Background Story

Esperion Therapeutics (NASDAQ:ESPR) was founded in 1998 by current Chairman Roger Newton, after he achieved success with Lipitor at Warner-Lambert. After a successful Phase IIa clinical study in 2004 for a synthetic HDL-C therapy, Pfizer (NYSE:PFE) purchased Esperion for $1.3 billion. In the aftermath of the failure of Torcetrapib, Newton was able to persuade Pfizer's executives to sell some pre-clinical small molecules that the original Esperion had worked on. In May 2008, he raised $23 million from venture capital investors to buy the rights to the old Esperion Therapeutics (these investors remain ESPR's majority shareholders). ETC-1002's mechanism of action wasn't fully understood prior to being studied by the new Esperion. Esperion's sole drug is ETC-1002, and it owns its entire worldwide IP rights. It is a first-in-class, oral, small molecule pill which has a CoA derivative that inhibits ATP citrate lyase. The molecule acts to reduce cholesterol biosynthesis, upregulate LDL receptor expression in the liver and reduce circulating levels of LDL cholesterol. In Phase II trials, it has achieved an average 30% reduction in LDL-C, when used as a monotherapy and in patients on background statins. Used in combination with ezetimibe, it achieved an average 50% reduction.

Current Position

At year-end 2015, Esperion has successfully undertaken three Phase I and seven Phase II trials testing ETC-1002 in 727 patients, with the drug being well-tolerated and associated with no dose-limiting adverse events. Esperion has guided that its Phase III program and a CVOT will cost approximately $125 million up to 2018. The FDA has recommended that Esperion has the trial well underway (completion not a condition of approval) at the time of seeking approval in 2018. To achieve its full commercial potential, Esperion will have to license out to a larger pharmaceutical partner. Any potential partner would likely demand that a CVOT be completed to improve the commercial potential. Esperion hopes that commencing one before approval will "open the door" for label expansion based on positive, long-term data. While it is more likely that a potential deal maker will wait until the data plays out next year and in 2018, the CV/diabetes market is already served with large salesforces from several large pharmaceutical companies.

Risks to the Efficacy of ETC-1002

Esperion's share price alternated sharply between the extremes of over-expectation to under-expectation in 2015 (current share price factors very little future expectation). The speculative nature of the company appears to be the primary reason for this. Analysts are largely positive on the long-term potential of ETC-1002, but recognize that questions remain over certain areas of the data picture. These risks could be fatal and include:

- Efficacy when used in combination with high-dose statins.

- Potential unknown safety concerns as ETC-1002 was placed under two FDA partial clinical holds in 2013.

- Expression's characteristics of ACSVL1 in broader human test populations.

1. High-Dose Statin Efficacy

The HDS combination fear relates to the concern that prior doses of high-dose statins will "max out" the pathway preventing ETC-1002 from being effective. This fear might stem from failed development efforts undertaken by Bristol-Myers (NYSE:BMY), Merck (NYSE:MRK) and Takeda Pharmaceutical (OTCPK:TKPYY) to find complementary mechanisms of actions to HMG-CoA reductase further along the pathway. These efforts focused on inhibiting squalene synthesis (squalene being the final element on the pathway). When tested in rats, these compounds showed evidence of liver toxicity. Takeda's TAK-475 was the only one of these to reach late-stage development. Large-scale trials produced a dose-dependent (100 mg) increase in the enzyme alanine aminotransferase, along with a rare case of bilirubin, which indicated potential hepatic toxicity in two patients. Answering this safety question would have required further long-term studies before marketing. Whether this was a rare case where causality was difficult to establish (as is considered to be the case with reports from Atorvastatin's clinical trials) is impossible to tell. At Esperion's 2015 Investor Day presentation, Dr. Narendra Lalwani (Executive VP of R&D and COO), gave his view that ETC-1002 is complementary to statins and enhances the decrease in cholesterol biosynthetic activity on top of that produced by statins. He described how both drugs work to produce bottlenecks at different sites along the pathway where cholesterol is being synthesized, similar to the action of "putting a break on a wheel to slow down the synthesis in a factory production line to reduce output." Esperion is currently undertaking a Phase II study with high-dose statins (ETC-1002-035) and expects to have top-line results in Q3 2016.

2. Partial Clinical Holds

Two partial clinical holds were placed on ETC-1002 to prevent it from being tested above 240mg/dl and in trials beyond six months in duration. These measures were due to ETC-1002's structural similarity to PPAR alpha drugs which have shown toxicities in monkeys. However, it showed clean results in two-year rat and mouse carcinogenicity studies, and the FDA lifted the PPAR partial clinical holds in record time. Dr. Lalwani pointed out at the Investor Day presentation that rodents are commonly known to express 10x more PPAR alpha receptors than humans and humans are known to have very low density of PPAR alpha in the liver where ETC-1002 CoA is active. In ETC-1002's human clinical trials, no increases were seen in PPAR alpha activation. Also, no triglyceride lowering or HDL activity was observed. These are two lipid biomarkers which are associated with PPAR alpha activation in fibrates. ETC-1002 has been tested at doses between 40mg/dl and 240mg/dl and no effect was seen in HLD or triglyceride levels. The high-dose toxicity seen in a few samples may have been due to a one-time, incorrect dosing error, as toxicity side-effects were absent from other preclinical studies and in rat and mouse carcinogenicity studies. Ultimately, these concerns will only be answered in long-term safety studies.

