice position here. Can it fall further? That will depend on the price of precious metals. As it stands now, we still contend that Hecla Mining is stronger than ever with its purchase of Klondex Mining. We believe the market is highly discounting the new and larger company here in 2019, which has focused on lowering costs, improving margins, and developing new assets. To be clear, a $1-$2 rebound in silver, or a $100 move in gold higher from present levels will translate to at minimum a 20% gain from present levels of $1.75. In this column we assess the company which we have traded many times as a bit of a longer-term investment.

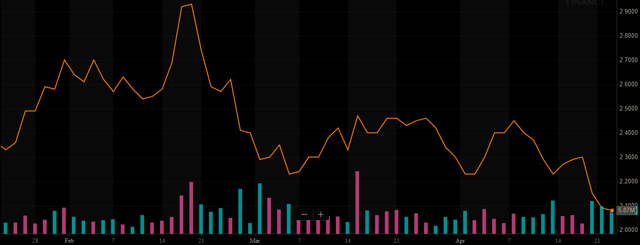

Technical picture

Let us have a look at some of the recent charts. Both the three months and the 5-day charts are pretty ugly:

Three month:

5-day:

There could be some bottoming action occurring soon, but you have to go all the

Here our chartist sees the price converging and suggesting that anything under $2.10 is a real opportunity in the medium-term. This could bounce in two weeks, or two months. It may take all of 2019. We do not have the kind of read but we are definitely in accumulation mode, provided of course the metals market does not entirely collapse. Again, we want shares to come down more to get a full position, but if we buy in and shares go up, that is a high quality problem.

The play

Target entry: $2.10

Second tranche: $1.85

Complete position $1.50

Target exits: If trading $2.30-$2.50, if investing and holding longer, $3-$4.

Timeframe: Month to Month

Comment: Buy in a pyramid fashion (eg. 500 shares, 1000 shares, 2000 shares) on the way down.

Discussion

Okay, even though the pressure is on now, we are looking at a good company at a fair price. We believe there is upside again, and in this column, we will specifically hone in on the most recent production numbers and financial performance in the just reported quarter.

Production numbers

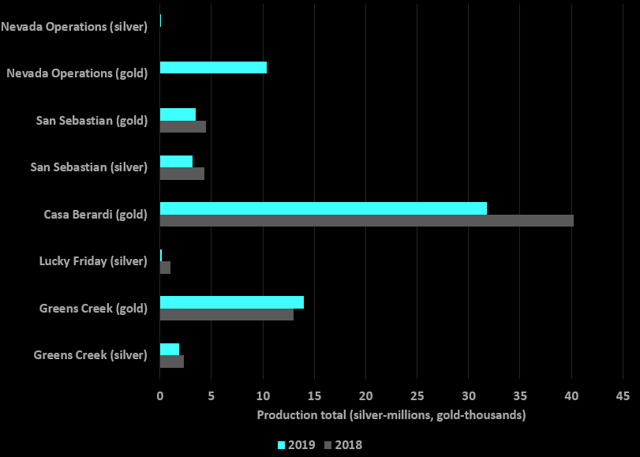

It was not surprising to see a decline in production in Q1 2018 versus Q1 2017, at least for silver, thanks to the ongoing strike at the Lucky Friday mine, in addition to planned declines at San Sebastian:

Source: Q1 production results, graphics by BAD BEAT Investing

Recall that when the mine is fully operational, there was significant silver production at Lucky Friday. The mine had a great quarter. The absolute results for silver production are unsurprising because ever since Q1 2017, Lucky Friday has been in limited operating capacity. There were silver production increases are Greens Creek, while San Sebastian production was down as planned (though higher than the company guided). Silver production was 2,923,131 ounces, surpassing our expectations that we outlined previously for 2.90 million ounces. This is up nearly 15% year-over-year versus the 2,534,095 ounces produced in Q1 2018.

The year-over-year numbers were impressive for gold and were better than we expected. Gold production came in 4% higher than a year ago at 60,021 ounces, rising from 57,808 ounces in 2018. This was at the high end of our expectations for up to 5% growth here in Q1. We saw upside, given the substantial production out of Case Berardi, similar to what we saw in Q1 2018.

