Why The Market Is Thinking About Bitcoin Differently

(Click on image to enlarge)

The Briefing

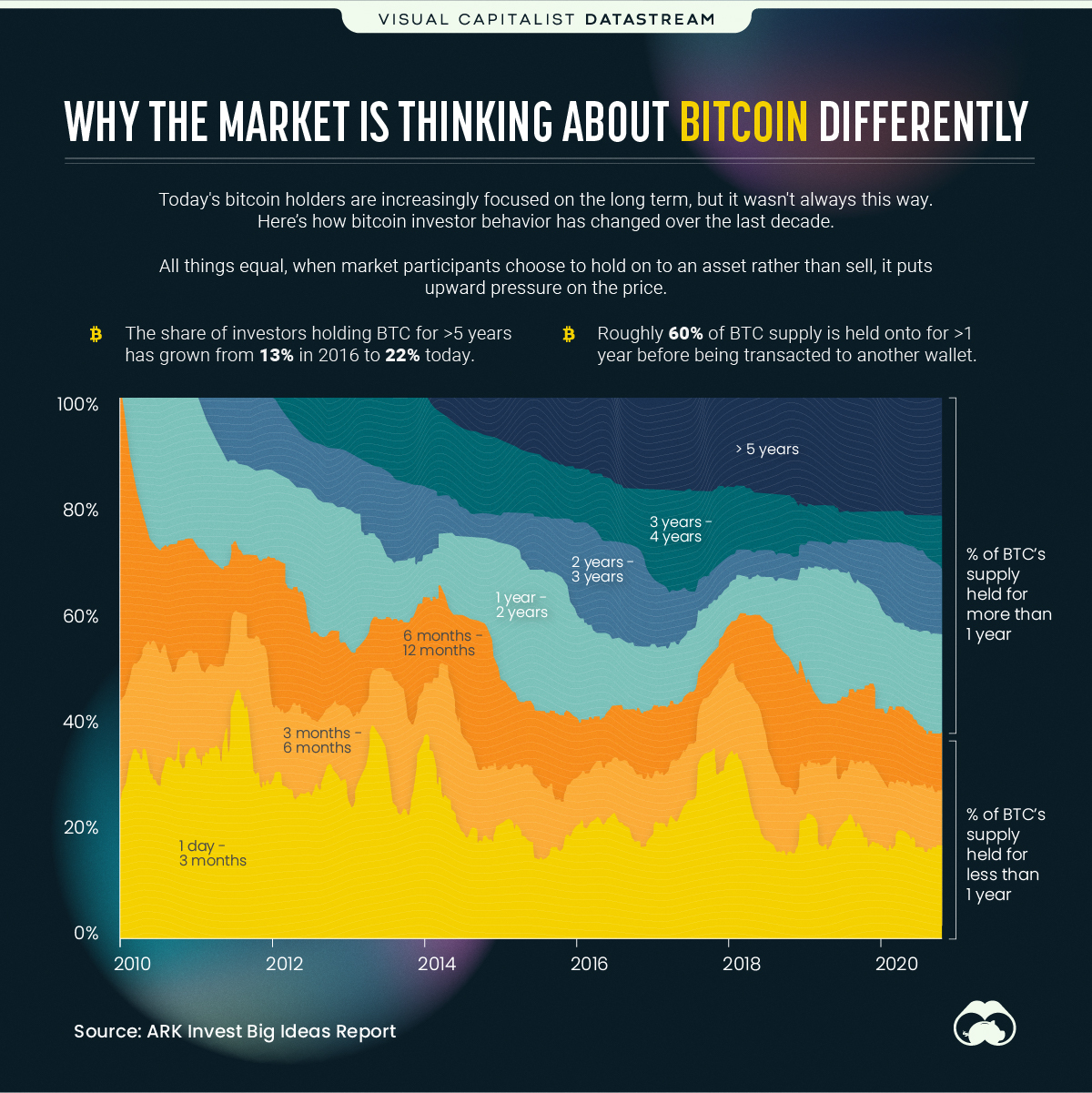

- Bitcoin investors are increasingly long-term focused. In 2020, 57% of bitcoin’s (BTC) supply was held onto for more than a year

- Today, nearly 22% of BTC supply is held for more than five years

- Bitcoin hit a $1 trillion market cap milestone in 2021

Why the Market is Thinking About Bitcoin Differently

The bull case for bitcoin is linked to the cryptocurrency’s limited supply of only 21 million coins. But scarcity is forming in another way, revolving around investor behavior.

According to research from Ark Invest, investors are holding onto bitcoin for longer and longer durations. By holding the asset rather than selling, it decreases the supply of coins available on the market at any given moment, which can drive up price. This suggests that market participants see the long-term value and potential future payoff the asset possesses.

In the past, durations of days and months were the most common holding periods for bitcoin investors, while holding for more than a year was practically non-existent up until recently.

| BTC Duration Held | % of BTC Supply |

|---|---|

| >5 years | 21.80% |

| 3 to 5 years | 13.38% |

| 2 to 3 years | 10.99% |

| 1 to 2 years | 10.70% |

| 6 months to 1 year | 8.30% |

| 3 months to 6 months | 7.07% |

| 1 day to 3 months | 27.76% |

But days and months have now transitioned towards years.

Near the end of 2020, 57% of bitcoin supply has been held for at least a year. In fact, investors who have held for five years or greater now make up a near 22% of the BTC supply, up from 13% in 2016.

Old School vs. New School

Cryptocurrencies are still relatively new phenomena. As with many new things that look to upend the status quo, they are often faced with resistance. For much of Bitcoin history, there’s been a tug of war between the old school and the new school of investors.

The more traditional views dismiss its application and see its price run-up as speculative mania. But it appears the new school train of thought has gained the upper hand in recent times as the cryptocurrency demonstrates further signs of entering the mainstream.

1. CEOs begin to show interest

Elon Musk and Jack Dorsey have made sizable bitcoin investments through Tesla and Square, respectively.

2. New ETFs on the block

Multiple Bitcoin ETFs have just been approved as of late by Canadian regulators. For many years the Grayscale Bitcoin Trust (GBTC) was the only readily accessible investment vehicle trading on equity markets that had exposure to BTC.

3. Financial institutions finally joining in?

Mastercard, Visa, and Bank of New York Mellon have made announcements to make it easier for customers to use cryptocurrencies.

The bitcoin price has frequently broken past former thresholds to enter new all-time highs. Recently milestones include BTC briefly skipping past $60,000 in mid-March while also surpassing $1 trillion in total market capitalization.