Elliott R. Morss ©All Rights Reserved

Introduction

Trump’s rambling discussions about why the US is not “great” include references to the large US trade deficit and in particular, its deficit with China. His suggested solution is to threaten a 45% tariff on goods imported from China. Trump also wants to penalize Japan and Mexico (why not Germany as well?) for their large trade surpluses with the US. Trump says such steps are justified because they regularly devalue their currency to promote exports.

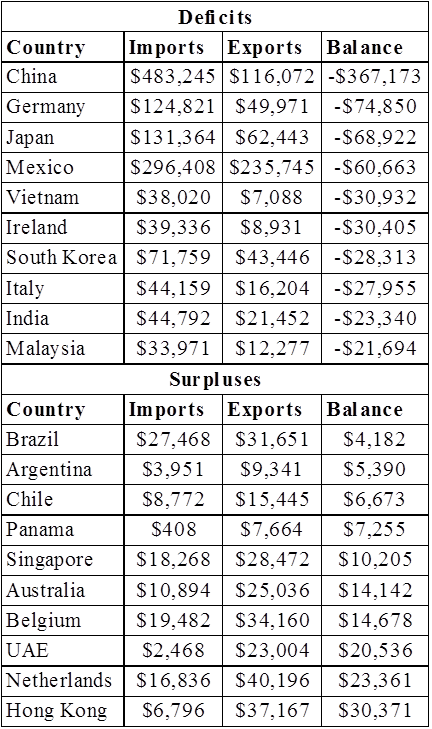

Table 1. – US: Largest Merchandise Trade Deficits/Surpluses, 2014 (mil. US$)

Source: US International Trade Commission

Trump’s Bogus Devaluation Argument

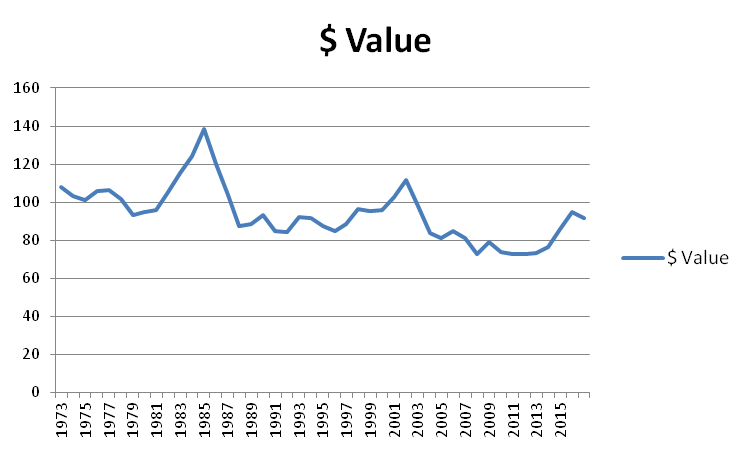

Let us suppose that the merchandise trade balance was key. The US has run large trade deficits since 1976. That would mean a large net outflow of dollars. As the supply of dollars in world markets increased, one would expect the dollar’s value relative to other currencies would decline. The following graph shows this has not happened. The dollar’s value here is trade weighted against other currencies. Over time, the dollar’s value has fallen only slightly.

Source: Federal Reserve Bank of St. Louis

Trump argues that other countries buy dollars and other US securities to strengthen the dollar against other currencies. And this in turn makes their exports cheaper to potential US buyers. This does happen, but there is another reason foreigners buy US securities: for their inherent value. Foreigners view US debt and equity as extremely attractive investments with little risk. Indeed, it is legitimate to argue they are one of the US’s most attractive “exports.” But unlike the trade in goods and services, financial transactions are not included as part of the “trade data.”

It appears that Trump has a very limited understanding of international transactions. Accordingly, I offer a brief “primer” on the subject.