We of course have to be clear that the overall numbers were influenced by the inclusion of the former Klondex assets. These really influenced the overall numbers with 67,438 ounces of silver being produced, and over 10,000 ounces of gold produced.

Silver production was higher in the quarter due to the standout performance from Greens Creek, with higher gold and silver grades and recoveries than the first quarter of 2018. The Lucky Friday also contributed with more silver production in the quarter than was achieved all of last year. San Sebastian production was about the same as last year’s fourth quarter. Quarterly gold production was higher than last year, but we expect significant production increases from Casa Berardi and the Nevada assets in the second half of the year, and this is a reason to be bullish.

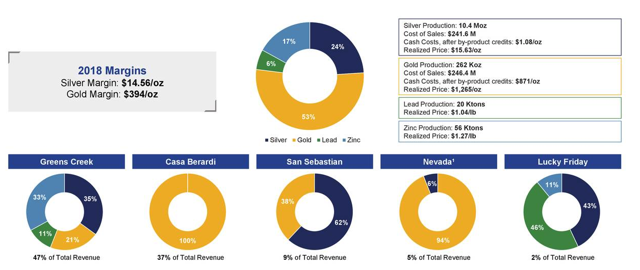

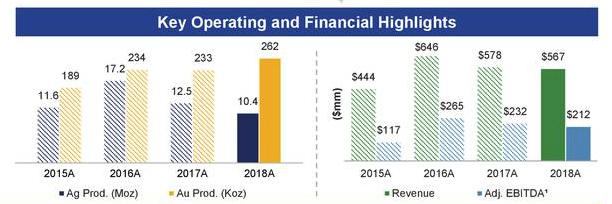

Fiscal performance (2018 annual)

We were pretty impressed with financial performance in 2018 despite how poor things went in the precious metal pricing. This was helped in part due to better production and ounces sold, but also due to cost controls, which helped margins. In 2018, sales were 2% lower than in 2017. The decreases were mainly due to lower silver production due to lower grades and production at San Sebastian as well as lower average silver prices, partially offset by higher gold production due to higher throughout at Casa Berardi and the addition of the Nevada operations.

That said, margins were pretty solid, but metal prices were bad. Average realized silver prices in the full year 2018 were $15.63 per ounce versus $17.23 last year. Realized prices for gold for the full year 2018 were and $1,265 per ounce, slightly higher than 2017.

Cash provided by operating activities for the full year of 2018 was $94.2 million, $21.7 million lower as compared to the prior-year periods. The decrease in 2018 was mainly the result of lower production and higher exploration spending, as well as acquisition costs, partly offset by cash proceeds from settlement of base metals derivative contracts prior to their maturity date.

Adjusted EBITDA was $211.9 million for the full year of 2018, compared to $231.9 million in 2017. The decreases were due to lower production and higher exploration spending.

Moving forward

While there is no clarity on the progress with resolving the strike at Lucky Friday, the company is moving forward with the Klondex deal which is closed. Integration has begun, and we are excited for what this means for the company in the coming years. With just a little help from metals pricing, the stock can really move. Operationally, the company is focusing its efforts on its new Nevada properties

We are excited for the exploration end of things here, not just the potential boost to production. We do expect some cash burn going forward unless we get some help from metal prices in the interim. While metal prices will fluctuate quarter to quarter, these new assets will help with long-term production and sustainability of the business.

Lucky Friday

This strike, once resolved, will be a very bullish development in our opinion. You see, the Lucky Friday mine is primarily a silver mine that also produces notable quantities of lead and zinc. The year-over-year production trend in this mine has been impressive during the past four years. But this strike called by the mine workers' union in March 2017 continues to date.

Around 250 mine workers have participated in the strike regarding concerns over mine workers' pay mechanism. The strike had a devastating effect on the mine's production, bringing it down by ~77% in 2017, compared with 2016, and barely budged in 2018. Given that Lucky Friday mine has over 80 MM oz. (5,632,000 tons X 14.4 oz/ton) of silver, this mine has the potential to deliver silver production for the next 23-27 years at the rate of ~3-3.5 MM oz. per year. That is impressive. Once the mine is back online, production will ramp up and so will revenues.

We believe the strike undermines the share price. Then again, this provides a good buy opportunity. Production from Lucky Friday is also expected to increase from FY 2019 when HL completes remote vein miner activities at the mine. In addition, the market is discounting the assets from Klondex.

