Weekend Report: Best Stocks To Buy

Top scoring weekly returns: Buy and Hold 1 Year

Overall Average: 545 bps EXCESS E. B. Capital Markets, LLC - Trailing 52 Week Best Scoring Stock Returns: 0% Turnover

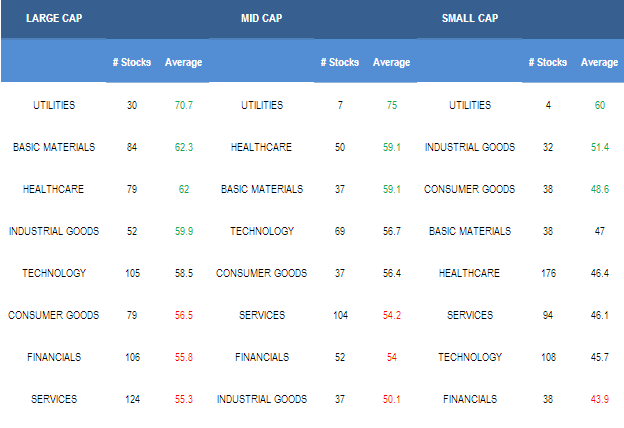

The best scoring sector remains utilities this week.

Basic materials and healthcare score in line with the average universe score. In basics and healthcare, large and mid cap score better relative to peers than small cap.

Consumer goods, industrial goods, technology, services, and financials all score below average. In consumer goods, focus on small cap. In induststrials, large and small cap are best. Services historically endure headwinds tied to retail sector headwinds through summer; however, some industries (trucking for example) remain high scoring.

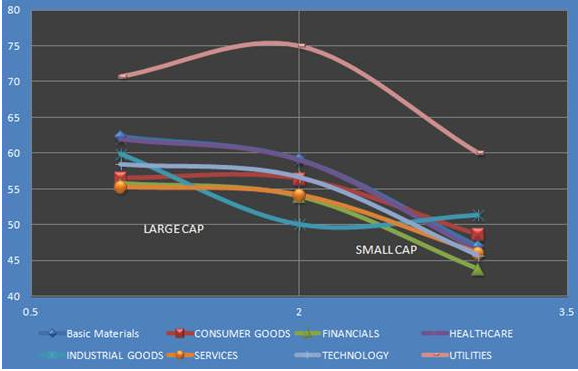

The following chart visualizes score by sector and market cap.

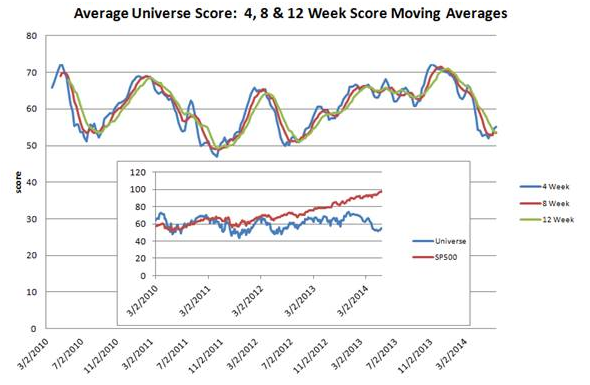

The four week moving average score moved above the eight and 12 week moving average score this week. Historically, that has been a bullish signal for risk (beta) plays. That said, one week doesn't equal a trend..stay tuned.

