Disclosure: Ely Gold Royalties is one of my sponsors. See full disclosure here.

Despite the tepid market for most metals and an ongoing bear market for junior resource companies, Ely Gold Royalties (ELY.TSXV; ELYGF) has been a shining star in my portfolio (and hopefully yours) over the past six months. Since its yearly low of 8.5 cents in early October and an interim slide to 11.5 cents during tax-loss December, the company has bucked peer market trends to establish a 2.5 year high of 20.5 cents in late April to early May; it closed at 18 cents on Friday.

Here’s the 52-week chart:

I submit that the main reason for ELY’s strong performance is its strategy to transform the company from a pure Nevada prospect generator by adding small producing or near-term royalties. Meanwhile, the company continues to grow its prospect pipeline and upgrade its partner list.

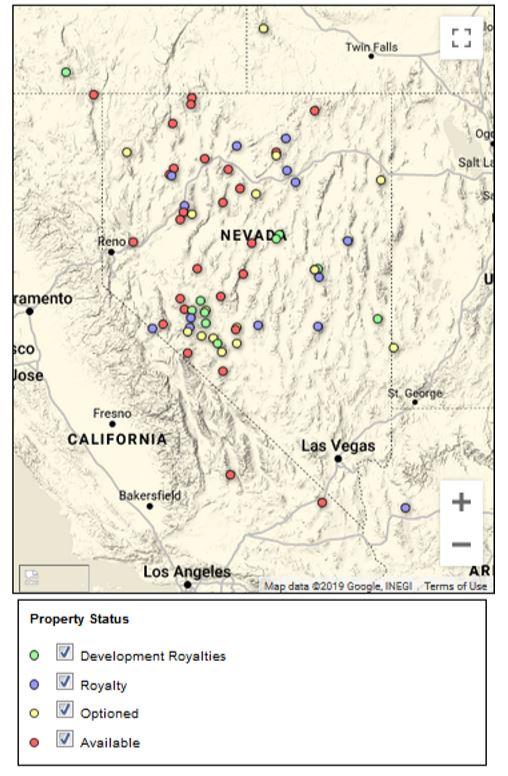

Let’s begin with a summary map of Ely Gold Royalties’ Nevada-centered option/royalty portfolio:

Since my last update in late February (Mercenary Alert, February 26, 2019), Ely Gold Royalties has enjoyed a busy plus-three months. The company:

• added to its royalty on Wallbridge Mining’s (WLBMF) Fenelon gold mine in west-central Quebec and closed the purchase of a 2% NSR for $600,000 in mid-April. The company briefly controlled a 3% NSR until a recent transaction that is detailed below.

• is acquiring a 1% NSR on the Lincoln Hill property, operated by Coeur Mining Inc. (CDE) in Pershing County, Nevada for total consideration of $755,000 and 500,000 warrants at 18 cents expiring in two years. The deal is expected to close soon.

• closed on its first producing royalty at Gold Resources Inc’s (GORO) Isabella Pearl mine in Mineral County, Nevada with US $300,000 for a 0.75% gross royalty. Note also that Ely Gold holds a 2.5% NSR on much of GORO’s planned expansions surrounding the current open-pit mine where drilling is ongoing.

Since 2016, Ely Gold properties sold to GORO for US $1.5 million have procured the following royalty interests: 2.5% NSR on certain exploration ground at Isabella Pearl; 2.5% NSR on the Country Line property; 2 to 3% NSR at the Mina Gold property; and a 2% NSR on certain claims at the Camp Douglas property.

• signed a letter of intent to acquire a sliding scale per ton production royalty on the Jerritt Canyon mill in Elko County, Nevada for a total cash consideration of US$650,000 over three years and 500,000 warrants at 18 cents with three-year expiry from the closing date.

This production royalty is highly leveraged to the gold price: 15 cents per ton of mill throughput at less than $1300 per ounce; 22.5 cents per ton up to $1600 per ounce; 30 cents per ton up to $2000 per ounce; and 40 cents per ton over $2000 per ounce. The deal is expected to close soon.

• announced sale of 1% of the aforementioned Fenelon royalty to Eric Sprott for $1.7 million. In addition, Sprott is making a strategic investment in ELY via a $1.0 million private placement at 18 cents with a three-year half warrant at 30 cents.

On the property front, ELY consummated the following deals:

• optioned 100% of the Rand property in Mineral County, Nevada to Goldcliff Resource Corp (GCFFF, GCN.V) for staged payments of $250,000 over four years. It retains a 2.5% NSR with 1% buydown for $1.0 million. Rand is a past-producing, epithermal gold-silver prospect that has been intermittently mined for gold and silver since the early 1900s and has never been drill-tested.

• optioned the Castle West property in Esmeralda County, Nevada to Bitterroot Resource Ltd (BITTF) for staged payments of $241,000 over four years. ELY retains a 3% NSR with 1% buyable for $1.0 million. Previous work by Kinross (KGC) identified near-surface, bulk tonnage gold targets and deeper bonanza-grade structures.

In other news, Fiore Gold (FIOGF) announced a $2 million budget for resource drilling and metallurgy on the fully permitted Gold Rock property where Ely Gold holds two royalties. Gold Rock is a satellite deposit to the operating Pan mine.

Also on the positive side, four small companies with options on ELY-owned properties brought in larger explorers and miners as partners. This shows Ely’s acumen in making 100% option deals with retained royalties as it allows a stronger party to enter into the project while the company receives earn-in and advanced royalty payments and retains its NSRs.

Projects with new partners include:

• the Weepah project optioned to Valterra Resources (VRSCF) was joint ventured to a private Aussie explorer, Ginguro Gold Pty Ltd.

• American Pacific Minerals (USGDF) brought in mid-tier gold miner Oceana Gold (OCANF) to explore Tuscarora in Elko County, Nevada.

• The Antelope Springs 1% NSR was acquired by Americas Silver (USAS) via its Pershing Gold acquisition. Antelope Springs is an exploration property near Relief Canyon, which Americas Silver has now financed to production.

• The Lincoln Hill acquisition by Coeur from Alio Gold (ALO) includes ELY’s 1.5% NSR on the Rosial project.

With the downturn in junior resource stocks, property deal flow is a mixed bag with a couple of properties dropped by optionees and returned to ELY. If the junior sector continues to struggle, I anticipate additional dropped properties and joint venture deals similar to the above in the coming months.

Given the Sprott transaction, Ely’s share structure will become 99.0 million shares outstanding and 124.0 fully diluted. There are 6.6 million options. Warrants include 2.6 million in-the-money at 10 to 14 cents with expiries from March 2020 to the end of 2021, 2.8 million at 30 cents expiring in June 2022, and 13.0 million at 22 cents with expiries in December 2023 to January 2024. The company is tightly-held with insiders and management at 10%, 25% with long-term shareholders, 10% with Rick Rule-led Exploration Capital Partners, and over 5% with Eric Sprott.

The recent Sprott transaction will up the company’s working capital position to $3.6 million in cash and tradable securities. That is an enviable number considering the ongoing bear market.

With its large Western U.S. database, portfolio of over 70 properties of which 50 are being explored by partners, and 33 deeded royalties with three currently producing, I opine that ELY is well-positioned both now and in the future when commodity prices and the junior resource market recover.

I remain a committed and dedicated shareholder of Ely Gold Royalties but please bear in mind that my opinions are colored by financial interest in the company and its sponsorship of this website.

You should always do your own due diligence before speculating in any high risk/high reward junior resource stock.