Why Shouldn't The Fed Write Off The U.S. Treasury Debt It Holds?

Another two or more years of ZIRP (zero interest rate policy) is a subsidy to banks carrying bad debt at inflated “extend and pretend” values permitted by today’s phony accounting. The Fed is willing to bleed the rest of the American economy to subsidize the banks.

The “bad banks” will not “grow solvent” as a result of this policy. The enormity of the bad debt is simply too great. ZIRP hasn’t helped the economy yet, so why should it going forward?

However, those who fear inflation in the intermediate term are premature. Bad debts don’t get repaid, they only get papered over until their failure is so absolutely plain to see it can’t be covered up any more. Deflation lies between now and the future Great Inflation, which is why we’re probably in for another round of “quantitative easing” in which the Fed buys bad debt from weak banks and hides it away where bad debts never see the light of day.

At this point, some of the Modern Monetary Theory solutions to our problems seem actually attractive. Why shouldn’t the Fed write off (i.e., charge off, write down to a zero value) the U.S. Treasury debt it holds? That’s not a default; it’s more like the kind of favor rich people do for each other (as when the board of a Colorado savings and loan “charged off” a $100,000 loan to a son of George H.W. Bush).

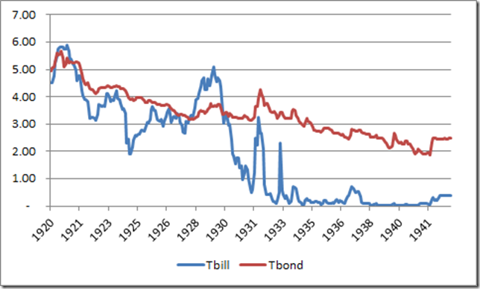

We’ve been here before. The Fed pursued a ZIRP in the 1930s. It didn’t end well.

See also the estimable Joseph Stiglitz’s four-part solution to our problems here.