New Investment – FundRise

My wife and I had a long discussion in early February, I believe February 3rd was the date. This was after the stock market surged through the first month of January. We could not find an undervalued dividend stock that fit perfectly in our portfolios. Furthermore, we had quite the position in the equity market. On the other hand, this is not specifically a bad position, but it was truly weighing on my mind for quite some time. You can review Fundrise service and approach to investing here.

Fundrise background

Fundrise has been around since 2012, investing over $2.5 billion into real estate. They are a premier, real estate crowdfunding investment platform. Interestingly, I knew of Fundrise for well over two years but never decided to open an account. Reason for the delay, I was not educated enough and had concerns after RealtyShares announced their closing. However, even with the news there, I knew Fundrise has been around for quite some time and has a different investment approach.

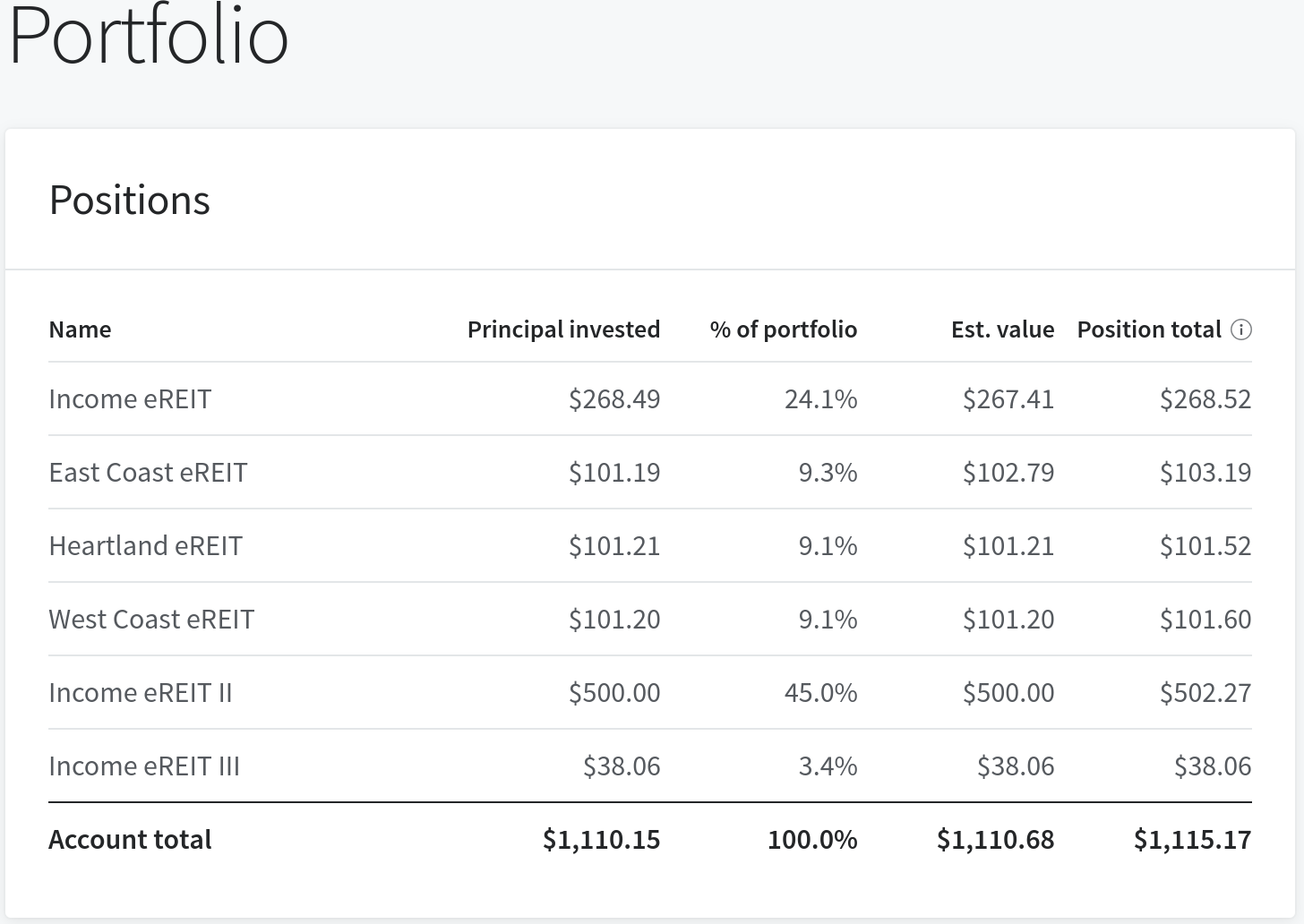

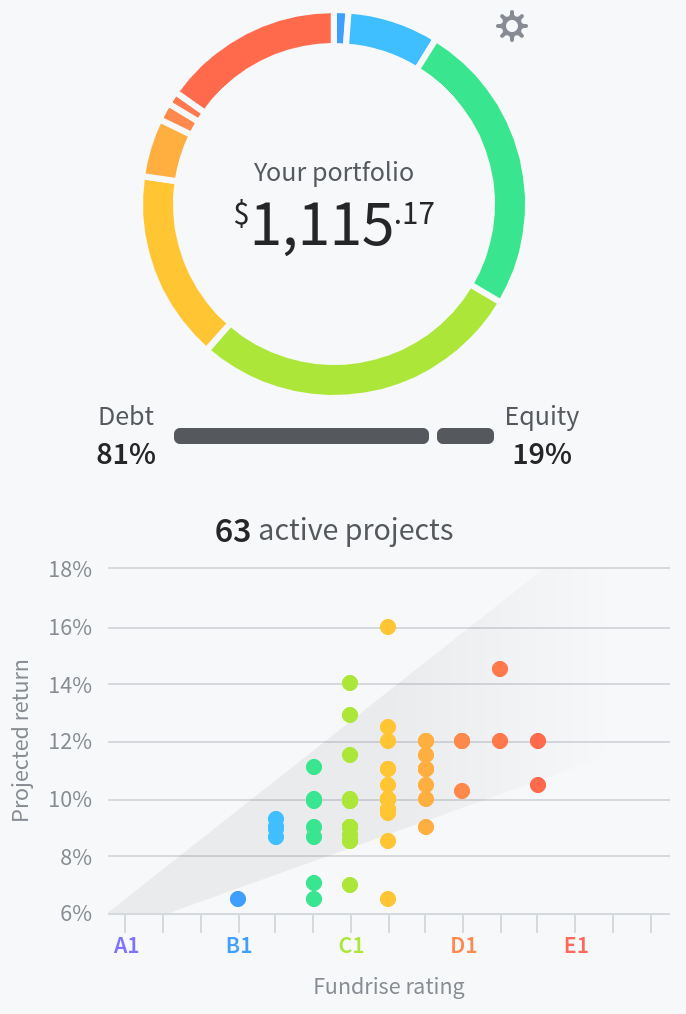

They have 3 different plans to invest and non-accredited investors can start with a minimum $500. Their fees are approximately 1.00% and your taxation, luckily, can be a 1099-DIV. It can be a 1099-DIV, if you select the appropriate plan (plan I chose has eREITS), which is what us dividend investors want to see! Here is an example of my investment portfolio with Fundrise:

The three plans are listed below and you can guess which plan we invested into (hint – it is the one with the longest dividend meter).

After we selected the Supplemental Income plan and invested our first $1,000.00, everything has been very easy. Fundrise sends communication letters throughout the process and they even send you updates on each project within your investment. Here is one example of a message we received from Fundrise on a recent project within our investments:

Sign Up to see the projects within your investments!

