Kumar and Raj were interestingly observing the Helicopter flying above the campus with its roaring sound. Prof.Sen who was crossing them stopped for a while and commented,

So, you guys are revisiting the childhood.

Anytime sir, answered Kumar. I would love to travel in it one day sir said Raj.

Agreed said the Professor, we have also thought about it when we were in School.

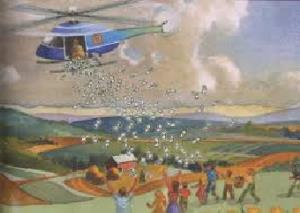

Raj added to the humour, Sir Kumar thinks what happened if there is a huge pocket full of currency dropped from the Helicopter.

All the students around laughed at that comment.

Well, do you all know that there is something known as Helicopter Money, said the Professor.

Now, everyone including Kumar looked at the Professor curiously.

What is it Sir, asked Kumar.

The Professor started explaining

Let me first explain the Principle of Helicopter Money

Helicopter money is a tool of monetary policy that involves printing large sums of money and distributing it to the public in order to stimulate the economy. Also known as the Helicopter drop, it is largely a metaphor for unconventional measures to jumpstart the economy during deflationary periods. Helicopter money is a theoretical and unorthodox monetary policy tool that central banks use to stimulate economies. Economist Milton Friedman introduced the framework for helicopter money. Former Federal Reserve Chairman Ben Bernanke made a reference to it in 2002. This reference earned Bernanke the sobriquet of “Helicopter Ben,” a nickname that stayed with him during much of his tenure as a Fed member and Fed chairman. This policy should theoretically be used in a low-interest-rate environment when an economy's growth remains weak. Helicopter money involves the central bank or central government supplying large amounts of money to the public, as if the money was being distributed or scattered from a helicopter.

As mentioned earlier, Helicopter money is an idea mooted by Milton Friedman in his paper ‘The Optimum Quantity of Money’ in 1969 for governments looking to lift their economies out of a slump.Originally used by Friedman to illustrate the effects of monetary policy on inflation and the costs of holding money, rather than an actual policy proposal, the concept has since then been increasingly discussed by economists as a serious alternative to monetary policy instruments such as quantitative easing. According to its proponents, helicopter money would be a more efficient way to increase aggregate demand, especially in a situation of liquidity trap, when central banks have reached the so-called 'zero lower bound'.

For example, Mr. Bernanke also embarked on successive rounds of (QE) that injected trillions of dollars into the U.S. economy from 2009 onwards through sustained purchases of mortgage-backed bonds and Treasuries. These “Quantitative Easing” QE measures differ from the helicopter drop in that the Federal Reserve has a greater degree of control over their eventual reversal. In a bid to stimulate growth and fight deflation, governments have effected cuts in interest rates, turned to negative rates and unleashed many rounds of the infamous QE or Quantitative Easing. But GDP growth rates, whether in the US or Eurozone and Japan remain low. Hence experts have been suggesting the recourse to more direct methods, like helicopter money.

How does it work sir, asked Raj?

Well the Process is simple

Friedman’s theory was that the lucky citizens, thrilled with the windfall, would rush to spend. Higher money supply with no immediate change in output would lift inflation. And improved consumer confidence would eventually prompt manufacturers to increase output and create more jobs, thus giving the economy a push to get it going. Putting cash directly into the hands of consumers, it is hoped, will quickly kick-start a virtuous cycle of consumption that can boost up GDP. This is something that indirect QE, which transferred liquidity to banks in order to step up lending, couldn’t achieve. Instead, some governments may decide to give tax refunds or tax credits or even make direct cash transfers to identified citizens. Some economists have even suggested pre-loaded smart cards with a certain amount of cash. If citizens don’t spend it within the specified time, the cash will simply disappear!

Although helicopter money is an unorthodox tool to spur economic growth, there are less extreme forms of the policy if other economic tools have not worked. The government or central bank could implement a version of helicopter money by spending money on tax cuts, and thereafter, the central bank would deposit money in a Treasury account. Additionally, the government could issue new bonds that the central bank would purchase and hold, but the central bank would return the interest back to the government to distribute to the public. Therefore, these forms of helicopter money would provide consumers with money and theoretically spark consumer spending.

