S&P 500 logs 4th gain in a row

US stock market closed in the vicinity of record high on Tuesday. The S&P 500 added 0.2% to 2862.96, just 0.3% off the record close of January 26. Dow Jones industrial average gained 0.3% to 25822.29. The Nasdaq composite index climbed 0.5% to 7859.17. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 95.202 but is higher currently. Stock index futures indicate higher openings today.

President Trump’s dissatisfaction with Fed’s plan of gradual increases of short term interest rates as he commented he was “not thrilled” with the Fed chairman Powell weighed on dollar. Dallas Fed President Kaplan said he expected three or four more quarter percentage point hikes before the central bank should pause and “step back and assess the outlook for economy”. The Fed is expected to hike rates once or twice this year, which would only leave one or two interest rate increases in 2019, less than the three hikes currently expected. Traders will focus today on central bank’s August meeting minutes which will be released today at 20:00 CET. No important economic data were released yesterday.

FTSEE 100 opens lower than main European indices

European stocks extended gains on Tuesday led by bank and pharmaceutical shares. Both the British Pound US Dollar and Euro US Dollar pairs accelerated their climb but both are down currently. The Stoxx Europe 600 gained 0.2%. The German DAX 30 rose 0.4% to 12384.49. France’s CAC 40 rallied 0.6% while UK’s FTSE 100 lost 0.3% to 7565.70. Markets opened mixed today.

Renewed Brexit talks between London and Brussels started on Tuesday with a meeting between UK Brexit minister Dominic Raab and European Union chief negotiator Michel Barnier. Euro strengthened as President Trump called the euro-zone, as well as China, currency manipulators once again the previous day.

Asian indices mixed

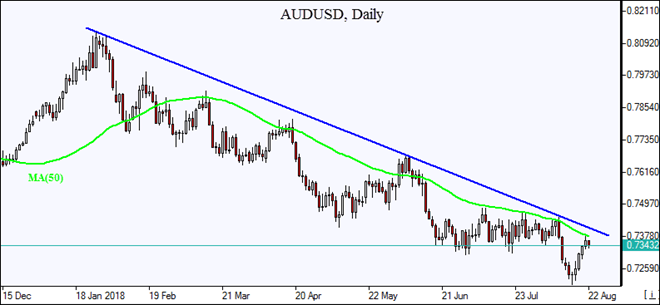

Asian stock indices are mixed today. Nikkei gained 0.6% to 22362.55 helped by continued yen slide against the dollar. Chinese stocks are falling after the People’s Bank of China said on Tuesday it would not resort to strong stimulus to support growth: the Shanghai Composite Index is down 0.7% while Hong Kong’s Hang Seng index is 0.4% higher. Australia’s All Ordinaries Index is extending losses by 0.3 percentage points despite Australian dollar’s turn lower against the greenback.

Brent rises on expected US crude stocks draw

Brent futures prices are higher today on expectations of falling US crude stocks ahead of sanctions on Iran. The American Petroleum Institute reported late Tuesday that US crude inventories fell 5.2 million barrels to last week. Prices ended higher yesterday: October Brent gained 0.6% to $72.63 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.