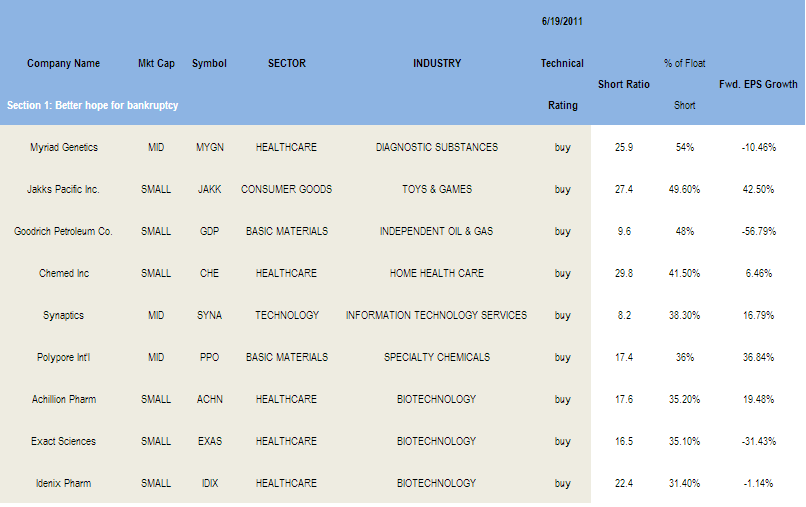

The following table breaks out stocks trading more than 5% above their 200 dma, with high short interest and where more than 30% of the floating shares are held short. These companies expose short sellers to higher than normal short squeeze risk -- tread carefully.

Utilities

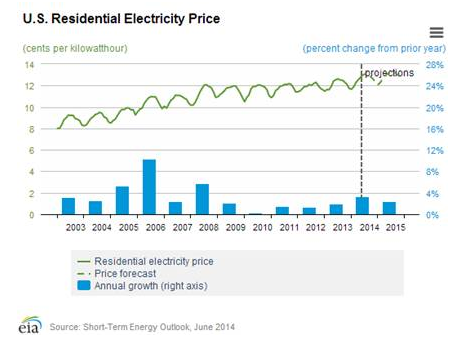

During the first quarter, total electricity consumption was 5% higher than 2013. The EIA forecasts that the average U.S. residential electricity customer will spend 4.9% more this summer (through August) than last year year as consumption grows 1.2% and prices climb 3.7%.

In New England, the average bill paid by electricity consumers will be up 5.6% from last year, while in the east south central states average bills will be 8.7% higher. Overall, the EIA expects that U.S. electricity prices for residential consumers will average 12.5 cents per kilowatt hour this year, up 3.4% from 2013.

Utilities remain the second leading source for dividend yield, trailing only telecom. Early year sector strength has current average utilities yields slightly below their 10 year average, according to Factset; however, four of the top ten yielding stocks remain utilities companies. Although utilities yields are slightly below their 10 year average, trailing 12 month payout ratios are slightly higher than their average 10 year levels.

The following are the best scoring across our utilities universe this week:

|

Top Scoring Utilities |

|

|

|

6/12/2014 |

6/19/2014 |

4 Week MA |

|

Company Name |

Symbol |

Sector |

INDUSTRY |

SCORE |

SCORE |

SCORE |

|

Edison Intl |

EIX |

UTILITIES |

ELECTRIC UTILITIES |

95 |

100 |

98.75 |

|

Nextera Energy |

NEE |

UTILITIES |

ELECTRIC UTILITIES |

95 |

100 |

98.75 |

|

Piedmont Natural Gas |

PNY |

UTILITIES |

GAS UTILITIES |

100 |

100 |

87.5 |

|

Entergy Corp New |

ETR |

UTILITIES |

ELECTRIC UTILITIES |

95 |

95 |

95 |

|

P P L Corp |

PPL |

UTILITIES |

ELECTRIC UTILITIES |

90 |

95 |

93.75 |

|

Energen Corp |

EGN |

UTILITIES |

GAS UTILITIES |

95 |

95 |

95 |

|

Calpine Corp |

CPN |

UTILITIES |

ELECTRIC UTILITIES |

85 |

85 |

85 |

|

Nrg Energy Inc |

NRG |

UTILITIES |

ELECTRIC UTILITIES |

80 |

85 |

82.5 |

|

Public Service Ent. |

PEG |

UTILITIES |

DIVERSIFIED UTILITIES |

85 |

85 |

87.5 |

|

New Jersey Resources |

NJR |

UTILITIES |

GAS UTILITIES |

85 |

85 |

85 |

|

American Elec Pwr Inc |

AEP |

UTILITIES |

ELECTRIC UTILITIES |

75 |

80 |

78.75 |

|

Dte Energy Co |

DTE |

UTILITIES |

ELECTRIC UTILITIES |

80 |

80 |

82.5 |

|

Avista |

AVA |

UTILITIES |

DIVERSIFIED UTILITIES |

85 |

80 |

81.25 |

|

Laclede Group Inc. |

LG |

UTILITIES |

GAS UTILITIES |

80 |

80 |

80 |

Top Scoring Stocks

|

LG CAP |

|

6/19/2014 |

4 Week MA |

MID CAP |

|

6/19/2014 |

4 Week MA |

|

Symbol |

Sector |

SCORE |

SCORE |

Symbol |

Sector |

SCORE |

SCORE |

|

BEST |

|

|

|

BEST |

|

|

|

|

EQT |

UTILITIES |

105 |

103.75 |

FTR |

TECHNOLOGY |

105 |

101.25 |

|

OXY |

BASIC MATERIALS |

105 |

98.75 |

CNC |

HEALTHCARE |

100 |

95 |

|

RSG |

INDUSTRIAL GOODS |

105 |

91.25 |

CTB |

CONSUMER GOODS |

100 |

98.75 |

|

SIAL |

HEALTHCARE |

105 |

108.75 |

HME |

FINANCIALS |

100 |

97.5 |

|

ADS |

FINANCIALS |

100 |

77.5 |

PNY |

UTILITIES |

100 |

87.5 |

|

APH |

TECHNOLOGY |

100 |

103.75 |

QCOR |

HEALTHCARE |

100 |

95 |

|

BKW |

SERVICES |

100 |

103.75 |

ARLP |

BASIC MATERIALS |

95 |

95 |

|

CHK |

BASIC MATERIALS |

100 |

93.75 |

CRZO |

BASIC MATERIALS |

95 |

95 |

|

CSX |

SERVICES |

100 |

103.75 |

EGN |

UTILITIES |

95 |

95 |

|

DHR |

CONGLOMERATES |

100 |

90 |

HLS |

HEALTHCARE |

95 |

86.25 |

|

ECA |

BASIC MATERIALS |

100 |

98.75 |

HLX |

BASIC MATERIALS |

95 |

82.5 |

|

EIX |

UTILITIES |

100 |

98.75 |

HUBG |

SERVICES |

95 |

93.75 |

|

JNJ |

HEALTHCARE |

100 |

102.5 |

ICLR |

HEALTHCARE |

95 |

82.5 |

|

LRCX |

TECHNOLOGY |

100 |

100 |

PRAA |

SERVICES |

95 |

86.25 |

|

MRK |

HEALTHCARE |

100 |

98.75 |

WOOF |

SERVICES |

95 |

92.5 |

|

NEE |

UTILITIES |

100 |

98.75 |

AER |

SERVICES |

90 |

93.75 |

|

SJR |

SERVICES |

100 |

91.25 |

AHL |

FINANCIALS |

90 |

88.75 |

|

ALB |

BASIC MATERIALS |

95 |

91.25 |

DDS |

SERVICES |

90 |

93.75 |

|

AN |

SERVICES |

95 |

97.5 |

FDS |

TECHNOLOGY |

90 |

70 |

|

AVB |

FINANCIALS |

95 |

96.25 |

ITT |

INDUSTRIAL GOODS |

