Hoplites Fighting in Ancient Greece

The rise of China as an economic and military power has been seen by some as a direct threat to the hegemony of the US as the sole superpower in the Pacific and around the world. In recent years there has been a great deal of discussion, speculation, and worry about this, and about the potential for an eventual war between China and the US due to the existence of a phenomenon called “Thucidides’s Trap.” This is a term coined by Harvard historian Graham Allison (2017) to describe recurring conflicts down through history that were apparently caused by similar confrontations between a rising power and a declining hegemon. Allison has for some years now pushed this idea in various articles and a trending book (2017; Destined for War: Can America and China Avoid Thucidides’s Trap?; Houghton Mifflin Harcourt, New York, 364p); he bases his argument on the standard military and political problems that tend to be faced by rising and declining powers, respectively, when they confront each other. He uses the Peloponnesian War, between the ancient city-states of Athens and Sparta, as a metaphor for what has happened over the last 500 years when great power struggles have occurred. He has examined 16 historical examples of such confrontations and concluded that 12 of them led to tragic wars (is there any other kind?), while the remaining 4 were resolved peacefully. Two of the generals (i.e., Mattis, McMaster) on the current White House team are well-versed on the notion of a Thucidides Trap and in fact Allison has made at least one presentation to the National Security Council on this subject (Albert Wolf, 2017).

Thucidides described the putative causes and horrible consequences of the Peloponnesian War (431-404 BC), fought between rising power Athens and established power Sparta. War became almost inevitable, according to Allison (and before him, Thucidides), due to the arrogance of Athens as it built its own empire, and the fear of Sparta as it saw its hegemony in decline. The war devastated both city-states over its nearly 30-year course, opening the way for an eventual bloody invasion by the Persians. Other examples of such destructive confrontations studied by Allison include the Napoleonic War (1793-1815; primarily France vs. Britain); the Franco-Prussian War (1870-1871; Germany vs. France); the World War I conflict (1914-1918), primarily between Germany, France, and Britain; and the Pacific Theatre portion of World War II (1941-1945), involving the conflict between Japan and the US (Graham Allison, 2015). The best of Allison’s examples of confrontations that were more or less peacefully resolved would be the Cold War between the US and its allies on one side, and the Soviet Union and its allies on the other (1947-1991).

However, there have been some cogent criticisms of Allison’s thesis. For example, Albert Wolf (2017) has referred to Thucidides’s Trap as the well-known “security dilemma,” in which the increase in one state’s security causes a decrease in the security of another state. However, states can break out of the security dilemma by altering the offense-defense balance, at least for a while. And it is not clear that states seek only security; indeed, history suggests that they also appear to seek status and hegemony. For example, Kaiser Wilhelm spoke about Germany deserving “a place in the sun” right before World War I. Some analysts suggest that modern China “believes it has a right to be a great power” (Richard Bitzinger, quoted by Bloomberg, 2014), and indeed it was one for many centuries, until about 200 years ago. Yale historian Donald Kagan (2003; The Peloponnesian War, Penguin Books, New York, 511p) has concluded from his studies of Thucidides’s writings that people go to war “out of honor, fear, and interest,” not just fear alone, as Allison would suggest. In effect, Kagan would spread the blame for any war amongst the participants in the power struggle, based on these various human motivations. In contrast, Allison would appear to put the blame for any war (arising out of a power struggle) mainly on the established power’s fear, rather than at least equally on the rising power’s over-reach. In Allison’s application of this metaphor to China’s competition with the US, his thesis seems to reflect academia’s love affair with all things China, rather than any kind of objective historical analysis (Lambert Strether, 2017).

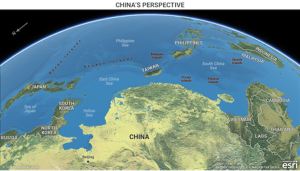

Indeed, China’s search for status in global trade (i.e., WTO membership) and within the global currency apparatus (i.e., as part of the IMF’s SDR basket), and its thirst for recognition of its economic prowess (e.g., as a leader in GDP growth; also as the builder of the new Silk Road, or “OBOR;” also as the founder of the “AIIB”), and finally its touting of its regional military dominance (e.g., its new bases in the South China Sea; also its new aircraft carriers) are recurrent themes in the foreign policy community; hence Kagan’s historical analysis into the causes of war appears to apply to the current facts better than Allison’s metaphor. The US may be a threat to Chinese dominance in the Pacific and on the margins of Asia, but it does not pose a direct threat to China’s security, at least not intentionally. The US Navy has actively defended freedom of navigation around the world for 200 years, so its active resistance to China’s somewhat wild claims in the South China Sea (Chart 1) is neither unique, nor any kind of causus belli that drops neatly into the Thucidides’s Trap metaphor, and the US has pushed back against many other countries on this particular problem (Mo Shengkai & Chen Yue, 2016). Trade between China and the US is still massive, although not as important as it was before 2008, and major US corporations (e.g., AAPL; WMT) have based their huge supply chains in China. Thus there is considerable interdependence between China and the US that was simply not present in the Athens/Sparta rivalry, nor really in any of the previous pairs of combatants mentioned by Allison in his analysis of the Thucidides Trap metaphor.

