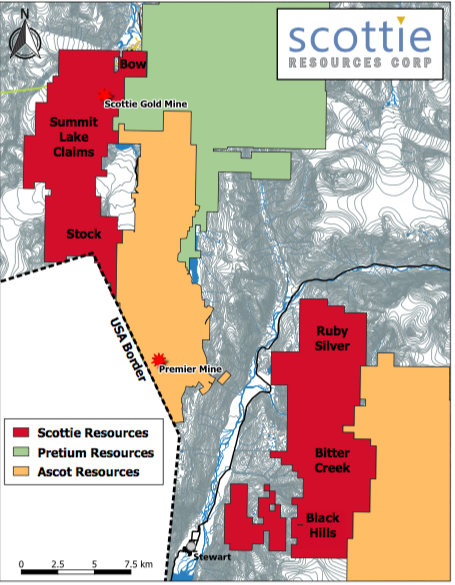

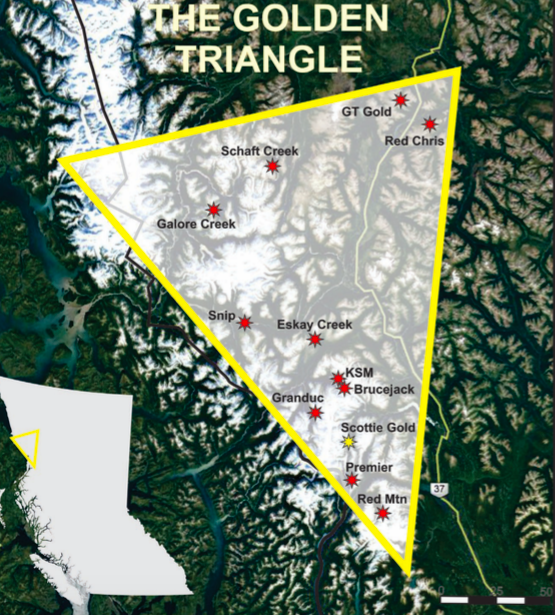

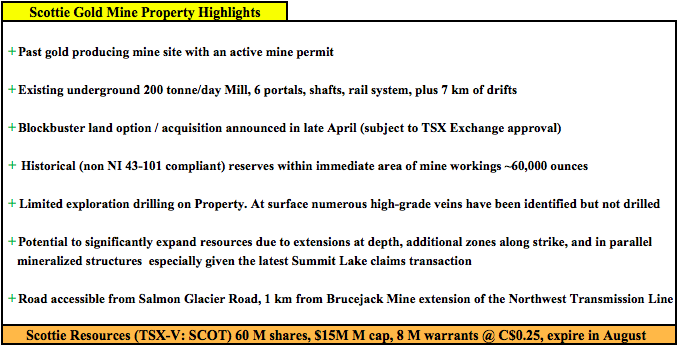

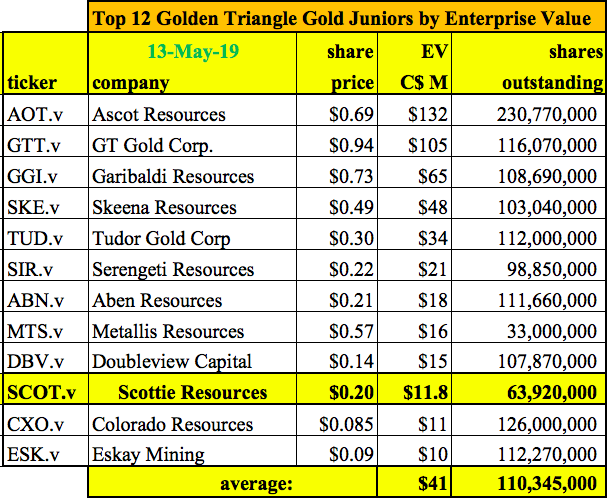

Scottie Resources (TSX-V: SCOT) is a lesser known Golden Triangle (northern BC, Canada) gold junior, who’s ship may have just come in…. Typically when the word, “blockbuster” is used, it refers to drill results. In this case I refer to Scottie’s recently announced option on a sizable (> 1,500 hectares) piece of property (the Summit Lake claims) surrounding its existing 100%-owned Scottie Gold Mine property {see map below}. Even before this announcement, Scottie seemed like a natural takeout target for Ascot Resources (TSX-V:AOT), [C$160M market cap]. Note: {the Company announced the intention to raise C$1.0M in an equity capital raise on May 13th.}

Ascot acquired IDM Mining and its Red Mountain project in March, and the Silver Coin property from Jayden Resources & Mountain Boy Minerals late last year. Furthermore, Ascot just upsized a capital raise to $15M. Subject to TSX approval, Scottie will own or control a contiguous land package [the Bow, Scottie Gold Mine, Summit Lake & Stock claims] totaling nearly 8,800 hectares = ~21,750 acres. Yet, that approximate 8,800 hectare position is less than half the Company’s total of more than 18,500 hectares.

