Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPNZD, published in members. As our members know, GBPNZD recently corrected cycle from the 07/30 low. Pull back has unfolded as Elliott Wave ZIG ZAG pattern. After the pull back completed we got expected rally when the pair broke 08/28 peak confirming further extension higher within the cycle from the 1.828 low. In further text we’re going to explain the forecast and Elliott Wave Pattern.

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag pattern.

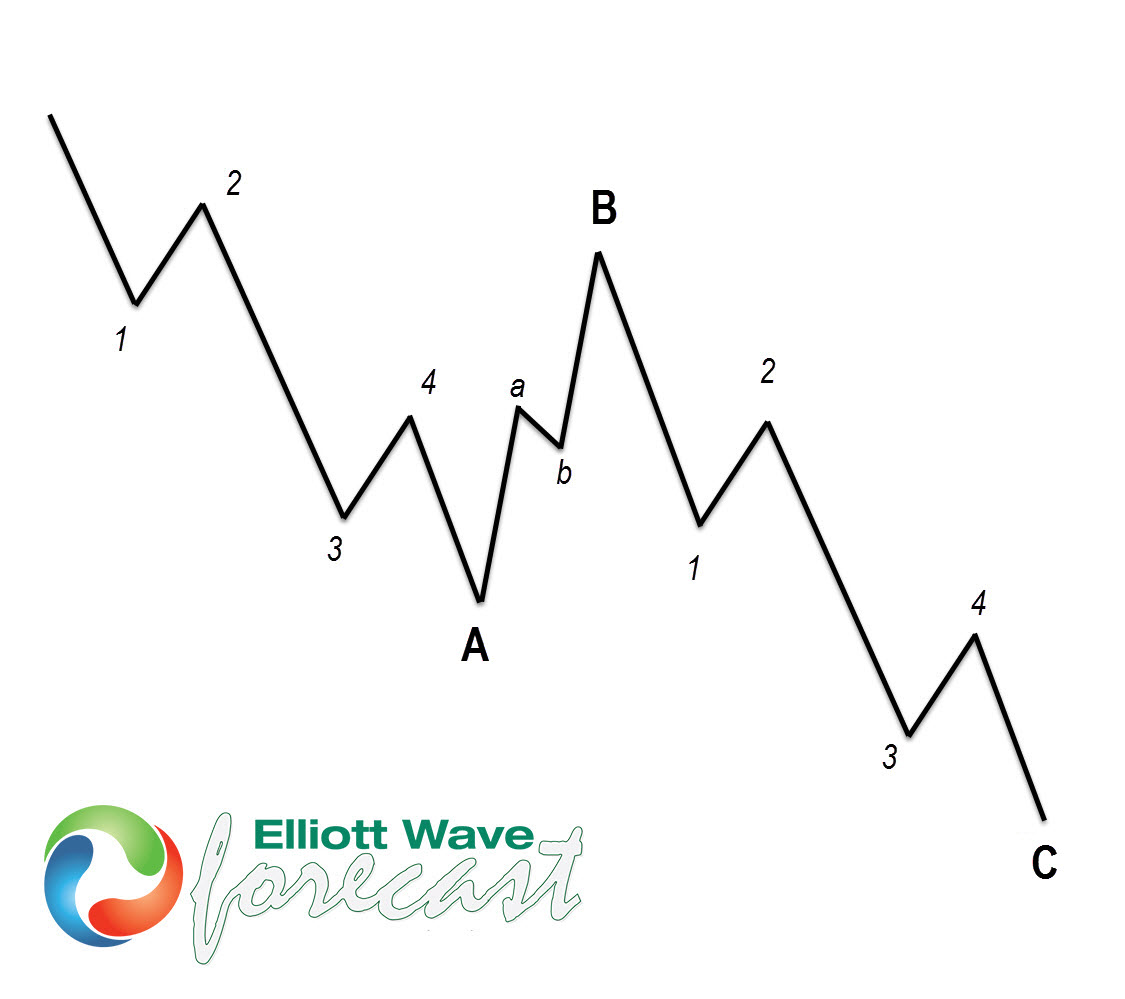

Elliott Wave Zig Zag Pattern

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings which have 5-3-5 inner structure. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions and ideal retracements.

At the graphic below, we can see what Elliott Wave Zigzag structure looks like. 5 waves down in A, 3 waves bounce in B and another 5 waves down in C.

Now, lets’ take a look what Elliott Wave Zigzag looks like in the real market.

