SP 500 gains third session in row

US stock market advance continued on Monday led by materials and energy shares. The S&P 500 gained 0.2% to 2857.05.Dow Jones industrial rose 0.4% to 25758.69. The Nasdaq composite index added 0.1% to 7819.71. The dollar weakening continued: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 95.708 and is lower currently. Stock index futures point to higher openings today.

Relief the US and China will resume trade talks tomorrow helped buoy market sentiment. However President Trump said he did not expect much progress from trade talks with China, and he had “no time frame” for ending the trade dispute. He also criticized Fed Chairman Jerome Powell for higher rates, telling he should be given 'some help' by the Fed. Atlanta Fed President Bostic on Monday repeated that he expected one more interest rate hike this year. Bostic is a voting member of the Fed's interest rate committee this year, and the median forecast of the committee is for two more rate hikes this year.

FTSE 100 opens lower than main European indices

European stocks rebounded on Monday on US-China trade talks optimism. Both the GBP/USD and EUR/USD continued their climb and both pairs are moving higher currently. The Stoxx Europe 600 index rose 0.6%. The DAX 30 rallied 1% to 12331.30 and France’s CAC 40 gained 0.7%. UK’s FTSE 100 added 0.4% to 7591.26. Markets opened flat to 0.2% lower today.

Greece officially exited the European Union’s stability program, ending the eight-year-long string of bailouts. A deal was struck earlier this year that will defer payments on 96 billion euros worth of bailout loans, or 40% of the country’s total debt, until 2033. And the maturity on some of the country’s other loans were extended. However Greece must commit to a primary surplus, a budget surplus excluding interest payments, of 3.5% of GDP until 2022 before transitioning to a ratio of 2% to 3% of GDP until 2060.

Trump accuses China of currency manipulation

Asian stock indices are mostly higher today. Nikkei gained 0.1% to 22219.73 helped by yen slide against the dollar. Chinese stocks continued recovering despite President Trump’s comment China manipulates its yuan currency to offset tariffs imposed by Washington: the Shanghai Composite Index is up 1.3% and Hong Kong’s Hang Seng Index is 0.5% higher. Australia’s All Ordinaries Index on the other hand is down 1% as the Australian dollar climb against the greenback slowed.

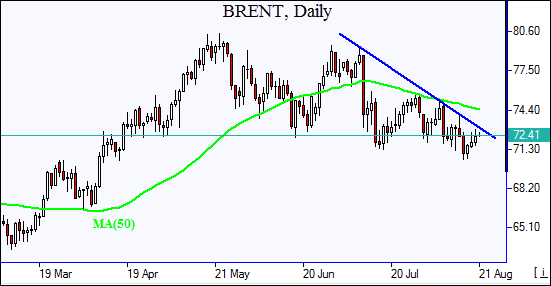

Brent rises despite US sales of strategic reserves

Brent futures prices are extending gains today ahead of the peak US demand period for fuels. However gains are expected to be capped by Washington’s offer of 11 million barrels of high-sulfur, or sour, crude from its Strategic Petroleum Reserve for delivery from October 1 to November 30. The released oil could offset expected supply shortfalls from US sanctions against Iran. October Brent crude settled 0.5% higher at $72.21 a barrel on Monday.