Why I Own The Trade Desk For The Long Term

The Trade Desk (TTD) is a volatile stock, and the company operates in an emerging industry prone to technological disruption. However, The Trade Desk is in a position of strength to capitalize on massive growth opportunities over the middle term, and management is effectively translating those opportunities into growing sales and earnings for investors.

As long as the fundamentals remain strong, owning The Trade Desk stock over the long term could produce attractive returns in the years ahead.

The Business

The Trade Desk is a market leader in programmatic advertising. The company provides software that allows advertisers to buy media digitally, anywhere that digital media lives outside of the Walled Gardens provided by Facebook (FB) and Google (GOOG) (GOOGL). The Trade Desk uses artificial intelligence combined with advertiser data to make advertising better targeted and more effective.

This approach has some clear advantages for both users and advertisers. For users, ads that are more relevant to their interests and needs are less intrusive and potentially even appreciated. Advertisers get more control, more information, and better performance from their ads. Because of these advantages, The Trade Desk has a customer retention rate consistently above 95%.

In the words of Procter & Gamble's Chief Brand Officer, as quoted in the most recent earnings conference call:

Moving from mass blasting to mass reach, one-to-one precision has helped us get substantial efficiencies in media, which then allows us to grow, that's helped us in the cycle. You raised the bar on superiority, you find ways to get more productive, then you reinvest back in superiority, reach more people and the cycle continues.

When it comes to live sports, the unpredictability of events creates a huge opportunity for both content providers and advertisers in programmatic advertising. For example, when a major league baseball game goes into extra innings or an NFL game goes into overtime, everyone is watching, and the value of ads increases exponentially.

However, in linear TV, these ad pops are often wasted. The advertiser can't plan for them, and the broadcaster often ends up giving them away at a discount. In programmatic advertising, on the other hand, the advertiser can make decisions in real-time, which can be a game-changer in terms of value generation.

The Growth Drivers

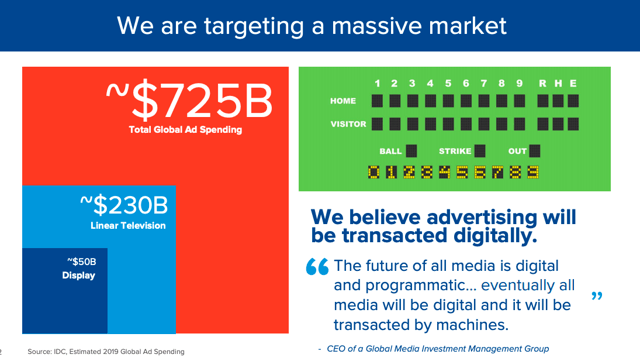

Media is increasingly going digital all over the world, and advertising money needs to go in the same direction as the consumer's attention. This massive trend is creating huge opportunities for The Trade Desk.

The overall advertising industry is expected to reach a TAM - total addressable market - of $1 trillion in the next 10 years. According to estimates from Magna Global, programmatic advertising is growing at around 20% this year, while the overall advertising industry is growing at 4%. This means that programmatic advertising is growing five times faster than total advertising.

In the fastest-growing segment of the ad industry, which is programmatic advertising, The Trade Desk is significantly outperforming the competition and gaining market share. The company is growing at about double the pace of the industry, with revenue growing 38% year over year last quarter.

(Click on image to enlarge)

Source: The Trade Desk

According to eMarketer, connected TV - CTV - media spending will increase by 38% to $6.94 billion in the U.S. this year as advertisers work to reach audiences on streaming services like Hulu, Roku, and YouTube. Going forward, eMarketer estimates that CTV ad spending will hit $14.1 billion in 2023. The Trade Desk is a major beneficiary from this trend, and CTV spend on The Trade Desk’s platform was up 145% in the third quarter.

Audio is another large and growing market, about $3 billion according to PwC digital radio estimates. Audio is highly attractive to customers because it regularly delivers high-performance metrics such as completion rates. While music currently dominates the audio market, podcasting could be a powerful engine in the years ahead. Audio spending on The Trade Desk platform was up 162% year-over-year last quarter.

The company has recently announced two key partnerships with Disney (DIS) and Amazon (AMZN). According to management, this is a game-changer for the industry, and it puts The Trade Desk in a position of strength from a strategic perspective.

In the words of CEO Jeffrey Green:

These content providers are not our direct customers. They are our partners. More and more, they are asking to work with us. It's not just Amazon and Disney as its other major global providers worldwide, including Channel 4 in England, ProSieben in Germany, TF1 in France and pretty much every other significant network and content providers. They are coming to us because they want to make sure they do everything right so that advertisers can apply data-driven strategies to their content.

The company is aggressively expanding in international markets, with spend in The Trade Desk's offices in Seoul and in Tokyo growing 166% and 65%, respectively, last quarter. Europe is also performing well, as spend growth in Madrid and Paris grew 75% and 57%.

The Trade Desk recently hired a new country General Manager in China, Calvin Chan, who was previously the CEO of AdMaster, one of the leading ad tech companies in the country. The company opened a new office in Shanghai, and it forged a new partnership with one of the leading media agencies in China, Blue Media.

