Original Post:

.https://twitter.com/RobertPBalan1/status/1400039545626845185?s=20

.JUNE 2, 2021.

PRE-EUROPE OPEN BRIEFING.

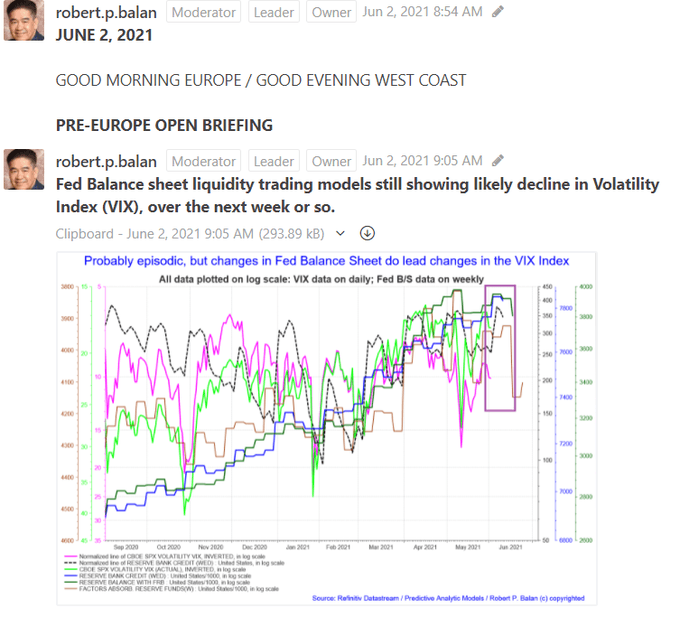

1/X Fed Balance sheet liquidity trading models still showing likely decline in Volatility Index (VIX), over the next week or so.

.$SPX $SPY #NQ_F $NDX $QQQ #RTY_F $RUT $IWM #ES_F #DXY #GOLD #BONDS #stockmarket #equities #investing

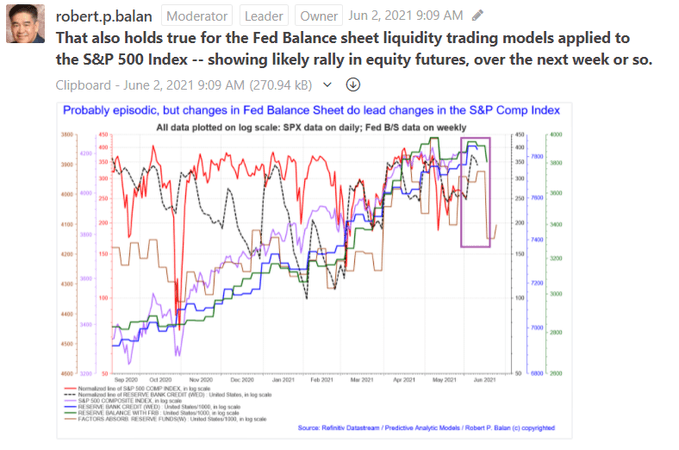

2/X That also holds true for the Fed Balance sheet liquidity trading models applied to the S&P 500 Index -- showing likely rally in equity futures, over the next week or so .

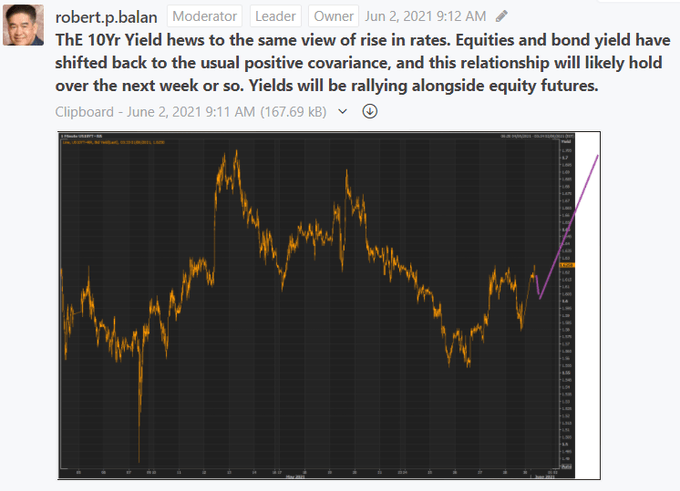

3/X ThE 10Yr Yield hews to the same view of rise in rates. Equities and bond yield have shifted back to the usual positive covariance, and this relationship will likely hold over the next week or so. Yields will be rallying alongside equity futures.