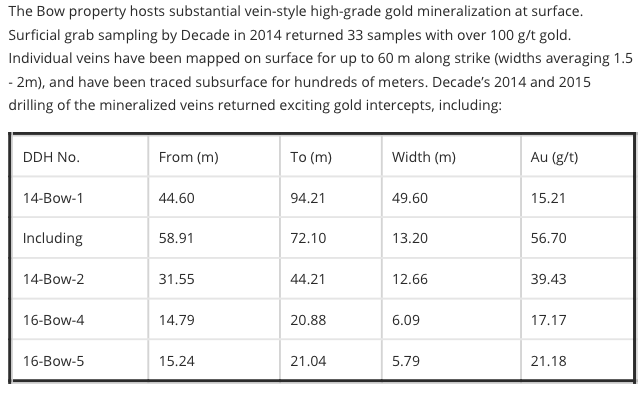

Scottie Resources has another 10,000 contiguous hectare block adjoining, directly west, of IDM’s (now Ascot’s) property. One need only glance at the map to see that the chances of Ascot wanting to take out Scottie have likely soared. Before picking up these new claims, management was excited about its 472 hectare Bow property, the subject of this April 26th press release. Below are some historical drill hole intercepts from the Bow property, which is contiguous with the Scottie Gold Mine property. Imagine if the Company could find more intercepts like those on the newly expanded property that’s now roughly 18x the size of Bow.

This “blockbuster” land acquisition opens up much more than additional hectares, it enhances the probability of putting the Project into production on a standalone basis. It opens up the possibility that other mid-tier or Major precious metals companies might want a piece of the action. Regional players like Pretium, NovaGold, Seabridge, Imperial Metals and GT Gold Corp. Or, companies outside the district that want an entry into the world-class Golden Triangle. Giants, Teck Resources and Newmont GoldCorp Corp. already have direct interests in the district.

The following interview of Brad Rourke, President, Director & CEO of Scottie Resources, was completed by text, email & phone in the week ended May 10th. As always, please see disclosures at the bottom of the page.

Please give readers the latest snapshot of Scottie Resources.

Our focus is on the past producing, high-grade Scottie Gold Mine property in Canada’s Golden Triangle, in northern British Columbia, which operated for nearly 4.5 years from 1981-1985. It produced > 95,000 ounces of gold at ~16 g/t or 0.5 opt, with a 200 tonne per day Mill. On April 30th we announced a blockbuster land transaction. Our VP Exploration Dr. Thomas Mumford commented, ‘The optioning of this land package is truly momentous for Scottie Resources. It fundamentally changes the potential of the Scottie Gold Mine property by substantially expanding our previously restricted footprint. While high-grade gold is known to exist along our borders, we were unable to properly advance it. With this new opportunity to explore the entire mineralizing system, we are eager to get boots on the ground this summer.’

Significant potential exists due to extensions at depth, additional zones along strike and in parallel mineralized structures. We also have other contiguous properties, (see map above), nearby, between & bordering land controlled by Ascot Resources. In total, we now own or control > 18,500 hectares in the Golden Triangle. By comparison, Ascot’s flagship Premier Gold-Silver project is roughly 10,500 hectares in size. However, the Premier project is much more advanced.

Can you expand upon the history of your Company?

Sure. Since Scottie Resources (formerly Rotation Minerals) acquired the Scottie Gold Mine claims in 2016, (we started with just 400 hectares) there has been 713 m of surface drilling (3 holes), 1,935 m of underground drilling (18 holes) and 162 surface rock samples taken. Previous work on the property included 29,000+ m of underground drilling, airborne geophysical surveys, geological mapping and various soil & ground geophysical grids. There has been $150M of infrastructure expenditures, and there’s an existing 200 tonne/day Mill, 6 portals, a rail system & 7 km of drifts.

Why is last month’s announcement so important? Why was it so hard to get this land package?

We just picked up the Summit Lake claims, I think it might be one of the best deals in the Golden Triangle in decades! Summit Lake is a tremendously attractive opportunity, a land package that we and others tried to acquire many times over the years. However, the price tag was in the tens of millions. These claims are a real game-changer. The proposed terms are very reasonable; over 4 years, a total of $250K in cash + 2.2M shares + a 1.8% gross smelter return (“GSR“) royalty.

This newly optioned property completely opens up our ability to explore the mineralizing system that formed Scottie. Prior to this, the Scottie Gold Mine property consisted of only ~212 hectares of crown grants that the mine was on and 110 hectares of Mineral claims. We were completely surrounded by the Summit Lake claims owner, who was very reluctant to make deals that smaller juniors could reasonably entertain.