Chart 1: China’s Wild Claims in the South China Sea

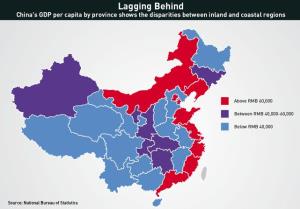

So it seems a bit over the top to claim that war might be inevitable in the region, simply because of the challenge China poses to US hegemony. Indeed, that challenge is widely overstated. Famous intelligence expert George Friedman (2016; reprinted by Zero Hedge) has suggested that geography alone makes China’s projection of power somewhat limited (Charts 2, 3, 4, 5), and its military buildup reflects its relatively weak position, not its strength. China is in reality (for purposes of military strategy) a long, narrow country with its wealth concentrated along its coastal regions. Those regions face an array of US allies that essentially surround China’s maritime borders. So it is perhaps understandable that China seeks to build a defensive perimeter in the South China Sea. So far that perimeter, including all the new military outposts on man-made islands, is truly defensive in nature. Although that could easily change, there is not presently any reason for the US to come to blows with China over the existence of such a perimeter. China has objected strenuously (in diatribes meant for local consumption) to the Freedom of Navigation cruises of the US Navy, but nothing untoward has happened so far. Even China’s confrontations with Japanese, Vietnamese, and Philippine navy ships involve little more than water fights with big hoses.

Chart 2: East Asia at Night, Indicating the Concentration of Chinese Wealth Along Its Coastline

.png)

Chart 3: Mainly Coastal Concentration of GDP Per Capita in China

Chart 4: From China’s Point of View, It’s Coastal Waters Are Surrounded by US Allies, Leaving It with Little Control Over Its Sea Lanes

Chart 5: Half of China Is Desert, Pushing Economic Development and Population Towards the Coast

.png)

Indeed, Friedman has repeatedly pointed out (2017) that China’s military situation is obviously one of inherent weakness, not challenging strength, for a variety of reasons. For example, China’s navy is no match at all (currently) for the US Navy, and its air force does not compare favorably, in terms of training or experience, with the US Air Force either. Nor could China win in a war against Japan (especially with the US backing it), and therefore it is Japan that is the real regional hegemon in East Asia. Indeed, the case can be made that it is Japan that is the target of China’s strategy, not the US, for richly historical reasons (Gideon Rachman, 2017). Furthermore, although China’s army is admittedly huge, it is not very well equipped, it is still quite unable to project power, and it lacks the extensive combat experience of the US Army and Marines. China’s extensive military buildup in the South China Sea thus has the effect of making China look scarier than it actually is (George Friedman, Xander Snyder, & Cheyenne Ligon, 2017).

This is not to say however, that some kind of accident couldn’t happen, as I’ve mentioned elsewhere. China and the US each have allies whose interests and security they are committed to defend, and this could still lead to trouble. The ultimate fates of Taiwan, North Korea, the South China Sea, and the East China Sea are still big political problems in the region, and it will take continuous diplomatic efforts to avoid greatly increased tensions. It is not at all clear that such efforts will ultimately succeed, but Allison’s case for this being due to Thucidides’s Trap seems tenuous, based on the long-standing nature of most of these disputes, and China’s inherent weakness. We should not forget that there is also much residual anger in China about Japan’s depredations during World War II, in which some 14 million Chinese lost their lives; the potential for this resentment to flare up again is not trivial, but it has nothing to do with a US-China Thucidides’s Trap.

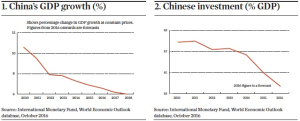

Any future war between China and the US or its allies would almost certainly result in a loss of trade, and this would likely be disastrous for the Chinese economy. This last point is indicative of the real problem facing China: it is still quite dependent on (internal) fixed investment and the growth in international trade, but since 2008 both of these have been in decline (Charts 6, 7). Indeed, exports are now contributing only 19% of GDP, but China’s much-vaunted switch to a consumer economy has not yet gathered much steam. The bulk (45%) of Chinese GDP is still generated by capital investment, with only 35% coming from personal consumption, according to Daniel Ben-Ami (2016). This is in sharp contrast to the typical composition of GDP in developed economies, which is about 60-70% personal consumption and about 15-25% capital investment; indeed, this suggests that China’s economy is still “dangerously unbalanced.” The most alarming aspect of this situation is not just that China’s economy is unbalanced, but that it has built this massive imbalance upon a foundation of extremely unproductive debt. For the uninitiated, unproductive debt is debt that is essentially a waste of resources, because it has no economic purpose and thus cannot generate enough income from its associated projects to retire that same debt over time. China’s famous ghost cities provide compelling anecdotal evidence for this kind of waste.

