When a company has a long-term track record of consistent and rising dividend payments, it is a clear indicator that the company's financial position is good. Investing in companies that regularly raise dividends provides security in an uncertain market and means higher returns ahead. I consider that besides dividend yield, the consistency and the rate of raising dividend payments are the most crucial factors for dividend-seeking investors.

Peter Lynch, the legendary manager of the Fidelity Magellan Fund, wrote in his book "Beating the Street":

The Dividend Achievers Handbook is one of my favorite bedside thrillers. Here's a simple way to succeed in Wall Street: Buy the stocks on Mergent's list and stick with them as long as they stay on the list.

In this article, I will show how to find the best large cap dividend growers stocks according to my criteria. To find out the best large cap dividend growers, I limited the search for companies that are included in the Russell 1000 index. Since this article is designated to income-oriented investors, I have considered only stocks that are yielding more than 2.5%. Also, I have put some more requirements:

- Payout ratio less than 100%

- Average annual dividend growth over the last five years higher than 5%

- Average annual dividend growth over the last three years higher than 5%

- Positive dividend growth over the last year

Since 86 stocks have complied with the requirements mentioned above, I have created a particular ranking system to rank the best ten dividend growers stocks.

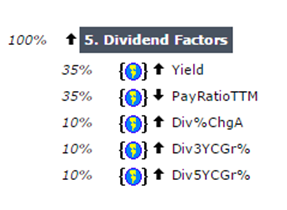

I have used the Portfolio123 powerful ranking system, which allows the user to create complex formulas according to many different criteria and evaluating performance by backtesting, to develop the following ranking system. The ranking system gives a weight of 35% to the yield, and 35% to lower payout ratio. Also, it gives a weight of 10% to dividend growth in the last year, 10% to the average annual dividend growth over the last three years, and 10% to the average annual dividend growth over the last five years, as shown in Portfolio123's chart below.

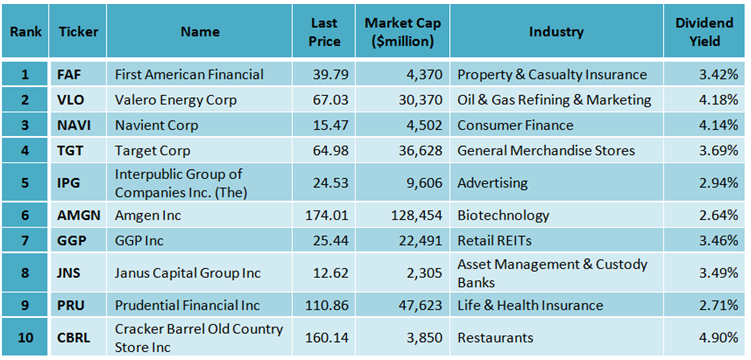

After running the screen on February 24, 2017, I discovered the following ten best dividend growers stocks, which are shown in the table below.

It is worth mentioning that the best ten dividend growers stocks represent ten different industries. As such, in my opinion, the system, which I have shown in this article, could be used by income-oriented investors to create a superior diversified dividend portfolio.