ALL GOOD THINGS MUST COME TO AN END…

PREPARE FOR A 30% US STOCK MARKET CRASH & GOLD FEVER BEFORE THE PRESIDENTIAL INAUGURATION

December 9, 2016

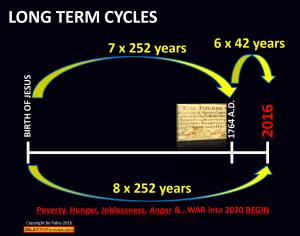

Below is a brief overview of our Long Term cycle calculations. The first is a long term or 42-year Stock Market CRASH cycle with calculations going back to 1764 and the second is an even longer long term 252-year cycle calculations going all the way back to back to the birth of Jesus, and both point to this year 2016 as a year of extreme interest!

Seven (7) biblical cycles of 252 years equates to 1764 and the Currency Act. Since the 1764 Currency Act, every 42-years there has been a Stock Markets crash, see chart.

The last crash was the Crash in 1974 and by adding 42-years to 1974 we arrive at HERE AND NOW, 2016!

On December 9, 2016 the DOW made a NEW ALL-TIME high at 19,757 and regardless of no crash yet based on the cycle calculations and the new highs occurring, the Long Term calculation continue to point to this year 2016 for a crash to occur.

TIME IS NOW RUNNING VERY SHORT AND WE BELIEVE THESE LONG TERM CYCLE CALCULATIONS WILL NOT FAIL, REGARDLESS THAT OUR SHORTER TERM CALCULATIONS HAVE NOT RESULTED IN A CRASH YET.

IF YOU BELIEVE IN HIGHER AND HIGHER STOCK PRICES AND NO END TO THE CURRENT ‘TRUMP RALLY’, THESE LONG TERM CYCLE CALCULATION ARE IN COMPLETE DISAGREEMENT. TIME WILL VERY SOON TELL…

Let’s look at Gold and the compare it’s price movement with the Stock Market and the US Dollar since 2015 now that ONE JUBILEE YEAR has now passed. A final 4.5-year cycle low was expected the first week of December 2015 and in an interview (link click here) on December 3, 2015 while gold was trading at $1045, and most analysis were looking for $700 - $1000 gold, we stated ‘Gold will go no lower’. To date, gold has not gone lower and $1045 holds as THE final low. While gold was making on December 3, 2015, the US Dollar topped at the 100 range and the DOW Industrials topped at the 18,000 range and then EVERYTHING SUDDENLY reversed, gold went up and the US Dollar and stock markets crashed.

Interesting but on the ONE YEAR ANNIVERSARY on December 5, 2016, gold made a LOW at $1156, ($111 higher than in 2015) and just as in December 2015 while gold was making a low the US Dollar once again was topping, this time at the 101-102 range, and the DOW Industrials in the first week of December 2016 are making new highs. At the time of this writing, on December 9, 2016 the DOW made a new high at 19,757; just shy of 20,000 by 243 points or a stone’s throw away.

Is history about to replay and EVERYTHING SUDDENLY reverses, with gold going up and the US Dollar and stock market crashing into December’s month end?

In our latest Interview of December 1, 2016, ‘December 2016, An Incredibly Important Point in Time’ we discuss how our analysis indicates what was in November 2016 will be the opposite come the end of December 2016 and then into 2017. LINK: https://youtu.be/hnNJxvPopl0

One thing is for certain, a crash is still expected BEFORE year-end and/or BEFORE the US Presidential Inauguration in January and the effects of JUDGEMENT will soon be obvious.

In closing, here is a great quote from Jim Rickards… ‘People say "I hear you Jim and I agree with your argument, but I’ll wait until it starts to take off." Sorry, you’re not going to be able to get the gold. It will take off, but you’ll be standing there watching it on television going to $2,000, $3,000, $4,000 an ounce while frantically calling your dealer saying: Get me some gold! You know what the dealer is going to say? Sorry, sold out: back ordered. You call the Mint: back ordered. You’re not going to be able to get it. That’s my point. Get it now, while you can, at a good entry point. Not 100%. Just get 10% of your assets in gold, sit tight, and you’ll be fine.’

We hope you own physical gold and silver before Gold Fever hits!

Warm regards,

Bo Polny

www.Gold2020Forecast.com