The Numbers

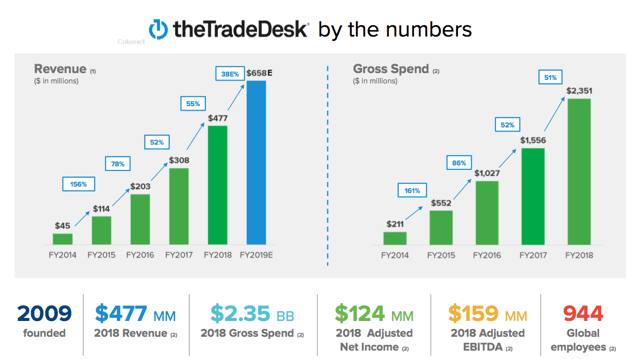

The company reported both sales and earnings numbers above Wall Street expectations last quarter. Revenue amounted to $164.2 million, growing by 38.2% year over year. Earnings per share came in at $0.75, surpassing market expectations by 13%.

(Click on image to enlarge)

Source: The Trade Desk

Many high-growth companies in the software sector are generating losses due to aggressive investments for growth. But The Trade Desk has been profitable since 2013, and it has produced positive GAAP net income in the past 14 quarters in a row.

Investors should expect some volatility in profit margins on a quarter to quarter basis, but the fact that the company is making money as opposed to burning cash is a major plus for a young business that is growing so rapidly.

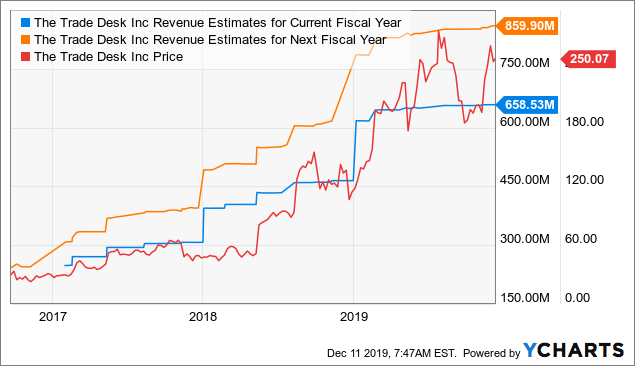

Analysts are on average expecting The Trade Desk to make $658.53 million in revenue during 2019 and $859.9 million in 2020. Under these assumptions, the stock is trading at a price to sales ratio of 17 and 13 for 2019 and 2020. The stock is not cheap by any means, but you don't get to buy explosive growth stories for below-average valuation ratios. In any case, The Trade Desk is priced in line with other successful players in the software sector.

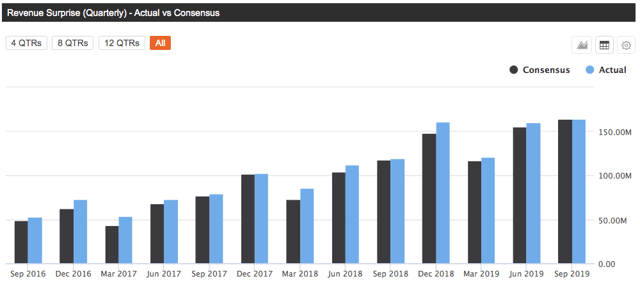

Importantly, current valuation figures are reflecting a particular set of expectations about the future of the company. When the business outperforms those expectations, this can be a powerful tailwind for the stock price. The Trade Desk has an impeccable track record in terms of outperforming expectations, the company has delivered both revenue and earnings above market estimates for 16 quarters in a row.

(Click on image to enlarge)

Source: Seeking Alpha Essential

The chart below shows how the stock price has evolved in comparison to revenue expectations for The Trade Desk in both the current year and next fiscal year. Like usually happens, revenue estimates and the stock price are moving in the same direction.

(Click on image to enlarge)

Data by YCharts

The Bottom Line

The Trade Desk is a volatile stock, and the market has high growth expectations for the business. If things don't work out as expected, the stock price would be vulnerable to the downside from current valuation levels. Even in the absence of any fundamental news, high growth names such as The Trade Desk can be particularly affected by overall market sentiment.

But short-term volatility can create opportunities for long-term investors. The Trade Desk has enormous room for growth in the years ahead, and management is doing a great job in terms of capturing and even expanding those opportunities. As long as the fundamentals remain intact, any pullback down the road could be considered a buying opportunity.

The stock is up by almost 30% from my purchase price in November of this year. While it may be tempting to take some short-term profits, I am planning to hold on to the position over a long-term horizon unless there are any material changes in the investment thesis.

In times when everyone is focused on trying to find out what a stock will do in the next 3 days, focusing on the next 3 years - or even more - can make all the difference in the world. Like Warren Buffett said: "Time is the friend of the wonderful company, the enemy of the mediocre".

The Trade Desk is growing at full speed, and it has both the opportunities and the capabilities to continue delivering outstanding growth over the coming years. Holding on to the position over the long term can potentially produce attractive returns for investors.

Disclosure: I am/we are long TTD, DIS, AMZN, FB, GOOGL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more