3. Expression Characteristics of ACSVL1

As a pro-drug ETC-1002 requires activation and meditation by an ACS (Acyl-CoA Synthetase) gene to convert into the active form ETC-1002 CoA. The isoform candidate gene that Esperion has identified is ACSVL1. The gene has shown expression levels concentrated inside human liver microsomes, however, this has only being verified predominately in rodent models (four human trials to date). Therefore, a key risk to ETC-1002's efficacy is how ACSVL1's expression characteristics will carry through in broad human populations in longer-term trials. Esperion's Dr. Steve Pinkosky feels that the results so far indicate a specific biological or physiological isoform that allows for the extrapolation that individual variability among a broad human test population would be similarly limited. Importantly, no other ACSs have shown signs of activation. ACSVL1's tissue expression characteristics have been examined in independent studies.

Changing Regulatory Framework

Esperion's investors were rocked by an apparent tightening in the FDA's regulatory stance after receiving the End-of-Phase II meeting minutes in September 2015. Initial fears were that the FDA was reconsidering its long-held view on the efficacy of LDL-C. Instead, the guidance given to Esperion was more standards based, and in the future, the FDA will be requiring all new drugs to prove their own risk/reward benefit and their ability to impact positive CD outcomes. In August, after the meeting but before receiving the minutes, Esperion communicated that a CVOT would not be a requirement for approval in ASCVD and HeFH patients. This remained the case, but instead it emerged that the FDA had urged that a CVOT be "well-underway" at the time of seeking approval. This caused a massive one-day 47% drop in the share price and the filing of a number of class-action lawsuits by aggrieved investors. While still not a requirement of approval having one, "well underway" will deplete Esperion's cash balance significantly prior to approval. In January, management dropped the ASCVD and HeFH labels and repositioned towards seeking initial approval with a label designed solely to treat statin intolerant patients. This change has a big impact on ETC-1002's valuation at this point in time, and this segment is the smallest of the potential market entry-labels. A statin-intolerant label will however separate ETC-1002 from the PCSK9 inhibitors (Praluent and Repatha) which have been approved to treat patients with rare lipid disorders.

Management Team

Esperion's executive team has extensive experience in lipid drug development and commercialization.

Tim Mayleben (MBA) is the president and chief executive officer. He has served as president, CEO or as a director of a number of life-science companies and has experience in venture capital.

Roger Newton (PHD, FAHA) successfully managed the original Esperion through its initial capital raise and eventual sale to Pfizer. He was on the team at Warner-Lambert that pushed for the development of Lipitor and has broad board experience in a number of other life science companies.

Narendra Lalwani (PHD, MBA) is a career lipid scientist and Fellow of the American Heart Association (FAHA) whose work included the development of Lipitor.

Mary McGowan (MD) is the chief medical officer. She is considered a national expert on lipidology and served as the principal investigator on many national and international lipid-lowering trials at the New Hampshire clinic (including Lipitor).

Marianne Andreach is senior vice president of strategic marketing and product planning. She has experience with the launch of both Pravachol and Lipitor as well as supporting both Plavix and Glucophage. She has worked in Medical Affairs at Pfizer Global R&D, and led marketing and product planning at the original Esperion Therapeutics.

Ashley Hall is the VP of global regulatory affairs. She served as vice president of regulatory affairs at Amgen (NASDAQ:AMGN) and Micromet (acquired by Amgen in 2012). She was global regulatory lead for cardiovascular at Amgen, overseeing the regulatory strategy and global filings for the evolocumab program (first PCSK9 inhibitor).

ETC-1002's Mechanism of Action

Esperion feels that ETC-1002 has a reduced risk profile due to its mechanism of action at the first stage of the cholesterol biosynthetic pathway. The pathway is well understood and characterized through numerous successful statin trials. Its differentiated profile relative to statins is based on how it targets a different enzyme on the pathway. This allows for reduced potential to produce muscle-related side effects. ETC-1002 is a pro-drug and is neutral upon entering the body - becoming active when it synthesizes with Acyl CoA to activate ETC-1002 CoA. This enzyme is upstream of HMG-CoA reductase. This allows it to produce competitive inhibitions within liver cells while not allowing for the buildup of concentrations in undesired tissue cells. Its expression is seen in the way that it produces a series of genes around the main liver hepatocytes that trigger the same effects as those seen with atorvastatin (members of Esperion's team were involved with developing). ETC-1002's added ability to reduce hsCRP by on average 40% (as monotherapy) and by an average 30% in patients on background statins (unlike PCS9k's). hsCRP is one of the main biomarker risk factors in cardiovascular disease. The results of the JUPITER study (2008) show that baseline C-reactive protein levels are a predictor for major adverse cardiovascular events and are thought to reflect most of the pleiotropic benefits of statin therapy.

