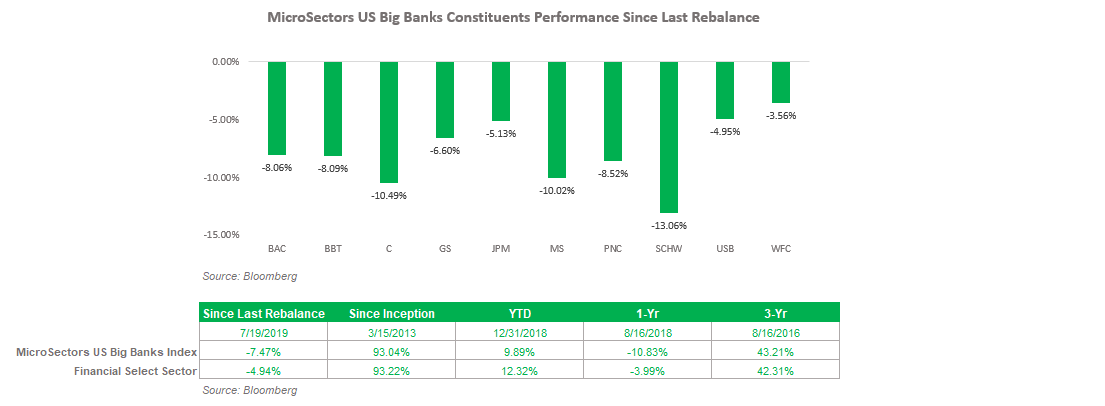

- Last rebalance date was August 16th, 2019. The previous rebalance date was July 19th, 2019

- The index constituents remain: BAC, BBT, C, GS, JPM, MS, PNC, SCHW, USB, WFC.

- The best performers within the index since the last rebalance date were Wells Fargo (WFC), US Bancorp (USB), and JPMorgan (JPM).

- The worst performers within the index since the last rebalance date were Charles Schwab Corp (SCHW), Citigroup (C), and Morgan Stanley (MS).

- Solactive MicroSectors U.S. Big Banks Index return since the last rebalance is -7.47%.

- Solactive MicroSectors U.S. Big Banks Index return year to date is 9.89%.

- Solactive MicroSectors U.S. Big Banks Index return since inception is 93.04%.

(Click on image to enlarge)

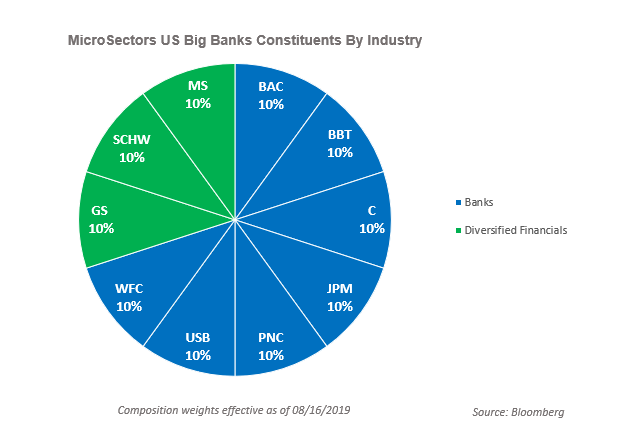

Solactive MicroSectors U.S. Big Banks Index Weightings

- The Solactive U.S Big Banks Index rebalances to equal weight effective after the close of the third Friday of every month.

- On the first business day of each month, the index constituents are reevaluated for possible replacement in the index.

(Click on image to enlarge)

What is the Solactive MicroSectors U.S. Big Banks Index?

The Solactive MicroSectors U.S. Big Banks Index includes 10 highly liquid stocks that represent industry leaders across today’s U.S. banking sector. The index’s underlying composition is equally weighted across all stocks, providing a unique performance benchmark that allows for a value-driven approach to investing. While the performance of indices weighted by market capitalization can be dominated by a few of the largest stocks, an equal-weighting allows for a more diversified portfolio.