Processing #REE Outside of China, Will Ucore Rare Metals Have an Answer?

by Peter Epstein, CFA, MBA of EpsteinResearch epstein.peter4@gmail.com @peterepstein2

Ucore Rare Metals [TSX-V: UCU] / [OTC: UURAF) continues to make meaningful strides in the potential commercialization of its Molecular Recognition Technology (“MRT”) platform. The most important updates on the SuperLig®-One REE separation pilot plant (“pilot plant”) were the completion of construction, on time and on budget, and subsequent commissioning.

As promised, Pregnant Leach Solution (PLS) from Ucore’s Bokan Mountain (H)REE project in Alaska will be the first to be processed. With the pilot plant commissioned and undergoing testing, Ucore is now pursuing a large number of leads across a range of potential applications. Management assures me that there are far more inquiries pouring in, than sales calls going out.

That’s due to Ucore’s 60%/40% JV with privately held technology partner IBC Advanced Technologies, Inc., allowing for exclusive use of MRT both inside and out of the REE realm. Diverse applications include inserting MRT directly into currently operating facilities, recycling and tailings remediation and the separating other metals such as lithium. Ucore is also evaluating a number of opportunities beyond these potential end uses. [Photos of completed Pilot Plant]

Ucore CEO, Jim McKenzie, has commented that,

“Our SuperLig technology has a broader scope of applications than most investors can appreciate right now. Yes, we’ve invented a better mousetrap for the separation of rare earths, which is an outstanding accomplishment in isolation. But the MRT platform is effective for the vast majority of technology metals, including lithium, tungsten, cobalt and PGM’s. So, our growth pathways across multiple resource industries are wide and deep.”

Are the tides turning for natural resource industries?

The timing of the pilot plant could prove to be fortuitous, as many natural resource industries are showing signs of improvement. For instance, oil prices have bounced 60%, from a brief stop at $27/bbl (WTI Crude), and the benchmark iron ore price is up about 75% from its December low. But lithium is the metal that’s captured the world’s attention, the price of which is reported to have more than tripled in the past 6 months.

Importantly, the seemingly never-ending flow of favorable news from the electric transportation and energy storage systems segments, directly benefits Ucore. Commercialized MRT systems for REE would be a significantly greener technology than those used in China, and would have a much smaller surface footprint. The fact that its superior selectivity makes REE processing safer, less expensive, faster & simpler, with 99%+ recovery and purity level, doesn’t hurt either.

