Hey, a quick observation about GE.

With GE's annual general meeting is occurring in a few days, I'd hate to be in managements position and have to explain to shareholders why they overstated earnings, for years 2016 & 2017, as the SEC raids revealed.

But, if you paying close attention to the operating net cash flows over the last 5 years, you have noticed a significant deterioration, faster then their earnings deterioration.

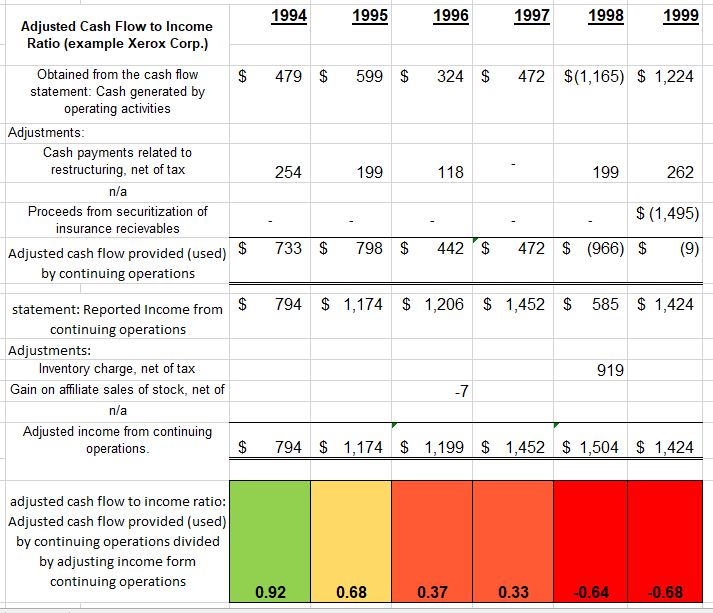

One ratio to detect earnings manipulation is the cash flow-to-income ratio. It measures over a time-series the difference between adjusted operating cash flow and adjusted net earnings. And if a significant difference between earnings and operating cash flows occurs over a period greater than 2-3 years, you could be looking at the next Enron.

Here is GE's cash flow-to-income ratio.

Paying particular to 2016, when you see a consistent pattern where operating cash flow below reported earnings, start asking serious questions.

A better example is Xerox in the late 1990's. Xerox had admitted to the SEC of premature revenue recognition during the years 1998 and 1999.

You can see a clear consistent deterioration of cash flows while earnings grow and flattened out. Cash flows are very hard for management to manipulate, whereas manipulating earnings are is much easier, as Enron demonstrated.

Understanding how earnings, and also cash flows, can be manipulated is a topic for every serious investor, and that is why we will cover it in depth in the 10-Week Investment Analysis clinic. Check out the 10-Week Investment Analysis information guide here.

Yours in investing

Adam Parris

Sign up to receive exclusive investment insights as an email subscriber - Click Here -