My new book launches a movement to reimagine capitalism at the DNA level, where ownership interests are defined. It’s called, The Fairshare Model: A Performance-Based Capital Structure for a Venture-Stage Initial Public Offerings.

The capital structure’s name reflects its goal: to balance and align the interests of investors and employees—capital and labor.

The Fairshare Model virtually eliminates valuation risk for IPO investors, making it more likely that they will profit when they invest in a company with high failure risk. It does that by taking a page from the playbook that venture capital and private equity investors use when they invest in a private offering.

They insist on deal terms that provide them with “price protection.” If a company’s performance is not as strong as expect, such terms effectively reduce their buy-in valuation, retroactively. Two ways this may happen are that the investor gets more shares for free, or receives a disproportionate share of proceeds when a liquidity event occurs.

It’s a sensible idea because no one knows how to reliably value a venture-stage company—often unprofitable, they have unproven business models, and rely on investors to survive. Such companies have high failure risk but deal terms can reduce their valuation risk.

Price protection makes it more likely that investors will profit when they invest in such a company and that, in turn, encourages them to invest in similar companies. Thus, price protection is critically important in an entrepreneurial economy.

There is a problem, however. While price protection is routinely provided in private offerings—the kind limited to wealthy or "accredited” investors—it virtually never happens in public offerings, the kind that anyone can invest in. That’s unfair because a dollar is worth a dollar, regardless of whether it comes from average or wealthy investors.

There is a derivative problem—public investors assume far more valuation risk than private ones, even when failure risk remains similar. That is, IPO investors don’t get a valuation safety net, and they buy-in at far higher valuations than pre-IPO investors do.

The Fairshare Model can change that because it places no value on future performance. It does that with a dual-class stock structure—both classes vote, but only one can trade. Investors—IPO and pre-IPO investors—get the tradable stock. Employees get it too, for performance delivered as of the IPO. But for future performance, which accounts for most the enterprise value, employees get the non-tradable stock—it converts into tradable stock based on performance milestones.

The journey that led me to author the book began in 1996, when I co-founded and led a company called Fairshare, Inc. Years before the term “crowdfunding” was coined, we sought make it easier for companies to market public offerings directly to investors, without a broker-dealer. To do that, we worked to build an online membership of people who had interest in learning about offerings from companies that:

- Had a legal public offering

- Passed a due diligence review

- Adopted the Fairshare Model capital structure, and

- Allowed Fairshare members to invest as little as $100.

To attract members before we had offerings, we offered education on deal structures and valuation. We provided the ability to interact online and a vision for how to encourage companies to offer Fairshare members a better deal than they typically get. We underestimated the time and expense required to address regulatory concerns. Nonetheless, we attracted 16,000 members before calling it quits after the dotcom and telecom busts.

My thoughts about Fairshare laid dormant for about a decade, until I noticed how attitudes about innovation were changing and that entrepreneurship was becoming cool. Heck, colleges increasingly offered degrees in it! Plus, valuation was becoming a more frequent topic of discussion. Then too, the JOBS Act of 2012 authorized reforms to securities law such as:

- Investment portals for accredited investors.

- Funding platforms for average investors.

- A dramatic increase in the amount that could be raised in a public offering using an exemption from registration called Regulation A—it rose from $5 million to $50 million.

- A new public offering exemption—Rule CF, for crowdfunding—to raise up to about $1 million.

Another factor fueled interest in financial service innovation—a movement now known as “fintech.” It was a loss of confidence in financial institutions and the regulators that oversee them. Whether that dissatisfaction was expressed as support for stricter regulation, or for new ways of doing business, the common denominator was dissatisfaction with The-Way-Things-Are.

In particular, with respect to capital markets, I saw ideas on how to innovate the distribution or sale of new stock (i.e., crowdfunding), but few on how to innovate how equity interests are structured for public investors. I concluded that:

- The time was ripening for a Fairshare-like innovation,

- I had a unique perspective on IPO deal structures, and

- Others would emerge to help popularize and implement the core idea behind Fairshare—a deal structure that minimized valuation risk for IPO investors, the Fairshare Model.