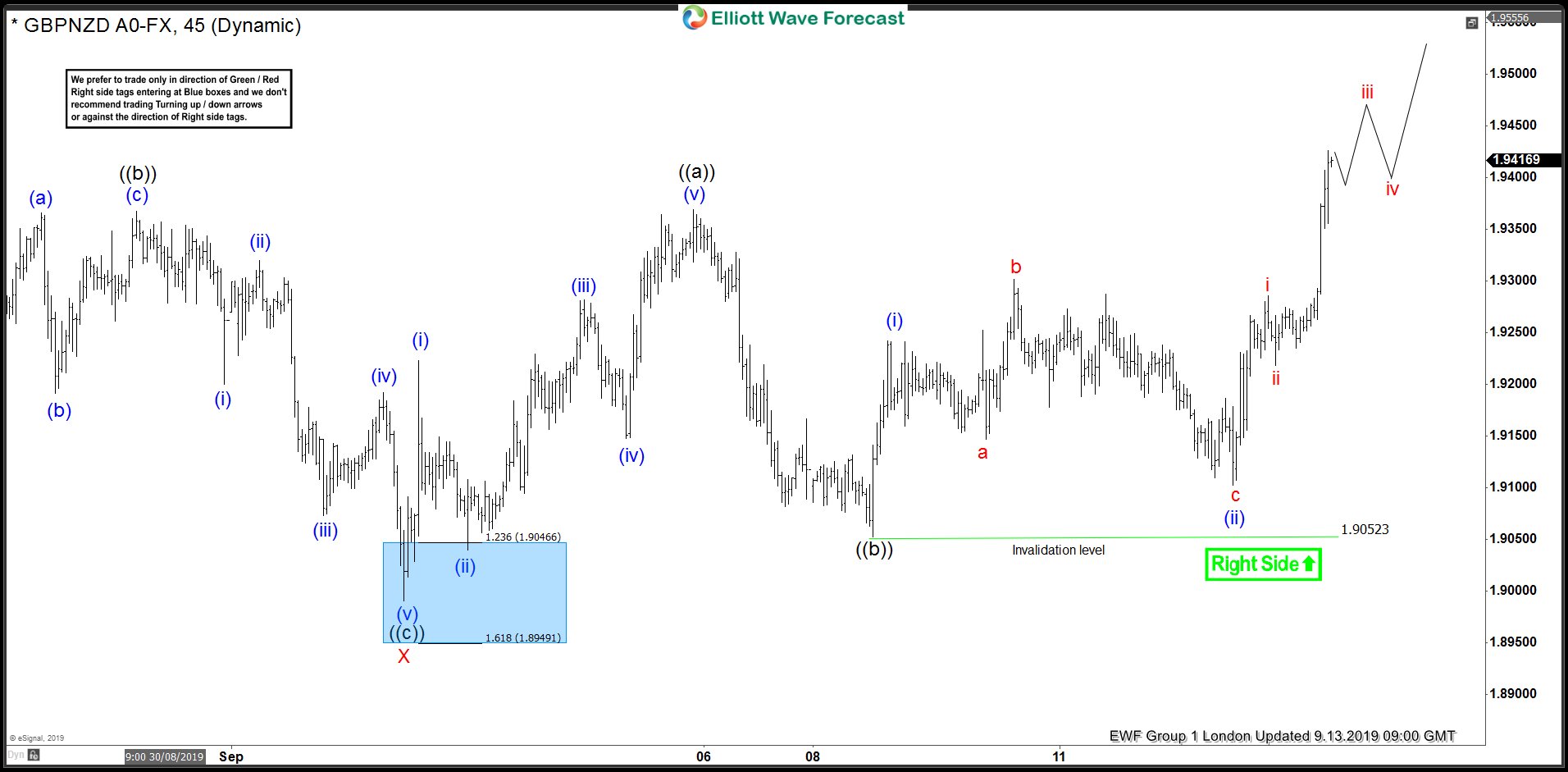

GBPNZD 1 Hour Elliott Wave Analysis 9.2.2019

As we can see on the chart, we are getting 3 waves down in wave B red pull back. Pull back is unfolding as ((a))((b))((c)) Elliott Wave Zig Zag pattern. First leg ((a)) has made a very sharp decline, which is obviously impulsive structure. ( 5 waves are not labeled on this chart but they’re vissible on lower time frames) . Then we got 3 wave bounces in wave ((b)). And finally another leg down ((c)) that should be unfolding as a 5 waves structure. At this moment we are calling Zig Zag incomplete, looking for a more short term weakness toward blue box area : 1.91154-1.8957. At mentioned zone buyers should ideally appear for proposed rally or 3 waves bounce alternatively.

As our members know , Blue Boxes are no enemy areas , giving us 85% chance to get a bounce.

GBPNZD 1 Hour Elliott Wave Analysis 9.3.2019

At this moment we are calling Zig Zag completed at 1.8993 low. As far as the price stays above that level, we expect further rally in the commodity pair. We would like to see further separation from the 1.8993 low and ideally break above A red peak ( 08/28 ) to confirm next leg up is in progress.

You can learn more about Zig Zag Elliott Wave Patterns at our Free Elliott Wave Educational Web Page.

GBPNZD 1 Hour Elliott Wave Analysis 9.13.2019

1.8993 low held well and we got proposed rally as expected. Eventually the price has broken above 08/28 peal confirming next leg up is in progress. We expect further strength in the pair within the cycle from the 07/30 low.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.