Times Square on New Year's Eve, 2020 (Photo via Gabe Gutierrez).

New Year's Eve Flex

The sharpest juxtaposition on New Year's Eve this year was between empty Times Square in New York City,

and the packed crowds in Wuhan, China, epicenter of COVID-19.

This divergence didn't start on New Year's Eve, of course. While young New Yorkers have been huddled in their tiny apartments (with the exception of some "mixed-age teenagers"), Wuhan's youth have been moshing.

As our correspondent Michael Story notes, New Year's Eve celebrations are a national flex.

Packed New Year's Eve celebrations in Wuhan are the ultimate China flex. In fact, they're the cherry on the top of a three decade long sundae of China flexes.

At Least We Have Our Freedom

As U.S. Senator Marsha Blackburn pointed out, in this country, we're free to criticize the Chinese premier online.

So we've got that going for us. But despite the new COVID vaccines, Americans weren't free to celebrate New Year's Eve in their biggest city, or do much of what they used to take for granted. Why not?

State Of Fear

In his 2004 novel State of Fear, Michael Crichton suggested an answer. For those unfamiliar Crichton, he was more than a novelist: he was also a graduate of Harvard Medical School and was ahead of the curve on science and technology for most of his life. In 1983, when William Gibson was writing Neuromancer on a manual typewriter, Michael Crichton published his guide to personal computers. In State of Fear, Crichton's stand-in explains why global warming alarmism took off in 1989: with the collapse of the Berlin Wall, fear of nuclear war receded. Fear of global warming replaced it.

Fear facilitates social control. China, which has more direct means of control, can let it is young people party in the streets. Expect our masks and social distancing mandates to continue for for a while. Some cynics thought they'd end the day after November's election. They weren't cynical enough.

Investing In A State Of Fear

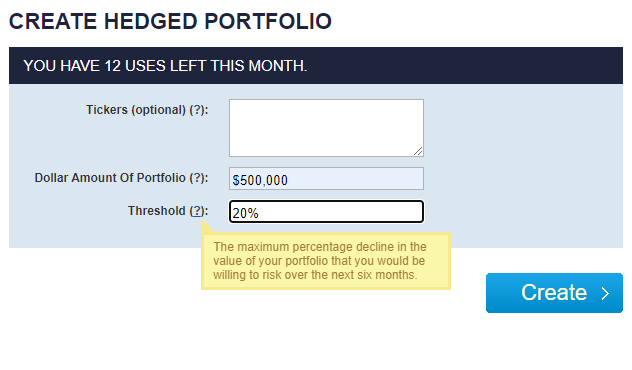

Our approach to investing in a state of fear is to buy likely winners and hedge away the fear. Here's an example, followed by an explanation. Let's say that you have $500,000 in cash you want to put to work in 2021, but you aren't willing to risk a drawdown of more than 20%. If you indicated that in our hedged portfolio construction tool on New Year's Eve,

This and subsequent screen captures are via Portfolio Armor.

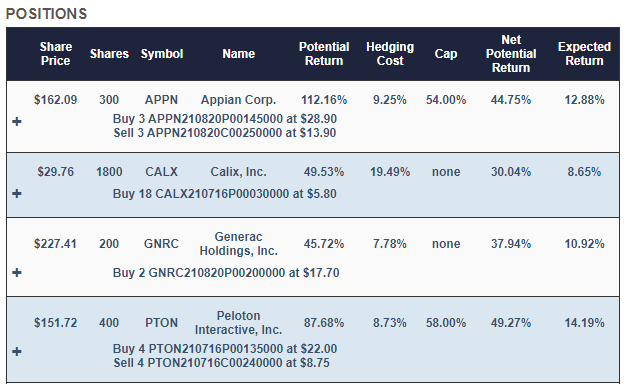

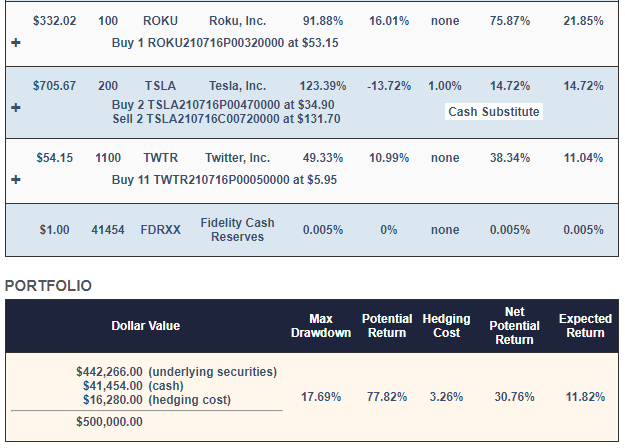

This is the portfolio it would have presented to you.

With this, your maximum drawdown over the next six months - that is, if every underlying security went to zero - would be a decline of 17.69%. Your best case scenario would be a gain of about 31%, and your expected return (a more likely scenario) would be a gain of about 12%.

Why These Stocks?

Each trading day, our system analyzes total returns and options market sentiment to estimate potential returns for thousands of stocks and ETFs. Since we added a new source of alpha last May, the returns of our top names have consistently beaten the market. Appian (APPN), Calix (CALX), Generac (GNRC), Peloton (PTON), Roku (ROKU), and Twitter (TWTR) were selected because they were among our top names - the ones that had the highest potential returns, net of hedging costs. Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Tesla (TSLA) position, to further reduce hedging cost.

Why These Hedges?

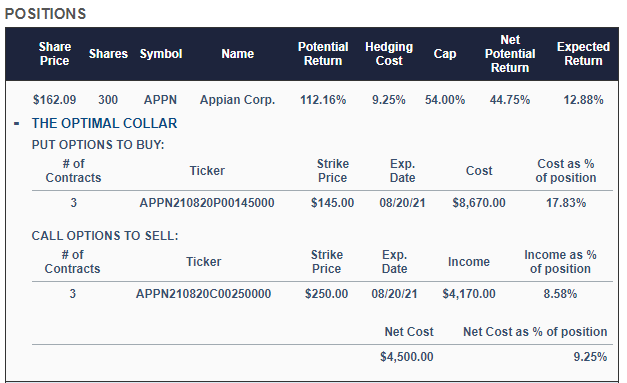

On our website, if you click the plus signs in the portfolio above, the positions expand to give you a better look at the hedges. For example, this is what the APPN position looks like expanded.

As you can see, APPN is hedged with an optimal, or least expensive, collar. Some of the other positions are hedged with optimal puts. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a recent post: When To Hedge With Puts Versus Collars.