I feel like the Billy Crystal character in Analyze This all the time. There’s always some mob boss politician or central banker or CEO or asset manager pinching my cheek and telling me that it’s all gonna be okay, that I’ve just gotta understand how things are.

My god, I am so tired of having my cheek pinched.

I am so tired of being nudged in such an artless, heavy-handed way.

I am so tired of being told that 2 + 2 = 5.

Yesterday it was one of the asset managers pinching my cheek, a senior partner at Baillie Gifford, a firm that manages over $200 billion. Here’s his FT Opinion piece.

Japan’s GPIF is right — short selling is downright irresponsible [Financial Times]

“Stock and bond markets, together with their investors, have a higher purpose than mere profit: their ultimate function is to provide capital to companies creating wealth for the benefit of wider society. This is best achieved through taking a long-term perspective and considered decisions.”

“What is the value created through stock lending? Those who defend the practice cite setting fair prices as an important outcome. But how valuable or helpful is this to the broader mission? Is such price discovery really helpful or necessary?”

“Baillie Gifford does not lend out stocks for our investment trusts or mutual funds, though many of our segregated clients do so, by their own choice. GPIF should be applauded for taking the long term and principled view of its responsibilities and hopefully more of our clients will follow its example.”

I mean, this is a sentence actually published by the FT in a non-ironic sense:

Is such price discovery really helpful or necessary?

As the kids would say on Twitter, let that sink in.

What is a Nudge?

It’s an article like this, pinching your cheek and telling you that of course it’s okay if market regulators decide to institutionalize GPIF’s “responsible” decision to stop lending out stock for short-sellers. After all,

Stock and bond markets, together with their investors, have a higher purpose than mere profit.

What do I mean when I say that capital markets have been transformed into a political utility?

This.

This is the water in which we now swim.

Or to use another vocabulary in vogue these days, it’s a method of normalizing an exceptionally non-normal world, where price discovery is something to apologize for, something distasteful and uncouth, like farting loudly in public.

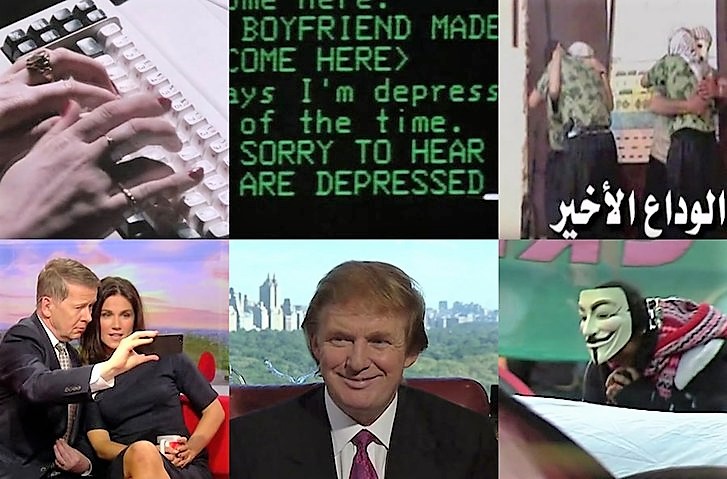

from Hypernormalization, by Adam Curtis (2016)

This is a cover shot for a BBC documentary by Adam Curtis, called Hypernormalization. It is, in the words of The New Yorker, “painting a picture of a world increasingly dominated by the false reality put forth by corporations and politicians.” In Curtis’s own words, channeling Alexei Yurchak:

“No one could imagine any alternative. You were so much a part of the system that it was impossible to see beyond it. The fakeness was hypernormal.”

Yep, that’s the Zeitgeist. That’s Fiat World. That’s the Long Now.

But I see people waking up to this. I get hundreds of emails every week from people opening their eyes.

Change is coming. Not from above, but from below. Yes to tear down, but also to rebuild.