What's your number? I don't mean phone number. Have you seen the TV ads by a financial services company with the people walking around carrying (mostly) seven-digit numbers on their backs, representing the amount they've calculated they'll need to have accumulated in order to retire?

In the most recent of a series of "The Number" posts I've done, I talked about a $3 million number. But my point in that column was only partially about how a $3 million portfolio can make for a successful retirement. It was just as much about things you can do to increase your chances of putting together a successful retirement plan regardless of your number.

A successful retirement is partially a question of probabilities. Unless you have some secret income-generating vehicle that will kick out an absolutely certain amount of money, year in and year out, no matter what the stock market does or inflation does or if war or crisis breaks out, you simply have to pay attention to probabilities.

I can put it another way. For most of us, so-called straight-line projections--where income, spending, taxes, and so on are assumed to move in an orderly fashion, year in and year out--simply won't cut it. The real world does not operate that way.

I'm a fan of Monte Carlo simulations. Monte Carlo is used in all sorts of disciplines outside of finance, like weather prediction and engineering. For the purposes of retirement planning, a Monte Carlo simulation takes into account your assets, tax bracket, the historical volatility of your investments, the correlations among your investment types, and more to estimate the probability--measured in percentage terms--of your plan succeeding.

So if it's less of a binary matter (yes I can retire with this plan vs. no I cannot), and more of a probability matter (my retirement plan has an X% chance of succeeding), what can we do to get the probability higher?

Preaching About The Converted

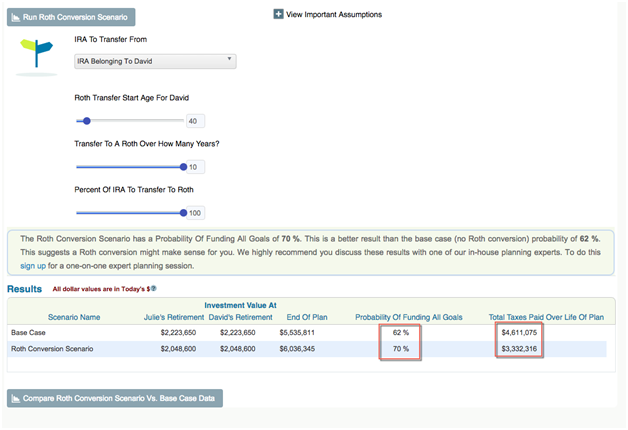

One way to increase your probability could be to convert a traditional IRA to a Roth IRA over time.

I recently wrote an article about this topic. The gist of that article is that most people don't need to consider converting their traditional IRA to a Roth. But there are exceptions. In some cases, making the move can increase a plan's probability of succeeding by several percentage points.

It basically comes down to tax minimization: Under which investment type are you more likely to reduce your tax burden over time?

As I have written about before on this forum, I like solid dividend paying stocks for retirement income. They may not be as certain as that imaginary secret income-generating investment I mentioned earlier, but some of them are pretty close. I like companies such as Chevron CVX, Coca-Cola KO, Southern Co SO, and Verizon VZ, which tend to kick out payments through thick and thin. Some of these companies have boosted their dividends every year for decades. If you're investing your IRA money in these stocks ahead of retirement, might it make sense to move some or all of that money to a Roth over some period of time?

Using the publicly available WealthTrace Financial Planner, you can enter your spending, saving, and investment information, and then use the Roth IRA Conversion tool to see what might happen if you converted your traditional IRA to a Roth.

In this case, the probability goes up, due mostly to the fact that taxes drop so substantially.

Like I say, for most people, converting probably is not necessary. But given what is at stake, it's definitely worth having a look using a tool that takes probabilities into account.