Chart 6: China’s Capital Investment Has Been Declining

Chart 7: China’s Trade Volume Growth Has Eroded Since the Big Fiscal Stimulus of 2009

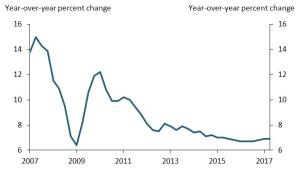

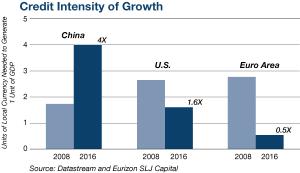

Overall economic (i.e., GDP) growth in China, however suspect its measurement, has thus also declined sharply (Chart 8) since the great fiscal stimulus of 2009, and China now faces daunting economic problems arising from its attempts to re-balance its economy towards consumption, its efforts in fighting corruption, and its ever-growing pile of unproductive debt. Indeed, China expert Michael Pettis (2017) has recently written about the huge overstatement of China’s GDP measurements when compared to those of other countries, based primarily on its penchant for unproductive debt. George Friedman (2016) has repeatedly pointed out that China’s economic problems suggest that it is already in decline, not in any sort of ascendancy. James Rickards (2017) has claimed that at least half of Chinese investment is unproductive, or wasted. Subtracting this waste from reported GDP (similar to a write-off under GAAP rules) would drop actual (productive) GDP into the range of around 5.2%, down from the 6.7% reported for 2016. Michael Pettis also supports this idea of a Chinese write-off of unproductive debt against GDP. Because so much debt burdens its economy, and because so much of that debt is unproductive, it now takes $4.00 of debt to produce $1.00 of actual growth in the Chinese economy. So China’s Keynesian multiplier is about 0.25, a clearly unsustainable dynamic. This is reflected in comparisons of the credit intensity of growth between China, the US, and the Euro area (Chart 9). In effect then, China is afflicted with the economic equivalent of a wasting disease (cachexia), and its economy will continue to decline as a result. The US is on a similar but much less severe path.

Chart 8: China’s GDP Growth Has Declined Sharply Since the Big Fiscal Stimulus of 2009

Chart 9: China’s Unsustainable Credit Intensity of Growth

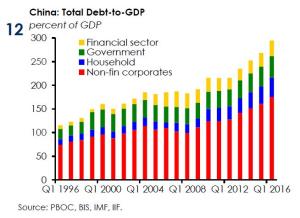

China’s total debt/GDP ratio has soared in recent years (Chart 10), which by itself would be daunting; however, if much of that debt has been unproductive or wasteful, as both the measured data and anecdotal evidence strongly suggest, then China is facing a drastic decline in its fortunes over the next few years. Indeed, some analysts (such as Mark Williams of Capital Economics in London [2017]) are already forecasting this outcome, with GDP growth potentially falling to just 2% within 10 years. Yet China’s economic problems get short shrift in Allison’s book on Thucidides’s Trap, in spite of the fact that they are actually a critical part of the story (Lambert Strether, 2017). China also faces a huge demographic challenge (Ian Buruma, 2017) in the wake of its long-term one-child policy, but it also faces a structural energy supply shortage, a truly debilitating shortage of water resources, massive internal immigration, a re-balancing to a consumption-based economy, a mass exodus of money and citizens to other countries, and a wobbly financial system.

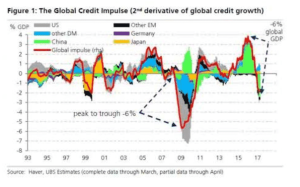

Given the already sharp decline in the global credit impulse (Chart 11), which suggests that a global recession may be on the way within two years, China will face economic decline and a major recession at some point relatively soon. This will most likely keep her too weak (for quite some time) to pose a threat to her neighbors or the global hegemon. Thus, China and the US will not fall into a modern version of Thucidides’s Trap, and we should probably take a breather on worrying about that apocalyptic scenario. There is still reason for concern about international tensions in China’s sphere of influence, and as I’ve already said, an accident could still happen. But if it does, it will more likely be due to China’s weakness than its strength.

Chart 10: China’s Total Debt/GDP Has Soared Since 2008

Chart 11: China’s Economy Will Suffer From Any Potential Global Recession Triggered by the End of the Credit Cycle

Investors might want to consider the implications of all of this. There is a strong likelihood thatChina will continue to export deflation to the rest of the world. The yuan may rise (relative to the US dollar) over time, commodity prices will probably fall (except perhaps for gold), bond yields will probably continue their long secular decline, and stocks, including defense stocks, will eventually fall significantly. I would buy or hold US Treasury funds (WHOSX, TLT, BIV) and other traditional bond funds (MUB, BOND, TOTL); a small allocation to gold (GLD, IAU); and certain defensive liquid alternative funds (OTCRX, PMHIX, QLENX). I would be wary of the US dollar (UUP); inflation-linked bonds (TIP, FLOT); and US index funds (SPY, DIA, QQQ, IWM).