What Do CMBS Spread Forecasts Say About Commercial Real Estate?

Predictions about future bond spreads by market participants provide a window on their thinking about their expectations regarding the performance of the underlying asset class. CMBS industry’s weekly newsletter, Commercial Mortgage Alert published its semi-annual polling of predictions on CMBS spreads six months later last month. One interesting fact in the data was that not a single person asked for their prediction thought that the spreads will be wider six months later! Does this unanimity reflect wisdom of crowds and indicates a steadily improving commercial real estate market, or is this a contrarian signal with respect to where commercial real estate and CMBS spreads are headed? And how does that reconcile with forecasts of the real estate market conditions?

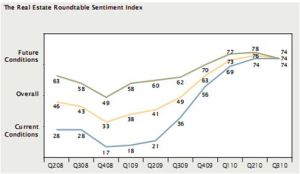

For the commercial real estate property market conditions, The Real Estate Roundtable has just published its 3rd Quarter 2010 Sentiment Index survey of more than 110 senior real estate executives. While the survey found significant concerns and uncertainty about economic & job recovery outlook, government policy, and capital markets, the overall sentiment is that the industry is in for a long slow recovery. The survey reports a Current Conditions Index (reflecting how markets are today vs 12 months ago), a Futures Conditions Index (expectations on how markets will be 12 months from now), and an Overall Sentiment Index, which is the average of the two. For the first time, the survey’s current and future conditions indices merged, scoring an Overall Sentiment Index of 74 (down from 76 in the previous quarter).This score suggests a relatively positive trend and a flat trajectory.

Real Estate Roundtable Sentiment Index

The actual data on commercial real estate is sending conflicting signals and is being read by different people in different ways. Cushman & Wakefield report last month showing US CBD office vacancy dropping to 14.8 % in Q2 from 15% at end of Q1 -first drop since 2007, CMBS statistics showing declining pace of deterioration in delinquencies, etc are seen by many as signs that the CRE market is stabilizing. Others point to declining rents and high unemployment as factors that point to further declines ahead. Both the viewpoints have some validity, which probably implies that the CRE sector might move sideways in near term with some volatility caused by which of the two views is stronger at any given point, till additional market data clarifies the picture more.

Going back to CMBS spreads, the tightening probably just reflects the sentiment expressed in other surveys of an expectation of slowly stabilizing CRE market. For CMBS, as opposed to properties, a consensus that the property price decline has stopped will be enough for bond spreads to tighten. Real estate prices do not necessarily need to go up for CMBS spreads to tighten. What happens if the sentiment on the economy sours impacting the view on the commercial real estate too?Even in that scenario, more and more people are coming to the view that the senior most CMBS bonds will likely not suffer a principal loss, which makes them attractive given the additional yield they provide compared to other similar investments. So, worsening economic conditions may actually cause people to move up in capital stack, creating demand for senior most bonds, and providing support for spreads. No one knows what future will bring, but logically, odds look in favor of the spreads moving in the direction suggested by the unanimous view.

All of the above is fine for trying to understand these markets, but one practical conclusion, and the real point of this article is this: if senior CMBS securities can go up in value even when property markets go sideways, and will have some support if the property markets decline, then logically, senior CMBS bonds have to be better investments at present than commercial real estate properties or loans for those who can invest in any of those.

Disclosure: None