Yesterday, Illinois unofficially accepted their fate that they will be 'junked'.

It begs to question why haven't investors realized this yet. Maybe because the last decade of ZIRP (zero interest rate policy) has forced yield starved investors into eating anything offering more than the paltry U.S. treasury bonds.

No matter how rotten. . .

Illinois has negotiated lower credit rating termination triggers for its interest-rate swap deals with banks, which stood to pocket fat fees if the state is downgraded to junk as soon as next month, a spokeswoman for the governor's office said on Monday - wrote Reuters.

Now, when the broke state gets their credit rating knocked down to junk status, they wont be forced to pay roughly $40 million in fees to banks.

But, if they get knocked down again to the second level of junk status, they will have to pay these high fees. That is BB for S&P and Ba2 with Moody's.

This only gives them borrowed time. . .

But, most importantly, this move tells us they are preparing to bedowngraded again.

It is not an 'if they will be junked' question, but rather a 'when willthey be junked' question.

This would be the first time a state in America will have a junk rating.

And it is the fifth largest state in the country. . .

How did things get this awful?

Illinois has a Republican governor (surprise), Mr. Rauner, that is at deep odds with the Democrat House Speaker, Mike Madigan, and his Democrat backed legislature. Two huge egos that can't agree on anything fundamentally.

The story is always the same. . .

In 2014 Rauner was elected governor of Illinois. He promised some 'right to work' ideas, cutting taxes, and adjusting public pension compensations. You know, the usual Republican agenda.

But the Democrats hate these notions. They took it as an attack on the working citizens, which are their voters. They vow to defend the over-powering unions, demanding higher taxation, and to protect pensioners. You know, the usual Democrat agenda.

Fast forward to present day, and the state of Illinois is in peril. The state is spiraling into uncharted territory. Yet neither side will backdown. It is the war to end all political wars.

Worst of all, they don't realize that if the states bond market bellies up and goes junk, they won't have access to money. This is because most mutual funds and pensions and insurance companies can only buy investment grade bonds, not junk rated. That would be a large source of capital the state can't access. And if they do get any loans, it will have higher interest rates, making the borrowing costs much greater.

With Illinois' political and fiscal problems showing no sign of abating, investors on Thursday demanded fat yields for the low-rated state's $1.3 billion of general obligation refunding bonds - wrote Reuters in October 2016.

Illinois economy and pension funds can't afford to be kept out of the credit markets or pay higher interest rates long term. They're barely getting by as is, even though their liabilities and deficits are spiraling. In the decade of Fed induced liquidity and easing, debtors were able to binge on cheap financing from yield starved investors.

But things are changing . . .

The Fed is tightening and the economy is weakening, investors will become more choosy of where their capital goes.

Similar reasons are what eventually unfolded Greece in 2010. They couldn't finance their crazy deficits and generous public pensions. And as their economy weakened, so did their bond ratings. Eventually they couldn't borrow affordable money and creditors cut them off.

In January 2010, the Greek Ministry of Finance published Stability and Growth Program 2010.[16] The report listed five main causes, poor GDP growth, government debt and deficits, budget compliance and data compatibility. Causes found by others included excess government spending, current account deficits and tax avoidance.

Illinois is heading down the way of Greece.

And if the United States economy slumps into recession, which it is coming dangerously close to, Illinois will finally break.

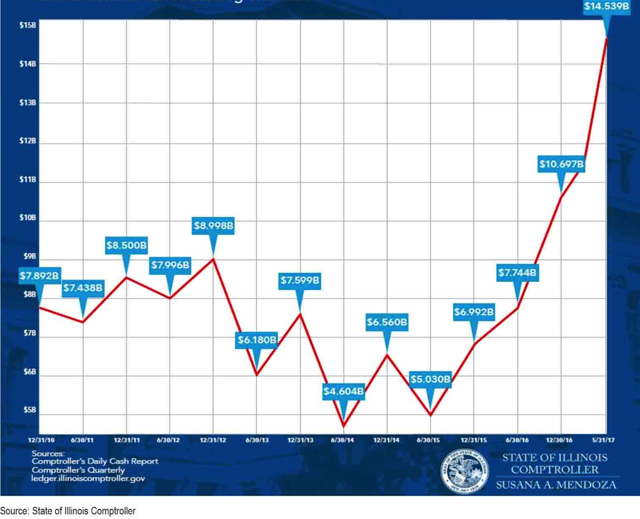

The state has compiled roughly $15 billion in unpaid bills. An annual deficit of $6 billion, which there is credible evidence that the deficit is actually 2-3x larger than reported. I can't forget to mention their $130 billion pension liabilities.

It gets worse. . .

The at-odds government hasn't even been able to pass a budget the last two fiscal years. It has been over 700 days without an operational state budget.

It's no surprise the state's bond rating has cratered to just one level above junk.

And it will worsen from here. . .

If getting knocked down to junk level isn't a wake up call for the state government, I don't know what will do it.

But, then again, the last seven downgrades did nothing.

And I personally don't believe they will fix anything until creditors force their hands.

Just as Detroit in 2013, Puerto Rico in 2016, and Greece in 2010. The people of the state will be the ones that are blindsided and suffer.

Illinois State Bonds should be avoided.

It doesn't matter how much they yield if they can't pay it back anyways.