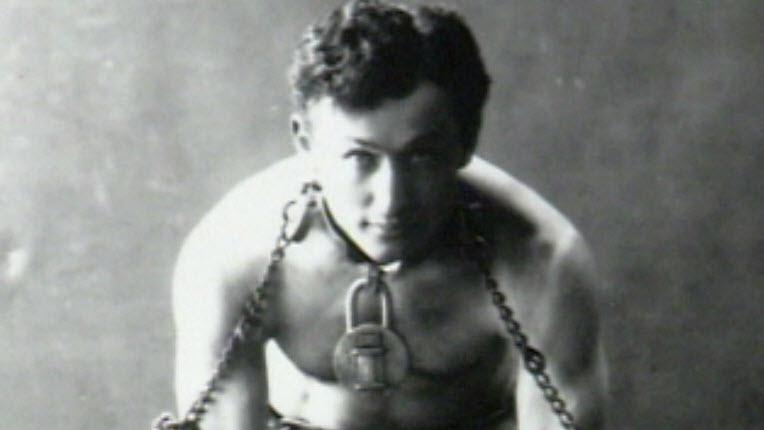

World Markets Trying The Great Escape Are Taking Lessons From Harry Houdini

The illusion becomes reality when the masses no longer can tell the two apart.

The world illusion is being presented by the G20 nations along with failing nations of Greece, Italy, Ireland, Spain and others treading the magic act in hope they won't be discovered through escaping a full dose of austerity and economic collapse.

The correlation of significance are perceived value to actual value or said in another way - the value found in our illusion-like ratings within bonds, treasuries and other instruments of derivatives, CDO, MBS and our list goes on.

Comments from the most recent Federal Reserve suggests Bernanke, the depression professor, gets it. Comments and an article out of Bloomberg says the QE3 ship must be launched if the G20 hopes pulling off the Great Escape that Houdini himself found in the end as death and the casket.

The article out of Reuters vividly puts JPMorgan (NYSE:JPM) now has replaced Goldman Sachs (NYSE:GS) to be our newest poster child, trying to move Wells Fargo (NYSE:WFC), Morgan Stanley (NYSE:MS), Citi Bank (NYSE:C) and Bank of America (NYSE:BAC) out of the spotlight. JPMorgan places huge bets on the world's stage of what we understand as a hedging position. Hence, the illusion remains real and working. Why? JPMorgan and other world governments become our answer of still believing in the harshness within keeping a world from dealing with severe austerity.

The talk of the increasing U.S. dollar and oil (Watching for Pull Back) and (Laws of Supply and Demand) with gold's fall within commodities are signaling a market in retreat. Short term illusion that only becomes the trap of bears gathered for a goring from the bulls on the wall of worry pushing world markets a lot higher from their current closing numbers posted on May 16 2012.

The answer comes from my previous statement based upon theory if depressions are in the offering; it needs hyper-inflation before deflation takes the prices down in all commodities. These metrics set our tone and landscape for future collapsing of the world markets. It's like watching the elections of EU and other nations voting themselves right off the edge of a financial cliff for collapse or deep recession or depression feared by Bernanke himself. Look for prices starting to rise again due to economic laws at play.

Recently, an article out of CNBC, Bill Gross stated the need for the Fed's monetary policy will follow with further easing or lead to a breaking of the illusion. Federal Reserve posture announced on Wednesday May 16, 2012, sent a continued shoring up of U.S. backed securities. Clearly, to hold off a world collapse as feared by Bernanke and other great minds is on the table.

The message of my article reveals a market ready to climb. It states clearly the reason behind unprecedented world easing because the illusion fails otherwise. The value of debt forcing world contraction and economic recessions or collapses is different than back in the years of Houdini.

Understand the use of inverse ETF(s) or well positioned closed-end funds as I've pointed out in prior articles and issues offering great early entry on pullbacks. These issues are offering significant and compelling profits for portfolio performance moving forward. Names like Cubist Pharmaceuticals, Inc. (CBST) signaled confirmation volume at 720,000 shares trading at a price of $42.30 with our first profit target coming in at $45.85 near-term.

Another issue on our radar continues with the recent upgrade of Seadrill LTD, (NYSE:SDRL). The upgrade out of Citi puts at as Buy with early entry at $36.30 the first profit sell signal is set at $47.50 and second sell target at $70.35 with a great dividend play at .82 cents moving forward.

Look to Biogen (NASDAQ:BIIB) with keeping your stop loss around $130.35 with a profit selling target at $158.50 along with taking looks at Lululemon Athletica, Inc., (NASDAQ:LULU) giving an early Buy and price profit target of $89.75. We invite you to continue looking at our instablog area where we tend to post other investment ideas.

Summary of Thoughts

Look for the market correction to be short lived and the tides to rise for the rest of this fiscal year.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.