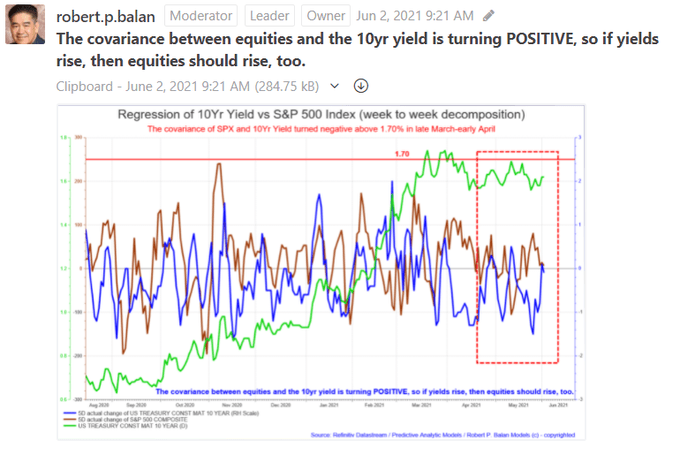

4/X The covariance between equities and the 10yr yield is turning POSITIVE, so if yields rise, then equities should rise, too.

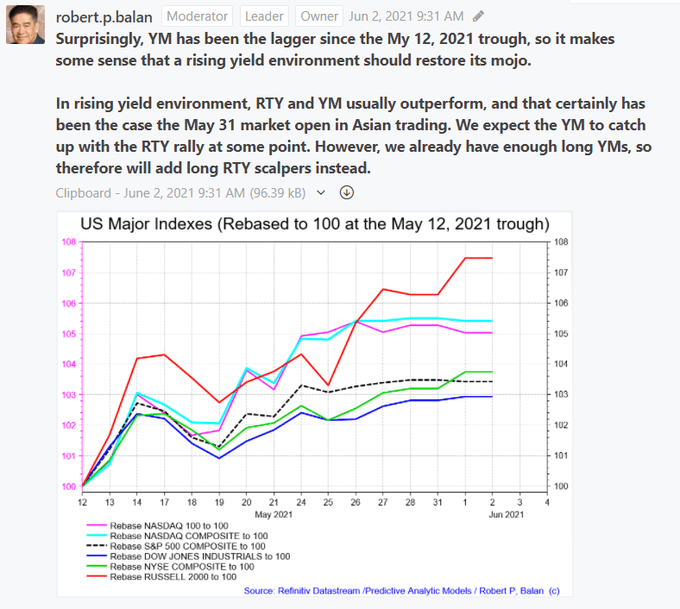

5/X Surprisingly, YM has been the lagger since the My 12, 2021 trough, so it makes some sense that a rising yield environment should restore its mojo. In rising yield environment, RTY and YM usually outperform, and that certainly has been the case the May 31 market open in Asia.

6/X The DXY has completed the "obligatory" test back of the upper trendline that has been breached, and should now rise, alongside the 10Yr Yield over the next week or so.

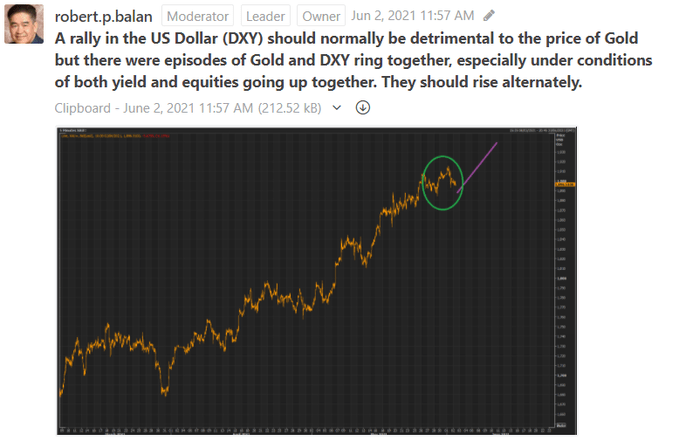

7/X A rally in the US Dollar (DXY) should normally be detrimental to the price of Gold but there were episodes of Gold and DXY ring together, especially under conditions of both yield and equities going up together. They should rise alternately.

8/8 I believe Gold will rise alongside equities. After all, changes in Gold price correlate more positively with the changes in the price of SPX, rather than the change in the price of DXY.