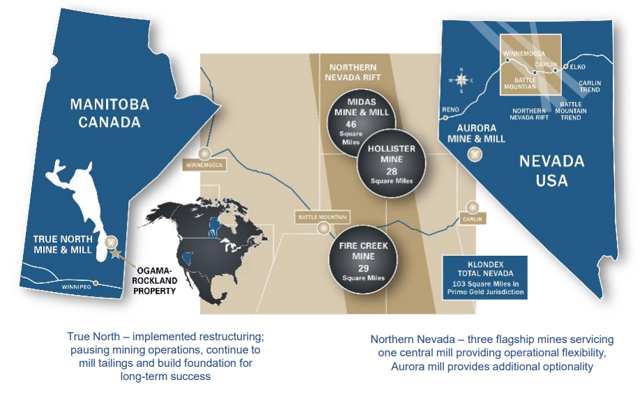

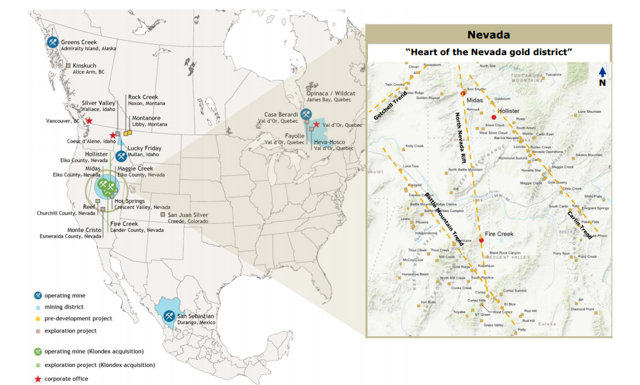

The new Nevada assests

There are three key properties to be aware of here. There is the Midas mines, Hollister properties, and Fire Creek. We know that the company sold off the Canadian assets, but we want to reiterate the key items being brought to the table which we think the market is ignorning and significantly undervaluing the assets.

The Midas mines are across nearly 30,000 acres. There is a lot to like here, but this acreage includes owned fee lands and unpatented mining claims in addition to seven lease agreements in Nevada (Elko County).

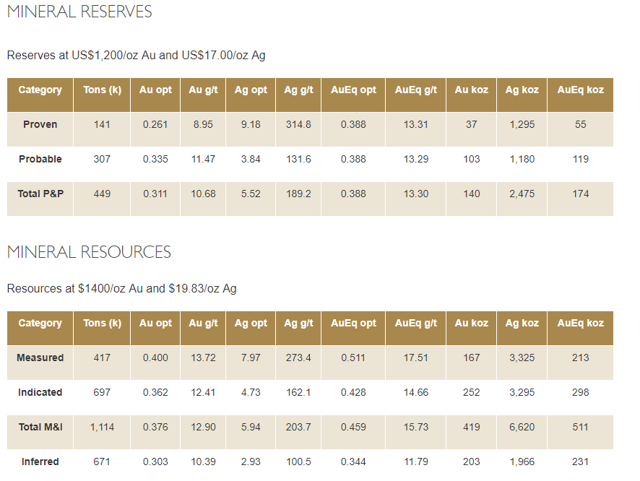

Most prominently, Midas's acreage includes the underground mine and the 1,200 tons per day Merrill Crowe processing facility. The mill and most of the Midas infrastructure are located on private lands. It is also the largest known gold/silver epithermal deposit along the Northern Nevada Rift. The reserves and resources are impressive:

Source: Klondex mining

Hollister

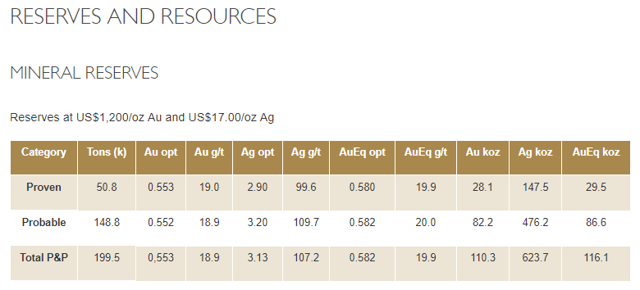

The Hollister mine is also located in Elko County, Nevada. Hollister is still young (comparatively), but we do know that the mine's drilling to-date has led to high grade veins that have produced 450,000 ounces of gold and over 2.5 million ounces of silver with decent grades (34 grams per ton of gold, 200 grams per ton of silver). Reserves and resources are respectable:

As you can see, the total resource and reserves are far beneath that of Midas, though the grades are a strong plus.