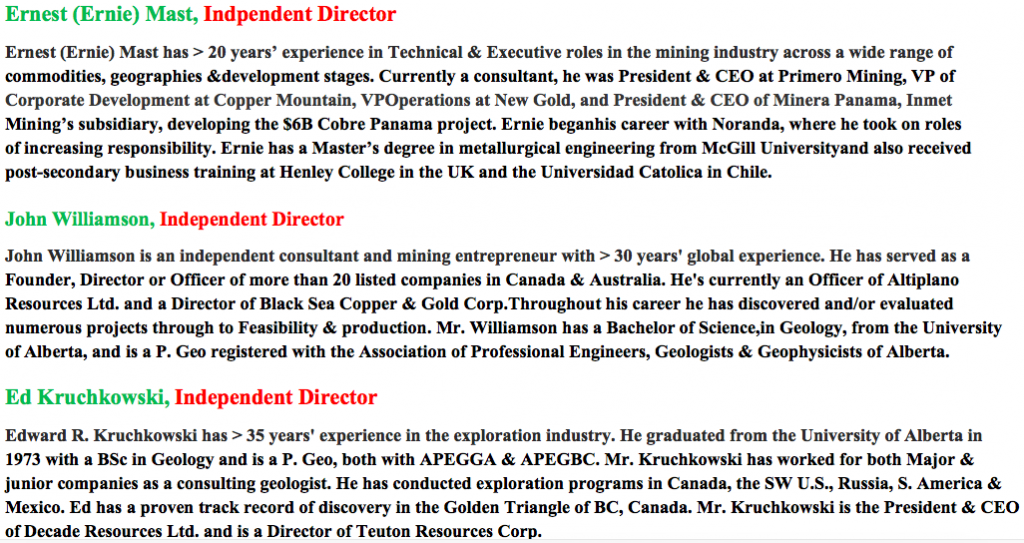

The Golden Triangle is a very complex district, you need a strong technical team, tell us about your team…

You’re right. The core of our Company consists of technical personnel, 3 members of our Board of Directors are technical professionals, either geologists or mining engineers, Ernie Mast, John Williamson and Ed Kruchkowski. We have several executives with track records of building successful resource companies.

In addition, our VP Exploration Dr. Thomas Mumford is a seasoned field geologist, with strong mapping experience in the Golden Triangle as well as managing drill programs across Canada. We’ve also been fortunate to be working with one of the premier mineral exploration consulting firms in Canada – Equity Exploration.

Please talk more about the tailings opportunity.

The Scottie Mine operated for nearly 4.5 years, at an average grade of 16.2 g/t Gold. Recovered grades were about 17.5 g/t for the first 2 years, but dropped to 14.1 g/t in 1984, even as Mill recoveries improved from 75% in 1981 to 92-95% in 1984. With lower recoveries in the first 2 years, a significant amount of gold ended up in tailings, deposited into a lake that has since drained. This past summer Equity Exploration sampled the tailings. Gold grades as high 6.2 g/t were found. This season we plan on doing more infill sampling to better define grade distribution and get a solid estimate of potential tonnage. We think that we should be able to monetize thousands of ounces of Gold from tailings starting as soon as next year, but more work is required before an operating decision is made.

What’s the probability of finding other metals in concentrations high enough for them to be by-products or credits?

In terms of by-product metals, the one we are most excited about is the Cobalt-rich veins on the Bow property. Many mineralized gold intercepts returned Cobalt values ranging from 0.10% – 0.44%. NOTE: {at the mid-point of 0.27%, the in-situ Cobalt value = ~$130/t}. A focus of future drilling on the Bow property will be to assess the distribution & grade control on the Cobalt and its association with the gold.

How is Scottie Resources different from the dozens of other gold juniors in the GT?

How are we different? We host a past producing mine with road access, 6 portals, shafts, a rail system & 7 km of drifts. There’s a $440M power line going through our property. A new global port is ~48 km from the Project. $150Mworth of infrastructure is in place. We now have the scale that could attract mid-tiers & Majors. It’s very hard to consolidate land, but we’re doing it, we started with just 400 hectares, now we control ~18,500 hectares. We’re working with a newly defined understanding of the geology, modeled for the first time by Equity Exploration, that was not understood when the Scottie Mine was in production. All historical exploration data has been re-logged & digitized. We share borders with both Pretium & Ascot. The Scottie Gold Mine project is high-grade, even by Golden Triangle standards!

Why should readers consider buying shares of Scottie Resources?

Any existing shareholder of Scottie Resources (TSX-V: SCOT) who knew the story before last month’s news should be thrilled with this latest development. If you liked it at 20c or 25c, with our tight float, you should love it now! We have a $12M (C$0.20/share on May 13th) market cap, and our closest meaningful neighbors, both of whom we share borders with, have market caps of $160M (Ascot Resources) & $2.0B (Pretium Resources).

As you (Peter Epstein) mentioned in your opening remarks, I reiterate that other players in the Golden Triangle include NovaGold ($1.75B), Seabridge ($990M), Imperial Metals ($285M), GT Gold ($95M), Great Bear Resources($84M), & Garibaldi Resources ($78M). If this season or next we have more success with the drill bit, on a much larger footprint, we think our $12M market cap has considerable upside.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned no shares of Scottie Resources and the Company was NOT an advertiser on [ER]. However, {ER} is negotiating with the Company for it to become an advertiser on [ER] in the near future. Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this interview or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.