ETC-1002's Improvement over Zetia

If approved, ETC-1002 will have a US label aimed at treating patients who are considered statin intolerant, ~10% of the 35m US statin population. Zetia is the current standard of care for these patients, but is also widely prescribed for patients who require additional LDL-C lowering. ETC-1002 should be a popular choice in the US patient-doctor care system as it can be used in combination with statins, and to reduce statin dose levels. The statin-rule of six holds that for every doubling of a statin dose, there is only a corresponding 6% LDL-C-lowering efficacy. For patients who are already responding poorly to statins or who are experiencing side effects at existing dose levels, additional statin treatment has been shown to be harmful. The FDA has guided that low-cost combination therapies that can complement the existing standard of care lend more towards producing positive benefits for patients. At the presentation to the American Heart Association in November 2015, Esperion's Marianne Andreach outlined how the same levels of baseline LDL-C were produced in patients in its trials as were seen in the original statin outcomes studies (4S-P showed baseline LDL-C levels of >190mg/dl). This is directly as a result of patients not being able to tolerate statin therapy and shows a significant need for a new therapy. At present, Zetia provides a 15-20% reduction and is insufficient for these patients.

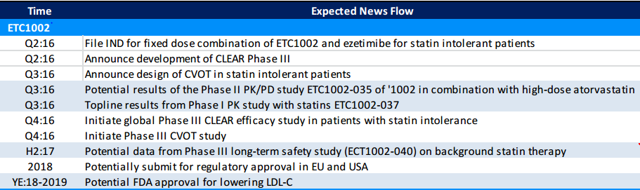

News Flow and Potential Catalysts

ESPR is heavily traded by short sellers, and positive news on its Phase III development plans in Q2 2016 could send shares higher by 10-30%. More dramatic movement is unlikely to happen until Phase III data begins to read out in H2 2017. Below is a timeline of upcoming events from RBC Capital Markets:

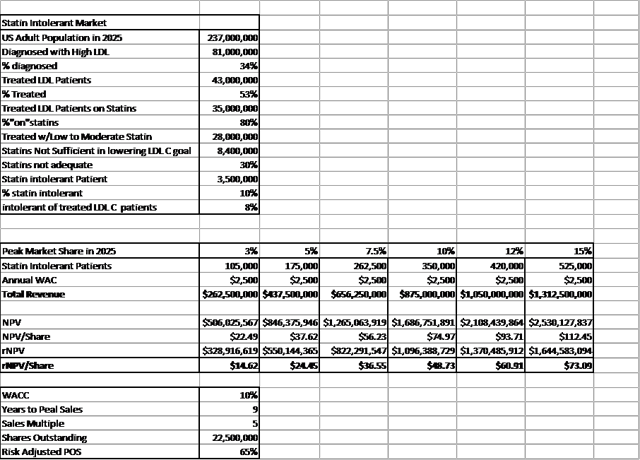

Summary of Financials and Valuation

ETC-1002 valuation is dependent on a myriad of factors - below is a rough-hand rNPV calculation:

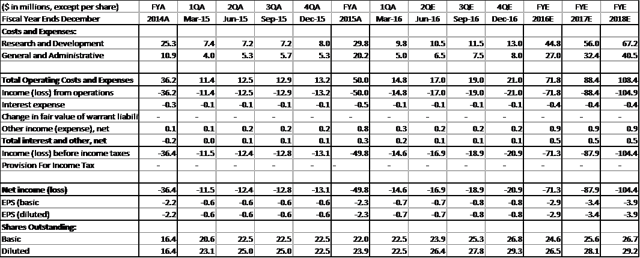

Financial Statements (Projections)

ESPR is trading close to cash value ($12-$13 per/share), and this reflects the uncertainty around ETC-1002's data picture (investors will require more detail in '17 before committing). Esperion's cash position is strong at present, but with the additional trials planned for 2017 and 2018 will exhaust cash balance by YE18. Here are historical and projected financials from RBC Capital Markets:

Conclusion

Long term, I believe that ETC-1002 will work and could become a $1B+ WW franchise that provides an oral and cheaper option for lowering cholesterol by 40-50%, particularly as a combination therapy with generic Zetia, and in statin-intolerant patients where there is a strong market need. However, in the medium term, several risks in the data picture need to be clarified.

Disclosure: I am/we are long ESPR. Article originally published 3rd June, 2016.