Fire Creek

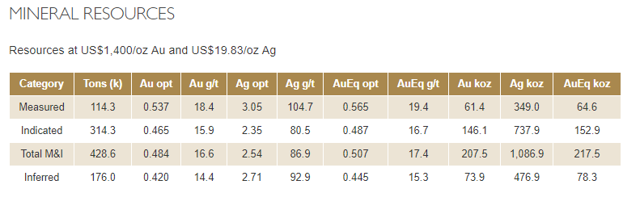

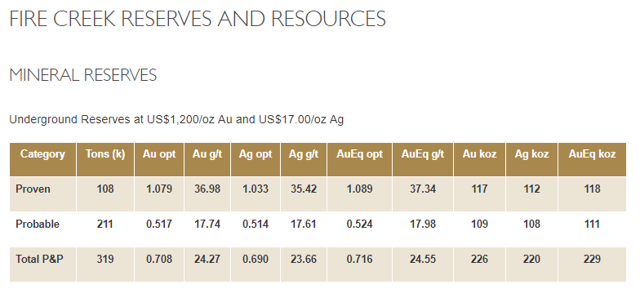

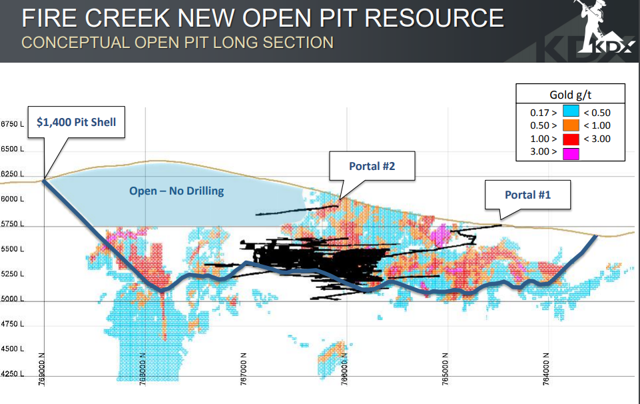

We are very pleased with what we see at Fire Creek. Fire Creek is in Lander County, Nevada. The land has 15,420 acres of unpatented federal lode mining claims, 1,110 acres of private fee land and 230 acres of mineral leases, which brings the total land package to approximately 17,000 acres. Further, the reserves and resources are strong:

What we like here is the potential. While the feasibility study from 2015 shows these potential resources, there could be much more. Why? Well, the authors of the feasibility study noted that additional potential exists to extend reserves along strike in both directions as underground access is developed. So, what this means is that as the footprint of the mine grows and the number of available mining areas grows with it, the mining rate can be increased, and cost reductions realized through economies of scale.

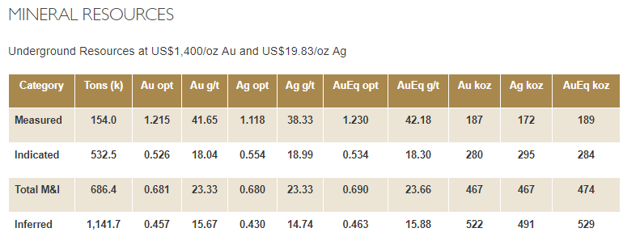

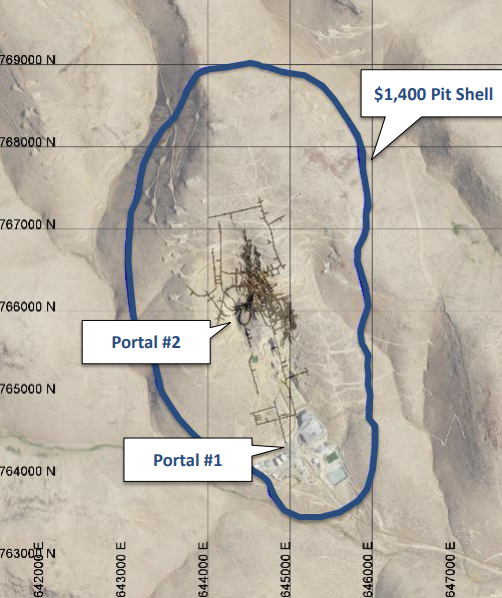

What is more, this project is capital-friendly. More mine development is what will make up the bulk of future capital costs. As more of the mine is developed, the ability to access multiple veins from common development should lead to significant cost reductions the unit cost per ounce, much like we would see with more developed mining operations. Take a look at the pit at its location in Lander County, showing the underdeveloped potential:

As you can see, there is a lot of potential here to reach new areas that have been largely untouched. What is more, there could be highly profitable assets here. The high grade reserves in the mine plan provide a high return and will sustain profitable operations with up to 40% adverse variations in metal prices, operating or capital costs. The total cost per ounce, including capital expenditures and net of byproduct sales, is less than $500 per ounce.

That screams value. What a pickup for Hecla, in our opinion. These are truly some of some of the highest grade gold mines in the world. However, there are still short-term concerns for the name which may have accelerated the selling. This really brings Hecla's presence in the western part of North America to a new level, especially in Nevada.

What about Rock Creek?

The first phase of the long-proposed Rock Creek silver and copper mine in Montana was approved by the U.S. Forest Service, HL says it needs to settle a legal issue with the state before proceeding. The Kootenai National Forest approves the exploration phase of the mine, which HL has said would continue to full development if exploration shows a full-scale mine is feasible.

However, Hecla's work will not start until the company settles a lawsuit with the state, which has said President and CEO Phillips Baker Jr. is a “bad actor” under state law and cannot operate mines in the state. State officials have said Rock Creek can proceed while the bad-actor case plays out in court. It remains to be seen what impact this will have, but we know that if Rock Creek gets up and running, it will be bullish for the company.

What also hurt recently was the overturned water permit last week. The US District Court revoked this. The licence would have allowed Hecla to pump groundwater to supply the proposed copper and silver mine in the Cabinet Mountain Wilderness, an area of glaciated peaks and valleys that take their name from the area’s box-like rock formations, making work easier.

The project as proposed will encompass approximately 481 acres and be developed in two phases: (1) the construction and development of the evaluation adit, approximately 20 acres, and (2) the development of the mine and construction of the mill facilities. The evaluation program will further define the technical and economic aspects of the project and result in a feasibility study. Presuming a positive feasibility study, and the receipt of the necessary construction permits, Hecla intends to develop Rock Creek as an underground room and pillar mine with conventional crushing and flotation processing.

Outlook

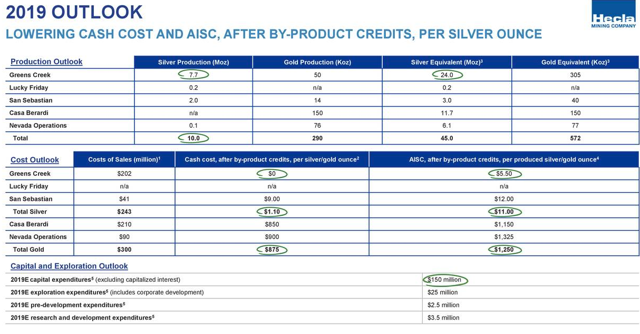

As we look to finish the year, the outlook remains solid, and there have been revisions higher for production, and lower for AISC.

The company is stepping up CAPEX, while investing in its infrastructure. We really like what we are seeing here.

Take home

We see both production and costs moving in favorable directions because of improved throughput at the company's properties and ongoing savings initiatives. All things considered, we think you should start buying here. If silver and gold rebound to even average prices seen in early 2018, the stock could double in 2019. We see real value here. Yes, we need help from silver and gold prices. No one knows where it is going. However, we believe at these levels, it is time to start buying.

This week only take 50% OFF the annual membership price at BAD BEAT Investing

If you enjoyed reading this column and our thought process you should immediately join our community of traders at BAD BEAT Investing.

We are available all day during market hours to answer questions, and help you learn and grow. Learn how how to catch rapid-return trades.

- 2-3 rapid-return trade ideas each week

- Monthly deep value plays

- Access to a dedicated team, available all day during market hours.

- Target entries, profit taking, and stops rooted in technical and fundamental analysis