Fundrise Performance

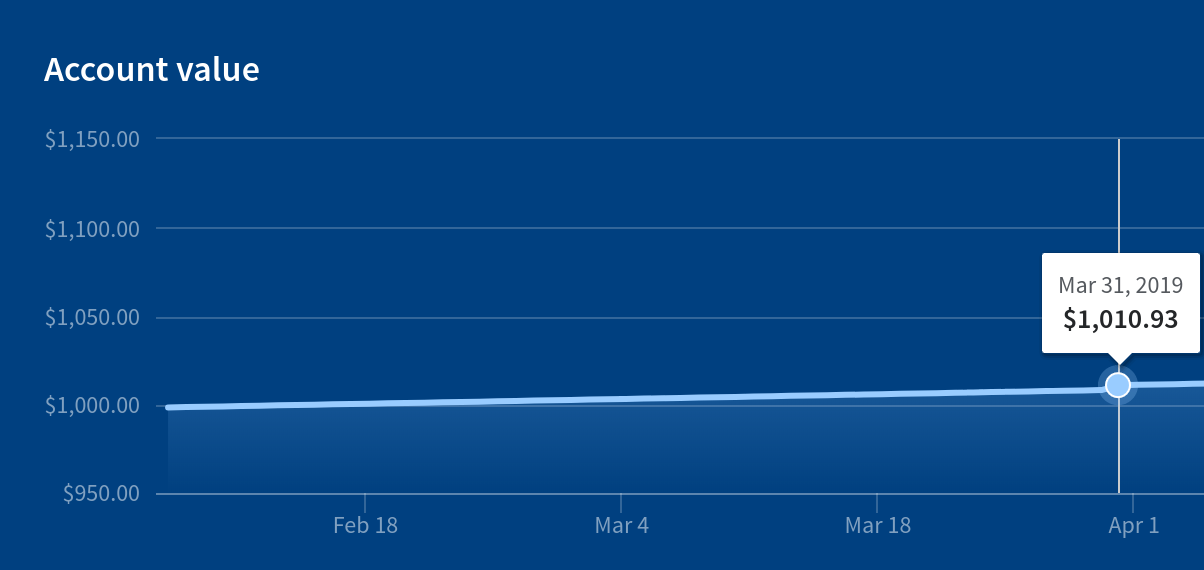

Their performance has ranged from 8.76% to 12.42%. Here is how Fundrise did in 2018:

Notably, here is our performance through March 31, 2019 from our initial $1,000 investment. The return has been over 7%, which is primarily through dividends and one can expect an over 7% yield on the investment:

Fundrise Pros, Cons & Summary

Pros:

1.) Easy to use with a low barrier cost to entry, at $500 and for non-accredited investors.

2.) Consistently informed regarding your application and afterwards, your projects within your investment portfolio.

3.) Provides diversification from the traditional stock market with dividend income.

4.) Provides you a real-estate experience without having to be hands-on with significant capital.

5.) Outside of the 1% management fee, there are no further trading costs. The 1% management fee can be waived if you have referrals, for 90 days per sign-up, as an FYI!

Cons:

1.) There is a chance your taxation could be different, depending on your investment. This can be the case if you aren’t invested in the eREITs and instead are invested in eFunds. The eFunds are structured as partnerships. Therefore, you more than likely will receive a K-1, instead of a 1099-DIV.

2.) Not as liquid as an equity investment. You typically are looking at a 5-year investment, unless you want to sacrifice 1-3% of your investment if redeemed earlier.

3.) Similar with any investment, there is no guarantee on your returns.

In summary, we are pleased with Fundrise over the last 3 months. Seeing this performance, our goal is to have $5,000 invested into the platform. Provided that, we are adding $100 per month to the account, automatically. In order to achieve this goal, we may have to increase our contribution after another phase of 3 to 6 months. We started the routine contribution, after the first two months of testing out the platform. Therefore, we will continue to review and adjust accordingly.

Ready to start with Fundrise? At only $500 to begin, it may be worth looking into and may be able to add to your diversification! Please share feedback, comments and experiences below.