I decided that a book was a good vehicle to popularize the concept of price protection for IPO investors because it could focus attention on the idea and avoid burdens associated with creating a platform to deliver it. That is, there would be others who would be interested in helping companies prepare for a Fairshare Model offering and facilitate the sale of their stock. What was needed was someone to popularize the idea itself with investors, entrepreneurs and others in the ecosystem of capital markets.

An inspiration was Linus Torvald, who released the LINUX operating system kernel as public domain software in 1991. It led to an explosion of computer applications that could run on any hardware platform, including smart phones and cloud computing. By making the Fairshare Model an open-source idea, I could ensure that it took root.

Even though I can describe the Fairshare Model in a few paragraphs, the book is about 400 pages, and took five years to produce. In part, it’s because the subject matter—capital structures and valuation—is unfamiliar to most of my target readers, so there are many facets to cover and it has to presented in an accessible manner. [At the same time, many in my target audience have expertise in capital formation. It was a challenge to find a way to engage both kind of readers.]

The other reason it took so long to produce is that the implications of the Fairshare Model ripple into other areas. I felt the book would be more interesting if it explored valuation and ways investors lose money in venture-stage investments, as well as macroeconomic matters such as economic growth, income inequality and shared stakeholding. Throw in chapters on game theory and blockchain, and you have a long book. One that amounts to an easy-to-grasp graduate level course on finance, economics, and philosophy.

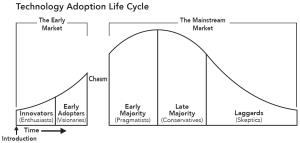

How might the Fairshare Model become more than an idea? Geoffrey A. Moore’s 1991 book, Crossing The Chasm, provides a framework that can visualize the answer. He uses a “technology adoption life cycle,” shown below, to explain how customer acceptance of a technology product evolves. The time scale begins at the left, when a product is introduced. The market expands in the growth phases until it reaches maturity, when the adoption rate declines.

The early market is comprised of “Innovators” who are enthusiasts for the technology and a larger group of “Early Adopters” who can imagine how they might benefit from it. The mainstream market has three different groups of customers. There is an “Early Majority” whose pragmatic concern—"What’s in it for me?”—must be addressed before they buy. Then, the “Late Majority” who is conservative when it comes to purchasing a new technology—they want evidence that it meets their needs. And, final group of customers will be the “Laggards,” who are generally skeptical about new solutions.

Moore says that there is a gap in the adoption cycle between the early market and the mainstream market. He called it “The Chasm,” and says that products that successfully cross it can go on to expand their market. Those that fail to do so are likened to a train that falls off a trestle bridge that spans the gap. The technology Adoption Life Cycle explains why some products grow from niche to mainstream markets, while others that do well with early customers fail to catch on with larger numbers of them.

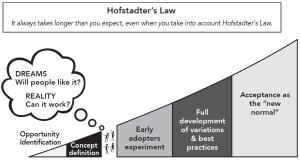

The Fairshare Model has a chasm to cross before it is put into practice by companies. I call it a “Concept Gap.” To cross it, investors must signal that they like the Fairshare Model, and professionals in the capital formation and organizational matters must be prepared to advise companies on how to make it work. The Concept Gap is shown here—the time scale is subject to Hofstadter’s Law (i.e., cognitive scientist, Douglas Hofstadter).

----------------------------------------------------

This is the first in a series of articles that discuss ideas in my book, The Fairshare Model: A Performance-Based Capital Structure for a Venture-Stage Initial Public Offerings.The full-length book--400 pages--is available on Amazon. In a few weeks a half-length Condensed Edition will be out. To learn more about The Fairshare Model, visit fairsharemodel.com