China Completely Dominates Global Supply & Processing of REE

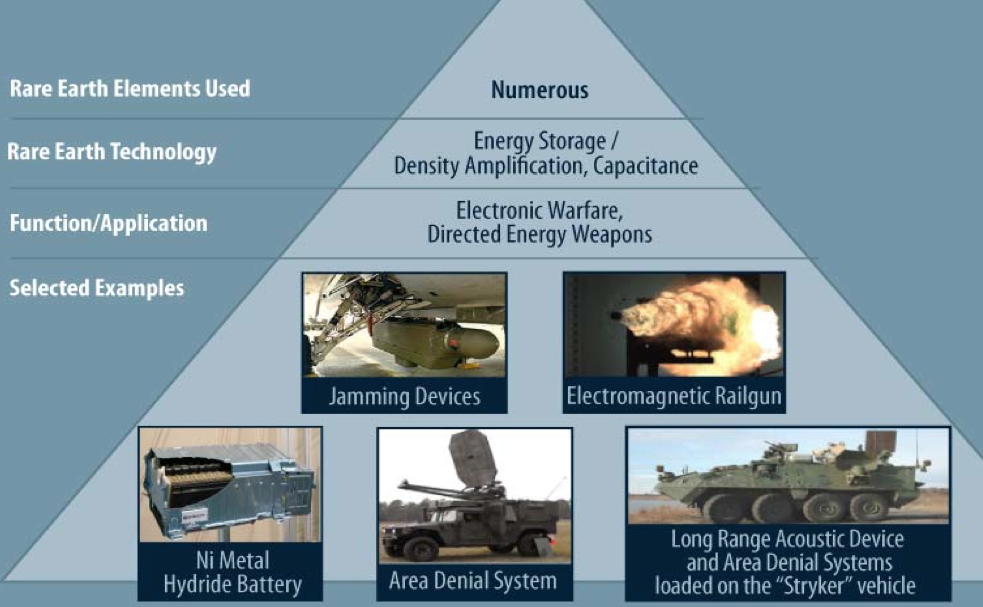

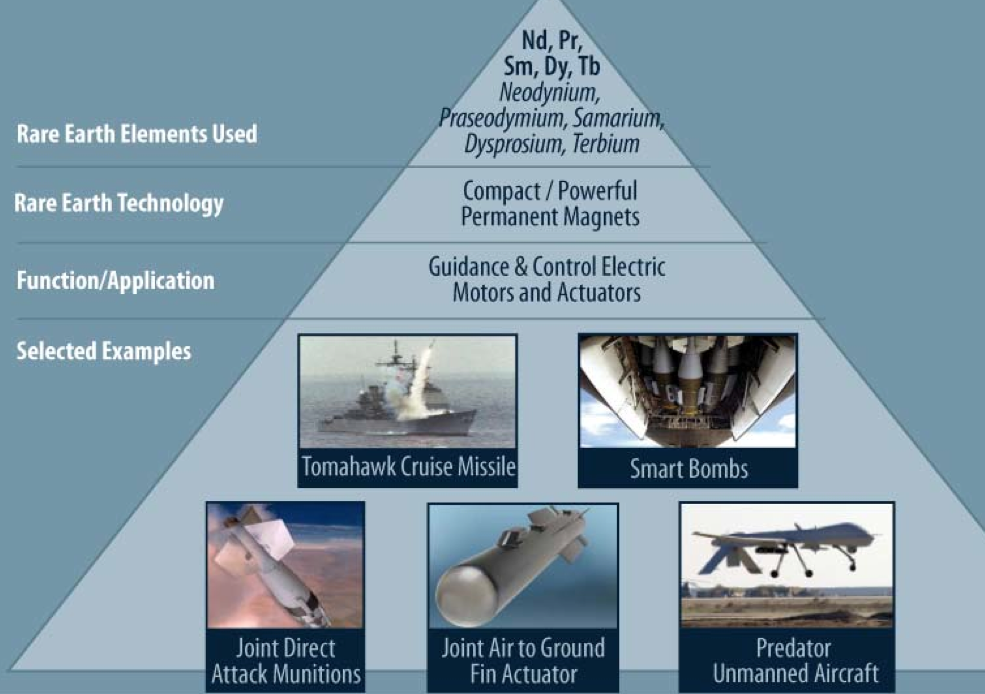

Li-ion batteries are a game-changer, not only in EVs, but also for storing renewable energy from intermittent sources like wind & solar. REEs are essential, and are typically hard to substitute for, in a growing number of components used in the green energy / storage / technology & military industries.

An even more compelling reason for the excitement over MRT is that it would be utilized outside of China. China completely dominates the supply and processing of REEs, yet no one appears to be overly concerned.

If MRT can be successfully commercialized, it would not only be greener, (offsetting China’s polluting industries), it would deliver desperately needed security of supply to global end users, especially in the U.S. Just-in-time processing and supply chains are the norm. Turning complex facilities and integrated systems off, and on, is time consuming, costly and sometimes operationally risky.

Security of Supply, or lack thereof….

Security of supply takes on even greater importance with regard to agencies like the U.S. Department of Defense (“DOD”). Our military complex cannot continue to be dependent upon China for both (H)REE supply & processing. China flexing its muscles on the REE front has happened before. When it did, REE prices soared, but more importantly, domestic inventory of some REE feedstocks fell to uncomfortable levels.

It’s both disappointing and alarming that U.S. agencies, both inside and out of the DOD, not to mention powerful industry trade associations, have failed to address this critically important issue. The ongoing failure to obtain security of supply is a clear and present danger. There are dozens of military applications dependent upon REEs.

Consider this 2010 NY Times editorial (this was big news) by Paul Krugman, referring to an international incident between China & Japan. An embargo on (H)REE to Japan (some contend to the U.S. as well) served to embarrass both political & private industry trade groups. Despite warnings dating back to at least the 1990’s, this event demonstrated our country’s dangerous ambivalence. Mr. Krugman stated,

“China’s abundance of REE and low extraction & processing costs — reflecting both low wages & weak environmental standards — allowed China’s producers to undercut the U.S. You really have to wonder why nobody raised an alarm, if only on national security grounds. Instead, policy makers simply stood by as the U.S. REE industry shut down. The result was [is] a monopoly position exceeding the wildest dreams of Middle Eastern oil-fueled tyrants.… China’s actions against Japan [in 2010] fundamentally transformed the rare earths market for the worse. As a result, manufacturers can no longer expect a steady supply of these elements….”

Six years later, I’m both happy and relieved to report that this critical issue has finally been addressed…. Well, I WISH I could say that, but just the opposite is true. China still dominates all things REE, the understanding of China’s capabilities has grown and geopolitical / trade / financial disputes between China, Japan & the U.S. remain in place.

The takeaways for prospective (H)REE producers outside of China, and companies with separation / processing technologies that could potentially make a dent in seemingly intractable problems, are profound. Ucore is in a prime position to 1) benefit from higher (H)REE prices down the road 2) be part of the solution to the global campaign for security of supply, and 3) address increasing demand for products and technologies that advance the paradigm shift away from fossil fuels.

All roads lead to Ucore Rare Metals [TSX-V: UCU] / [OTC: UURAF) and other emerging (H)REE companies with promising projects and separation / processing technologies.

For more information:

Comprehensive FAQ MRT platform

Academic Paper, “MRT: A Green Chemistry Process for Separation of Individual Rare Earth Metals“

By: Steven Izatt, James McKenzie, Neil Izatt, Ronald Bruening, Krzysztof Krakowiak & Reed Izatt (Feb, 20, 2016)

Academic Paper, “Increasing efficiency & decreasing cost and environmental damage of rare earth refinement.” — Massachusetts Institute of Technology (MIT)

Bokan (HREE) Project, (“Top 10 Advantages”)

Disclosures: Readers fully understand and agree that nothing contained in this article authored by Peter Epstein, from EpsteinResearch.com[ER], including but not limited to, analysis, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered in any way whatsoever, implicit or explicit investment advice or guidance. Further, nothing contained herein is a recommendation or solicitation to buy, or sell any security. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer and does not perform market making activities. The shares of Ucore Rare Metals are highly speculative, not suitable for all investors. Readers are urged to consult with their own financial advisors before making investment decisions.

Any comparison between or among stocks is for illustrative purposes only, and should not be taken as fact or relied upon. Readers understand and agree that they must conduct their own investment due diligence. An investment in any small cap stock, including Ucore Rare Metals, can deliver a 100% loss. While the author believes that he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein is not responsible for any perceived, or actual, errors including, but not limited to, analysis, commentary, opinions, views, assumptions, reported facts & financial calculations, or for investment actions taken.

At the time this article was posted, Ucore Rare Metals was a sponsor of EpsteinResearch.com and the author did not own shares in the Company.