What Middle East Tensions Mean To Your Investments

Escalating tensions in the Middle East have increased uncertainty levels in the stock market over recent days, with stocks pulling back and oil, gold, and volatility on the rise. In this context, it makes sense for investors to wonder if they should be selling stocks before things keep getting worse.

It is important to keep in mind that markets were at all-time highs and at overbought levels before the geopolitical tensions increased. From this perspective, a short-term pullback was already to be expected, and the military conflict could provide the excuse for the market to take some profits and wash out some of the recent optimism.

However, if you are managing your portfolio with a medium- to long-term horizon, meaning years and months as opposed to days and weeks, then you shouldn't be selling stocks based solely on geopolitical uncertainty.

Follow The Evidence

In theory, it makes sense to say that military conflict is bad for the markets, because uncertainty tends to increase in those periods, and markets don't like uncertainty at all. Importantly, the media coverage of these kinds of conflicts tends to exacerbate negative emotions such as fear and even panic, which makes it difficult for investors to analyze the environment with a clear and rational mind.

Needless to say, war can have tragic consequences for the people involved, both military and civilians, so these kinds of events naturally generate genuine concern all over the world.

However, a look at the historical evidence shows that the relationship between geopolitical instability and the stock market is not as obvious as it seems to be. In fact, the data indicates that many military conflicts turn out to be buying opportunities for investors as opposed to a reason to sell stocks and remain on the sidelines.

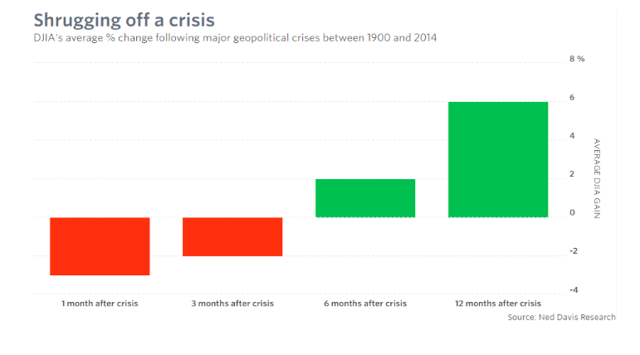

A 2018 article by Mark Hulbert in MarketWatch used data from Ned Davis Research to evaluate how the Dow Jones Index has performed in times of military conflict over the past decades. According to this data, short-term pullbacks in stock prices during times of war tend to be buying opportunities for investors.

This data shows that the initial decline when a crisis is triggered generally represents a good buying opportunity. Most of the time, the stock market makes a strong rebound from its lows, and prices are generally higher than when the crisis erupted over the following 6 and 12 months.

Image source: MarketWatch

Reaching similar conclusions, Mark Armbruster, CFA, analyzed how different asset classes performed during times of war, and the cold-hard evidence indicates that U.S. stocks tend to even outperform their long-term averages in times of military conflict.

The article entitled, What Happens to the Market if America Goes to War?, evaluates returns and volatility numbers leading up to and during World War II, the Korean War, the Vietnam War, and the Gulf War. According to the evidence, stocks have outperformed their long-term averages in terms of both return and risk during war periods.

Image source: Enterprising Investor

The stock market is a complex mechanism, and it's practically impossible to time your entries and exits based on geopolitical news. It's not just that the headlines are hard to anticipate, the market's reaction to those headlines is even more unpredictable.

Have A Plan And Stick To The Plan

In the short term, factors such as sentiment can have a considerable impact on stock prices. But over the long term, variables such as fundamental conditions, earnings growth, and interest rates are much more important drivers.

Even before the military conflict with Iran escalated, there was a high probability of a short-term correction in spite of the fact that market conditions remain favorable for stocks in the medium term.

From an article published on December 30, 2019:

The market is overbought and investor sentiment is optimistic in the short term, so any correction in the coming weeks should be no surprise at all. A 5%-10% pullback would be very reasonable and even to be expected to some degree.

But the market the environment still looks favorable for stocks over the next 6 to 12 months. Momentum is pointing in the right direction, the global economy seems to be stabilizing, and central banks all over the world are providing ample liquidity, which is a major driver for prices.

The right approach to risk management in this particular context depends on your time horizon and your overall investment strategy. If you are a short-term trader, meaning that you hold your positions over a few days, it makes sense to have well-placed stops so that any market pullback should allow you to take profits from current levels and then reassess the strategy in the near term.

On the other hand, if you are a long-term investor, meaning that you hold your positions for months and even years, patience is a much sounder approach. It makes sense to have some cash available in your portfolio in order to capitalize on the opportunities that may arise, but you don't want to be selling out of panic due to geopolitical risk.

Warren Buffett once said: "The stock market is designed to transfer money from the active to the patient," and this could very well be the case when it comes to the recent developments in the Middle East and the impact on your portfolio.

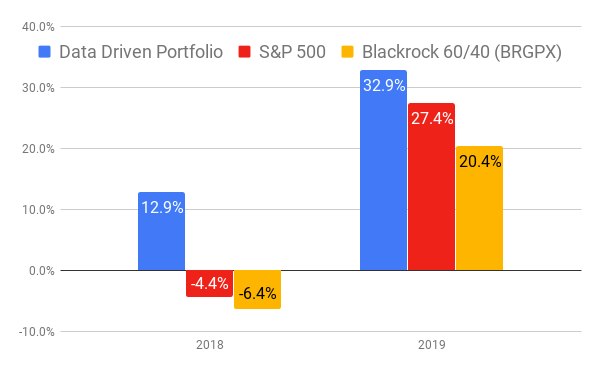

Performance as of December 31, 2019

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more