What To Do When Retirement Is Near

Where are you on the retirement timeline? If you're in the early years of your career, you may have barely given it a thought other than to regularly contribute to your retirement accounts. It might seem like a foggy, distant concept that may not even happen. Other things on your mind are more important and immediate.

Perhaps in your 50s or so, retirement starts to become a goal that's in reach, or at least one that you would like to be in reach. You're probably watching the stock market and your investment account balances more closely. You might be estimating what kind of equity you have in your house, and whether it makes sense to downsize eventually. It's almost instinct to be thinking this way.

Instinct is good; a plan is better. So we'll try to help your focus with a to-do list as you approach retirement. Are you on the right track to retire? If not, what can get you there?

The Cost Of Living

If you're not keeping track of what you spend, you should start making a habit of doing so.

Yes, you need to save and invest. Yes, you might have a "number" you're trying to hit, meaning a certain level of invested assets at which you would be comfortable calling it quits on full-time work. But before you get to that point, you have to have a sense of what your lifestyle requires in terms of outflows. Spending should be the basis of any plan.

And that's not just what you're spending on day-to-day expenses either, although that's very important. Utilities, vehicle maintenance, and fuel, groceries--these are all things you should have a handle on. But big-ticket items that come and go need to be accounted for too.

Here, we're thinking of things like medical expenses. You're probably paying for medical insurance in some fashion pre-retirement, whether you're fully aware of it or not. If you're covered by an employer plan, that's coming out of your pay. When you're retired, of course, it won't be. But it will need to be paid for somehow. Medicare will handle some of it, but not all of it. Medicare Part B premiums are just that--premiums--and those will cost.

Someone in your family might need some help with higher education expenses as well. If so, don't let it creep up on you--be sure to budget for it for the years you expect it to hit.

Automotive expenses (or call it transportation expenses if you don't own a car) are another thing. These expenses might actually drop after retirement since you'll no longer be commuting, but it's important to account for them. Be conservative (that is, make it a bit higher than you think it will be) with this number; the good news here is that if the going gets unexpectedly tough down the road, you should be able to adjust buy buying a cheaper or used vehicle, or by cutting back on travel.

It would be impossible to spell out all potential non-standard expenses here because everyone's plans--and lives--are different. Some like to travel and spend extravagantly on it; some stay home most of the time. Some families like to throw big weddings for their kids; some kids will elope (whether you want them to or not!). The point is to really think through expenses that could materialize down the road, and then include them in your plan. If you don't end up spending on those expenses, great--you just padded your plan a bit.

Tally Up Your Assets

With spending needs (and wants) out of the way, you can move on to your investments: What they're worth now, what they'll be worth going forward, and how much you can safely draw from them.

This part, frankly, gets a little complicated. There are a lot of moving parts. It's best to track and estimate this information using software.

If you are able to provide some basic data, though, a good software package should be able to give you the estimates you need to make some decisions.

The first thing to know is what you have paid for your investments--that is, their cost basis. You don't even need to know it for your traditional IRA, 401(k), or other qualified accounts. But it's important to know it for your taxable accounts and your Roth so that the software program will be able to estimate your anticipated tax burden more accurately.

You'll of course also need to know what asset classes you're invested in. If you own mutual funds and exchange-traded funds, these classes can change frequently as the funds make trades--another argument for tracking it and having it update electronically. Getting a reasonable estimate of what kind of total returns to expect depends on knowing what your funds own.

And what assets should you be invested in? You can probably handle most of your investment needs via just four ETFs: Vanguard Total Stock Market (VTI); Vanguard Total Bond Market (BND); Vanguard FTSE Developed All Cap ex US (VDU); and Vanguard FTSE Emerging Markets (VWO). What percentage in each is another question, having to do with your tolerance for stock market volatility, how close you are to retirement, and a few other things that a software program could help with. In any case, these recommendations are just a starting point. You pretty much can't go wrong with Vanguard investments in terms of their low fees.

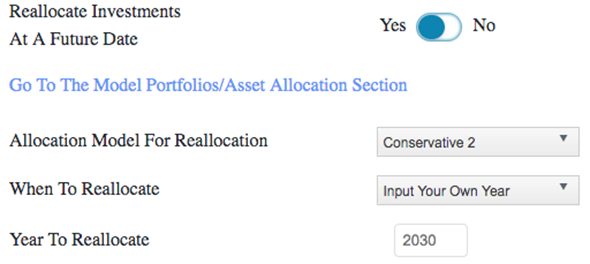

Related to that, you'll want to have some idea of what asset classes you will be invested in in the future. Most likely, you'll want to dial back the risk of your portfolio as you approach retirement, investing in more conservative asset classes than you would during your working years.

Just as you might own assets that can't be expected to produce income (such as your home or collectibles you don't plan on selling), you might also be expecting income down the road that won't exactly come from assets. Make a list of what income you expect to have that won't come via investments. Here, we're thinking of any pensions, inheritance, Social Security benefits (check ssa.gov to find out what those should look like), and even income from part-time work you plan to do after retirement.

Don't skip this part. Social Security, in particular, can make a huge difference in the success of a retirement plan.

Now You Have A Crystal Ball

OK, you may not be able to see into the future with absolute clarity. But you certainly have a lot better view than you did before starting this exercise. This way is much better than pointing to an almost arbitrary number ($2 million, $5 million) and saying, "as soon as I have this much in assets, I'm going to retire." That "method" won't work for most people.

So, to recap: Start with what you know. Make some educated guesses about what you don't know. Plug the data into a program that can handle the details like tracking cost bases and taxes. Monitor and adjust your holdings as necessary. And enjoy your retirement.