Trade Balances and Capital Flows

For many years, conventional wisdom held that the merchandise trade balance (the difference between exports and imports of goods) was all-important. A trade deficit meant you were buying more on world markets than selling. But something else has also been at work that has allowed the US to run such large deficits for so long: other international transactions. In addition to the trade in goods, there is also the trade in services. And beyond that, there is income from overseas investments and “secondary income” that include U.S. government and private transfers, personal transfers (remittances), insurance-related transfers, and other current transfers. Together, these items are known as the “Current Account” and are presented in Table 2.

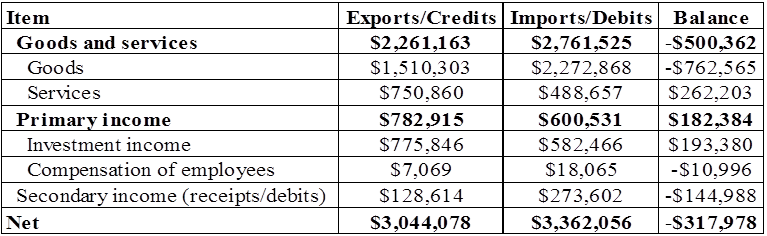

It is notable that the US runs a substantial surplus on services: in 2015, the US sold more services to overseas customers ($262 billion) than it bought.

Table 2. – US Current Account, 2015 (mil. US$)

Source: US Bureau of Economic Analysis

Together, these items whittled the goods deficit down from $763 billion to the US current account deficit of $318 billion.

Financial Flows

But the current account does not give a complete picture of US international transactions. It does not include a large number of financial flows. For decades, these flows were viewed as “adjustment items”. But the US experience over the last two decades has changed all of this. Just as is the case with the export of goods and services, there has been a huge global demand for US government debt and equities.

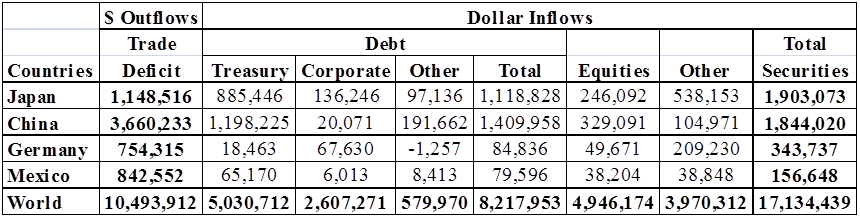

This is seen in Table 3 where the “export” of US securities since 2000 is compared to the US merchandise trade deficit. Over that period, US trade deficits totaled $10.4 trillion. This was more than offset by foreigners’ purchases of $17.1 trillion of US debt, equities and other securities. China and Japan also bought more securities than their cumulative trade deficit totals.

Table 3. – US Trade Deficits and Security Sales to Foreigners, 2000-15 (mil. US$)

Source: Treasury International Capital System and US Census

US Consumers Benefit from Inexpensive Foreign Imports

In attacks and penalty threats, Trump ignores an important point. Yes, the US runs large deficits with China and other countries. But in return, the US consumer gets less expensive products than if they were made in the US. Let’s look at some “details.” The five top-selling autos in the US last year were all Asian – Toyota Camry, Honda Accord, Toyota Sienna, Honda Odyssey and the Honda Pilot. The American public believes they are the best cars to own. Should they be subjected to a 45% import tariff or should American automakers be forced to compete with them?

And it gets more complicated. Many of these “Asian” cars were made in the US. In 2012, Toyota sold 2,274,600 autos in North America, with most of them made in the US. Of that number, 1,720,600 or 76% were made in US factories.

US Job Losses

Trump claims that many US jobs have been lost as a result of trade deals to foreign nations. He is mistaken. As I documented in an earlier piece, most of the US jobs that have been lost over the last few decades can be traced to labor saving technologies. The McKinsey Global Institute

Conclusions

Trump’s concerns over the large US trade deficit are misplaced. Trade in goods is only one of the several major international transactions categories, and the US surpluses in the sales of financial securities have been greater than its financial trading deficits. In addition, the US consumer benefits from purchasing inexpensive foreign products. And his plan to penalize countries selling more goods from the US than buying is bizarre.

The US has the strongest economy in the world. It can more rapidly commercialize good ideas than any other. It does not need Trump’s nonsense threats to penalize other nations.