Why I Am Bullish On Vietnam

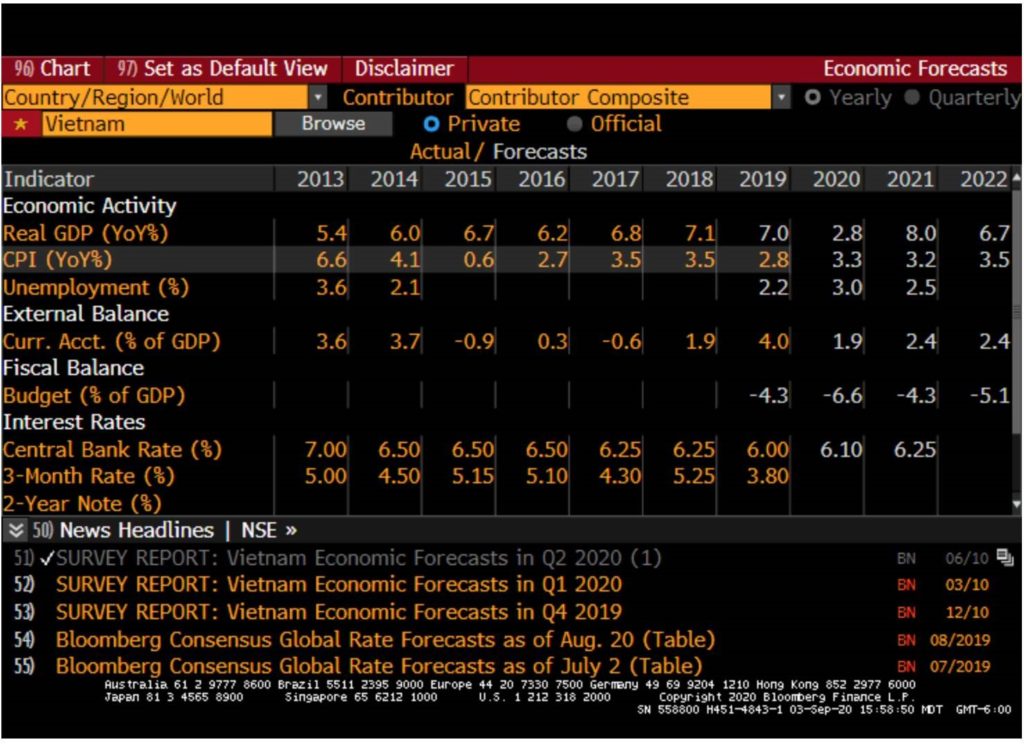

Vietnam is one of the few countries left in the world which will still boast a double-digit nominal GDP growth rate. They have 200-300 BP of real rates and a low fiscal deficit which is a rarity in today’s world. Positive real rates, low and stable inflation, low unemployment and Positive current account balance is a characteristic of a strong economy. India was exhibiting all these characteristics ( except positive CA balance) in 2002-2003 just before a domestic consumption boom was born.

