Summary

- January 2020 ended with a huge bang at PAM -- our two portfolios ended the month with stellar performances.

- SWING Portfolio: $21.524.57 gross profit out of $100,000.00 capital -- 258.29% Annualized Profit.

- ALGO Portfolio: $19,057,83 gross profit out of $100,000.00 capital -- 228.69% Annualized Profit.

- At the end of January 2020, the ALGO portfolio's open trades are up $2,003.86. The SWING portfolio's open trades are up $ 1,762.73 at the end of January 2020.

- These results are, by a mile, the best portfolio performances of any Marketplace service provider at Seeking Alpha, at any time.

2020

January 2020 ended with a huge bang at PAM -- our two portfolios ended the month with stellar performances, as follows:

SWING Portfolio: $21.524.57 gross profit out of $100,000.00 capital -- 258.29% Annualized Profit. This portfolio is liquidity model, algorithm-driven. plus some technical analysis driven trades.

ALGO Portfolio: $19,057,83 gross profit out of $100,000.00 capital -- 228.69% Annualized Profit. This portfolio is solely driven by liquidity-model algorithms.

At the end of January 2020, the ALGO portfolio's open trades are up $2,003.86.

The SWING portfolio's open trades are up $ 1,762.73 at the end of January 2020.

These results are, by a mile, the best portfolio performances of any Marketplace service provider at Seeking Alpha, at any time.

See the SWING portfolio closed trades spreadsheet here.

And see the ALGO portfolio closed trades spreadsheet here.

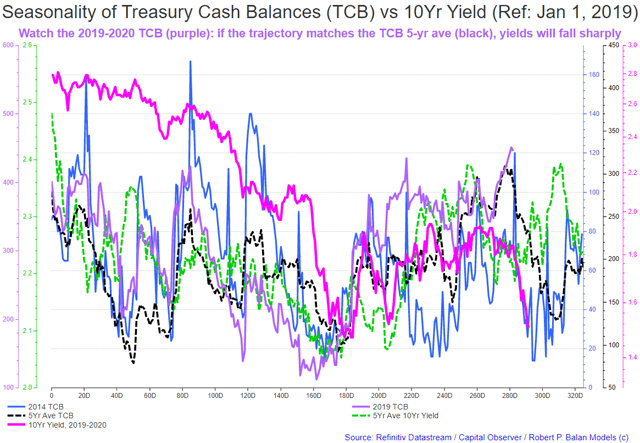

Our Treasury Cash Balance Model tracked the US 10yr yield beautifully, and with high fidelity, allowing the PAM community to profit from surging bond and gold prices (see chart below): The same Treasury Cash Balance model platform applied to the S&P 500 also provided high-fidelity signals of likely market turns, which allowed us to fine our exit from existing short equity positions (see chart below):

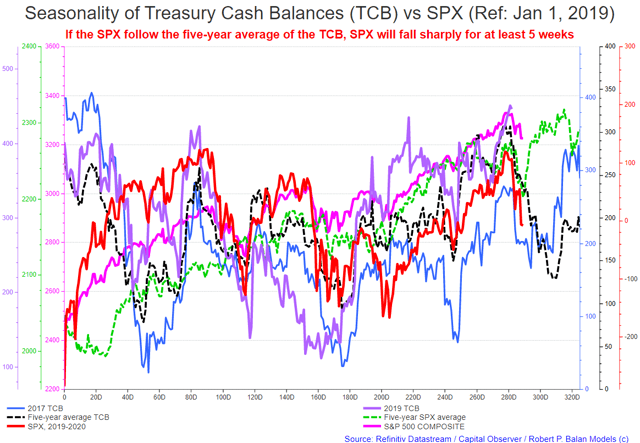

The same Treasury Cash Balance model platform applied to the S&P 500 also provided high-fidelity signals of likely market turns, which allowed us to fine our exit from existing short equity positions (see chart below):

------------------------------------

2019

2019 was a good year for SWING and ALGO trading for Predictive Analytic Models' portfolios. The liquidity models provided excellent guidance, allowing PAM to exceed internal goals of 40% annualized performance.

The ALGO Portfolio, debuting on September 25, 2019 delivered $16,075.57 (gross) income on capital of $100,000.00. Annualized profit was 64.30%. Portfolio had 78 trades, for 8.24% profit per trade.

Here is the performance of the model-driven PAM Portfolio ("ALGO" -- model-driven):

See the spreadsheet here.

The SWING Portfolio, debuting on March 1, 2019 delivered $72,813 (gross) income on capital of $100,000.00. Annualized profit was 97.08%. Portfolio had 360 trades, for 8.09% profit per trade.

Here is the performance of the SWING Portfolio (ALGO plus technical analysis trading):

See the spreadsheet here.

Here's the performance of the so-called "Legacy Trades"which included some day-trading. The Legacy PAM Portfolio, which ran from April 27, 2018 to February 28, 2019 delivered $37,460.96 (gross) income on capital of $100,000.00. Annualized profit was 44.95%. Portfolio had 228 trades, for 6.57% profit per trade.

Here is the performance of the "Legacy" PAM Portfolio (ALGO Plus Intraday Trading):

See the spreadsheet here.

See all PAM Member reviews here

To sign up to PAM's trading and advisory service, please go here

----------------------------------------------------------------------

Predictive Analytic Models (PAM) is the only advisory service at SA which provides REAL-TIME trading execution, investment analyses and commentaries.

PAM shows you how to trade successfully with actual trades, using PAM's own capital. You make money at your own pace and at the scale of risk capital you choose.

PAM has in its wings the most talented and experienced market traders and investors at Seeking Alpha, even elsewhere. They enrich the PAM experience with their expertise which they willingly share with traders/investors who are just starting out in their career.

We use statistical and numerical analyses to obtain the direction of actionable long or short opportunities from relationships that are inherent between and among fundamental (macro) data, systemic liquidity, and market prices.

We fine-tune the trade entry and exit points by using Elliott Wave Principle (EWP) price structures to optimize profitability, in REAL-TIME. More importantly, we do not use conditional "if not, then else" contingency application of EWP, which is a travesty. No "binary" recommendations.

PAM trades its own account and shares the trade and investment process with members of PAM. Trades for PAM are executed only after the members have been duly notified via the Chat facility. Completes trades are officially confirmed by email.

We provide REAL-TIME analysis of market developments in the four major asset classes (equities, bonds, commodities, foreign exchange) as the market unfolds on day-to- day.

When PAM decides to enter or exit trades, we give members of PAM the first opportunity to do so, ahead of us. We never front-run the trades of the members.

See all of Robert P. Balan's work here

--------------------------------------------------------------

For more detailed information about our service, kindly go here.