WTI Holds Gains Despite Bigger Than Expected Crude Build

WTI has extended gains, pushing back above $54, following last night's surprise crude draw reported by API and Saudi Arabia pledged to deepen production cuts.

The world’s biggest crude exporter will continue to curb output more than required by a December deal among top producers, Energy Minister Khalid Al-Falih told the Financial Times Wednesday.

“Oil is rallying further as investors were given confirmation that the Saudis will curtail output, and they see a lower chance of the trade tensions escalating at the moment,” said Kim Kwangrae, a commodities analyst at Samsung Futures Inc. in Seoul.

“Expectations of lower American crude stockpiles added to the optimism.”

API

- Crude -998k (+2.4mm exp)

- Cushing -502k (+1.4mm exp)

- Gasoline +746k (+1.2mm exp)

- Distillates -2.48mm (-1.7mm exp)

DOE

- Crude +3.63mm (+2.4mm exp)

- Cushing -1.02mm (+1.4mm exp)

- Gasoline +408k (+1.2mm exp)

- Distillates +1.19mm (-1.7mm exp)

DOE data refuted API's surprise crude draw with a bigger-than-expected build of 3.63mm barrels (2.4mm exp). Gasoline and Distillates also saw builds...

(Click on image to enlarge)

The large Cushing draw may be attributable to the shutting of the Keystone pipeline after a likely oil spill near St. Louis.

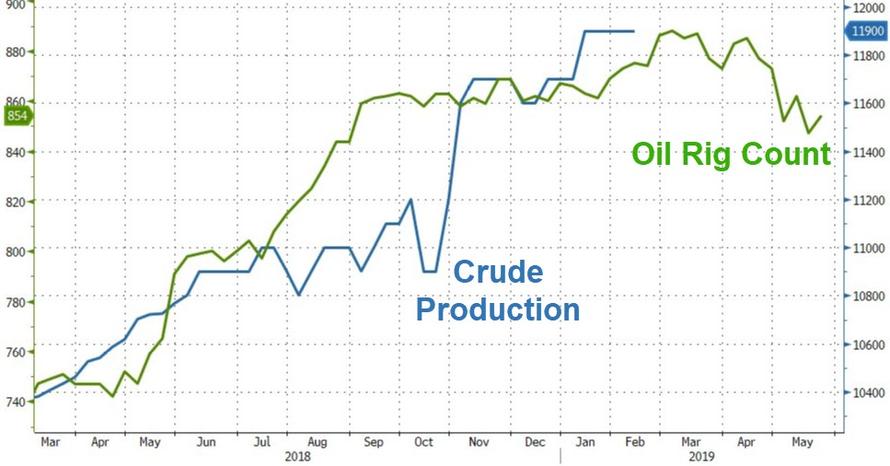

Production remains near record highs but the rollover in rig counts could signal a reduction in production looms...

(Click on image to enlarge)

WTI surged back above $54 this morning after the Saudi comments and knee-jerked lower on the bigger than expected build (but the machines BTFD and shrugged off the bearish data)...

(Click on image to enlarge)

Bloomberg Intelligence's Energy Analyst Fernando Valle points out that a sharp slowdown in refinery utilization drove the increase in crude inventories. The drop at Cushing should narrow the spreads to coastal grades. The increase in refined product stockpiles was due to weaker domestic demand, which was likely a timing effect and should recover in the coming weeks. Exports remain robust, and lower production should help ease the oversupply.