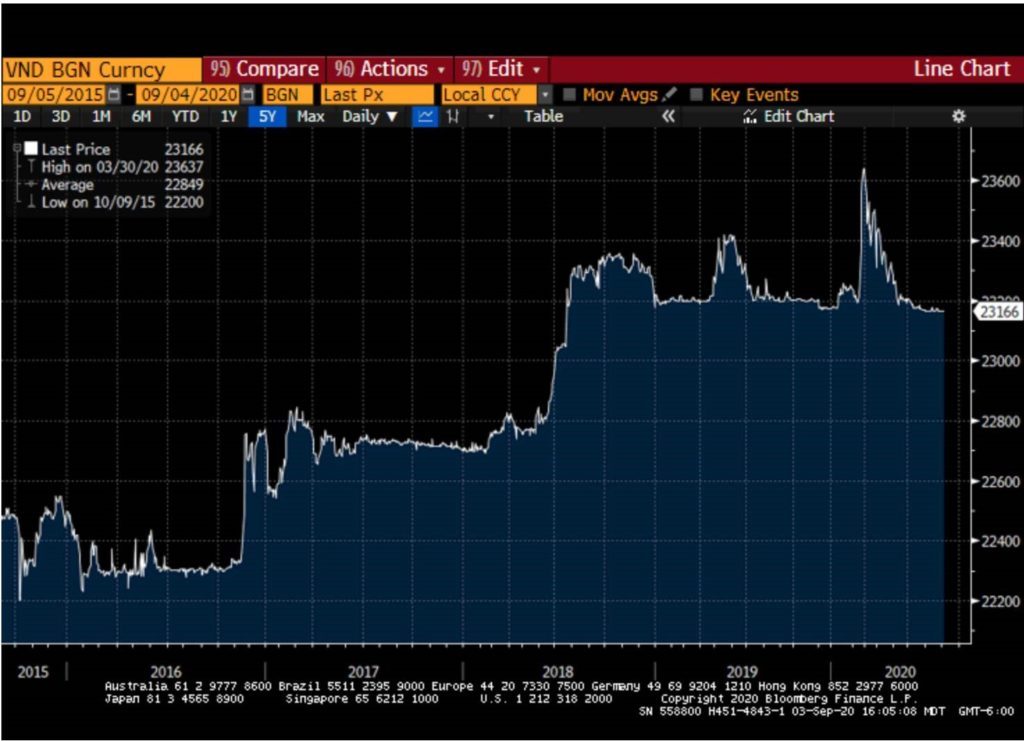

Vietnamese dong has been stable even in the year when Dollar was strong ( between 2015-2019). This is because Vietnam was the beneficiary of huge FDI during those years. In spite of stable currency, Vietnam outperformed its ASEAN neighbors which saw depreciating currencies but still couldn’t compete with Vietnam on exports.

Summary of my discussion on Vietnam with an industry insider

- The country is communist divided into two camps

- Pro-China which is in power

- Pro US which is gaining power

Irrespective of who is in power the work goes on and only the favorites shift but bribes and competition among provinces to attract foreign capital does not hamper the work.

There are three countries which are becoming favorite of South Korean and Japanese companies looking to “reshore” out of China and Vietnam is the favorite for Low-end tech followed by the Philippines and then Bangladesh ( for garments and textiles).

Low-end tech assembly can be easily taught to the Vietnamese because they have a high level of basic education.

Electronics is the biggest industry in Vietnam and the average salary is $300 USD per month.

Like any other developing economy, consumption is the best way to play Vietnam.

He told me a story about Indian Conglomerate who wanted to set up a steel plant in Vietnam and they were able to easily source iron ore and coal but were not willing to grease any palms. The steel plant went to a Korean company.

Vietnamese military owns a bank and is a big asset owner but they don’t interfere in the economy.

There have been a bank failure in the past but Vietnam's central bank did not allow the bank to go bust and have gradually tightened prudential norms over a period of time.

He believes that Vietnam has a great future and like any other Emerging economy will have its share of setbacks but in spite of communist characteristics, Vietnam is very pro-business.

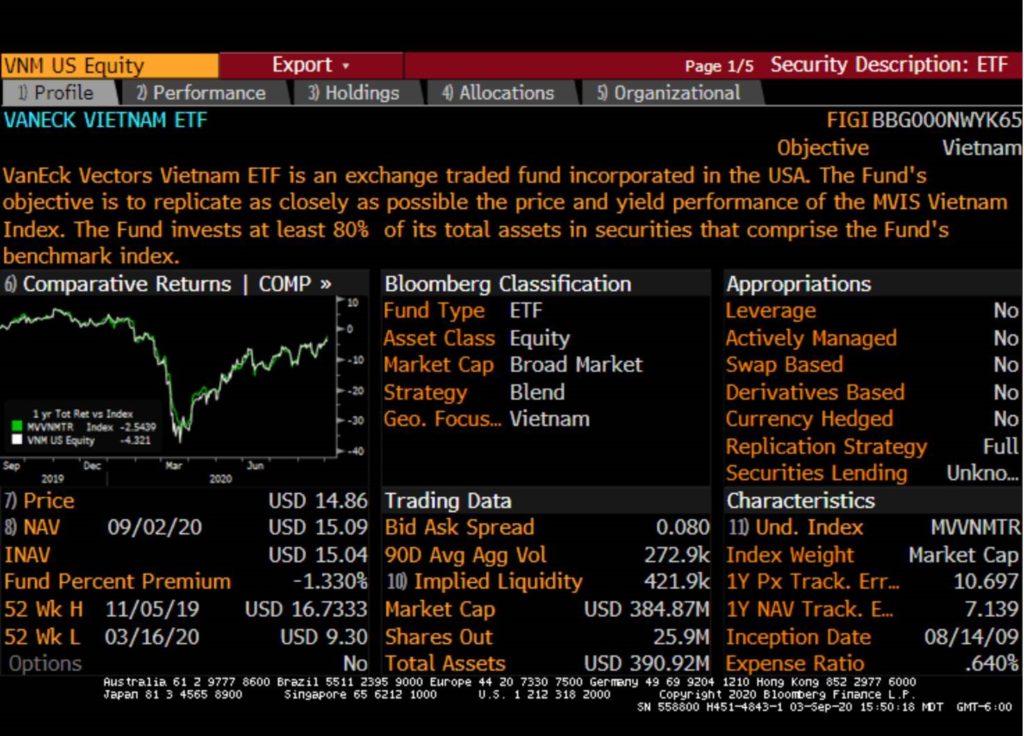

Below is the geographical holdings of VNM Vietnam ETF). You will see some south Korean and Taiwan companies over here. The reason is that as per mandate VNM invests in companies which derive at least 50% of their revenues from Vietnam.

The portfolio is a healthy mix of exports and domestic growth companies. There is also some details about the average valuation. The average daily traded volume are close to 200000 shares.

Disclosure: This is not an investment recommendation. Please do your own due diligence before investing