One of the main benefits of helicopter money is that the policy theoretically generates demand, which comes from the ability to increase spending without the worry of how the money would be funded or used. Although households would be able to place the money into their savings accounts rather than spend the money if the policy were only implemented for a short period, consumer consumption theoretically increases as the policy remains in place over a long period of time. The effect of helicopter money is theoretically permanent and irreversible because money is given out to consumers, and central banks cannot retract the money if consumers decide to place the money into a savings account.

Since last few years, some economists began advocating variants of helicopter drops. These proposals reflected a sense that conventional policies, including QE, were failing or having many adverse effects - on either financial stability or the distribution of wealth and income

Sir, how does Helicopter Money differ from Quantitative Easing asked Kumar?

Well continued the Professor,

Quantitative easing (QE), like helicopter money, involves money creation by central banks. Some economists argue that helicopter is different because the money created would be 'permanent' - it is irreversible QE. Others argue that it is really no different to an expansion of fiscal policy combined with increased QE.Contrary to the concept of using helicopter money, central banks use quantitative easing to increase the money supply and lower interest rates by purchasing government or other financial securities from the market to spark economic growth. Unlike with helicopter money, which involves the distribution of printed money to the public, central banks use quantitative easing to create money and then purchase assets using the printed money. QE does not have a direct impact on the public, while helicopter money is made directly available to consumers to increase consumer spending.QE provides capital to financial institutions, which theoretically promotes increased liquidity and lending to the public, since the cost of borrowing is reduced because there is more money available. The use of the newly printed money to purchase securities theoretically increases the size of the bank reserves by the quantity of assets that were purchased. QE aims to encourage banks to give out more loans to consumers at a lower rate, which is supposed to stimulate the economy and increase consumer spending. Unlike helicopter money, the effects of QE could be reversed by the sale of securities. In contrast, financing transfers to the private sector by creating money has a different effect on the central bank's balance sheet than conventional QE. Under QE, central banks create reserves by purchasing bonds or other financial assets. There is an 'asset swap'. Under Helicopter money, central banks create money and distribute it right away, without tangible counterparts (such as assets) in their balance sheet liabilities.

Sir are there any limitations asked Kumar. Yes, replied the Professor. There are Problems which are pointed by its critics

Some critics point out that the Helicopter Money it works only when people spend the money. Question is - will they hoard it? They argue that helicopter money, in the form of cash transfers to households, should not be seen as a substitute for fiscal policy. Given the government's borrowing costs are extremely low at close to zero interest rates, conventional fiscal stimulus through tax cuts and infrastructure spending should work. From this perspective, helicopter money is really an insurance policy against failure of fiscal policy for political, legal or institutional reasons.

In the past the idea had been dismissed because it was thought that it would inevitably lead to hyperinflation. This contradicts with the argument that people would not spend much of the money they receive (and therefore helicopter money cannot be inflationary).Contradicting this argument, several surveys conducted in the Eurozone concluded however that between 30 to 55% of the distributed money would be spent by households, in effect resulting in a boost of around 2% of GDP.

Another range of critics involve the idea that there cannot be such thing as "free money" or as economist say "there is no such thing as a free lunch". But according to its supporters "helicopter money is a 'free lunch' in the simple sense that, if it works and succeeds in closing the output gap, people won’t have to repay it through higher taxes or undesired (above optimal) inflation."

Other critics claim helicopter money would be outside of the mandate of central banks, because it would "blur the lines between fiscal policy and monetary policy" mainly because helicopter money would involve 'fiscal effects' which is traditionally the role of governments to decide on. However advocates of helicopter money counter this argument by claiming that standard monetary policy tools also have fiscal effects.

Interesting sir, said the students. Yes, Economics is full of such interesting concepts replied the Professor. So Kumar next time watch carefully, you may get a money bag. Everyone laughed. Raj said sir atleast once I want to travel in the Helicopter. Sure best wishes said the Professor and continued to walk towards his cabin.

The author is Prof. M. Guruprasad, UNIVERSAL BUSINESS SCHOOL