90 |

76.25 |

|

BP |

BASIC MATERIALS |

95 |

81.25 |

ODFL |

SERVICES |

90 |

93.75 |

|

DOV |

INDUSTRIAL GOODS |

95 |

93.75 |

PDS |

BASIC MATERIALS |

90 |

90 |

|

ENR |

INDUSTRIAL GOODS |

95 |

96.25 |

PRXL |

SERVICES |

90 |

81.25 |

|

EOG |

BASIC MATERIALS |

95 |

95 |

R |

SERVICES |

90 |

93.75 |

|

ETR |

UTILITIES |

95 |

95 |

ROVI |

TECHNOLOGY |

90 |

91.25 |

|

GD |

INDUSTRIAL GOODS |

95 |

98.75 |

SCI |

SERVICES |

90 |

93.75 |

|

GMCR |

CONSUMER GOODS |

95 |

97.5 |

SPW |

INDUSTRIAL GOODS |

90 |

92.5 |

|

GT |

CONSUMER GOODS |

95 |

95 |

SSNC |

TECHNOLOGY |

90 |

87.5 |

|

HAL |

BASIC MATERIALS |

95 |

95 |

TCO |

FINANCIALS |

90 |

92.5 |

|

IDXX |

HEALTHCARE |

95 |

97.5 |

TEN |

CONSUMER GOODS |

90 |

92.5 |

|

ILMN |

HEALTHCARE |

95 |

97.5 |

WIN |

TECHNOLOGY |

90 |

90 |

|

K |

CONSUMER GOODS |

95 |

97.5 |

|

|

|

|

|

LO |

CONSUMER GOODS |

95 |

95 |

|

|

|

|

|

MCHP |

TECHNOLOGY |

95 |

86.25 |

|

|

|

|

|

NBL |

BASIC MATERIALS |

95 |

82.5 |

|

|

|

|

|

PPL |

UTILITIES |

95 |

93.75 |

|

|

|

|

|

RAI |

CONSUMER GOODS |

95 |

95 |

|

|

|

|

|

STZ |

CONSUMER GOODS |

95 |

93.75 |

|

|

|

|

|

UA |

CONSUMER GOODS |

95 |

88.75 |

|

|

|

|

|

UHS |

HEALTHCARE |

95 |

95 |

|

|

|

|

|

SMALL CAP |

|

6/19/2014 |

4 Week MA |

ADRS |

|

6/16/2014 |

4 Week MA |

|

Symbol |

Sector |

SCORE |

SCORE |

Symbol |

COUNTRY |

SCORE |

SCORE |

|

BEST |

|

|

|

BEST |

|

|

|

|

ARTC |

HEALTHCARE |

95 |

93.75 |

ICLR |

Ireland |

95 |

83.75 |

|

GB |

HEALTHCARE |

95 |

97.5 |

AZN |

United Kingdom |

90 |

90 |

|

HURN |

FINANCIALS |

95 |

95 |

BIDU |

China |

90 |

76.25 |

|

SWHC |

CONSUMER GOODS |

95 |

98.75 |

GOLD |

South Africa |

90 |

67.5 |

|

ALIM |

HEALTHCARE |

90 |

76.25 |

NGG |

United Kingdom |

90 |

87.5 |

|

CTRN |

SERVICES |

90 |

96.25 |

NTES |

China |

90 |

68.75 |

|

ECOL |

INDUSTRIAL GOODS |

90 |

92.5 |

NVO |

Denmark |

90 |

77.5 |

|

MED |

SERVICES |

90 |

90 |

CIB |

Colombia |

85 |

85 |

|

PDLI |

HEALTHCARE |

90 |

93.75 |

NTT |

Japan |

85 |

83.75 |

|

AMRI |

HEALTHCARE |

85 |

85 |

ASMI |

Netherlands |

80 |

82.5 |

|

AMSG |

HEALTHCARE |

85 |

76.25 |

CTRP |

China |

80 |

80 |

|

ANEN |

TECHNOLOGY |

85 |

85 |

OMAB |

México |

80 |

81.25 |

|

BSTC |

HEALTHCARE |

85 |

83.75 |

SFL |

Bermuda |

80 |

83.75 |

|

IDIX |

HEALTHCARE |

85 |

88.75 |

BSAC |

Chile |

75 |

75 |

|

MACK |

HEALTHCARE |

85 |

87.5 |

BTI |

United Kingdom |

75 |

72.5 |

|

MPWR |

TECHNOLOGY |

85 |

83.75 |

CISG |

China |

75 |

78.75 |

|

NTRI |

SERVICES |

85 |

80 |

DCM |

Japan |

75 |

62.5 |

|

SIMO |

TECHNOLOGY |

85 |

72.5 |

ENL |

Netherlands |

75 |

67.5 |

|

TWIN |

INDUSTRIAL GOODS |

85 |

88.75 |

HNP |

China |

75 |

77.5 |

|

AVAV |

INDUSTRIAL GOODS |

80 |

60 |

PSDV |

United States |

75 |

73.75 |

|

CMTL |

TECHNOLOGY |

80 |

71.25 |

PVD |

Chile |

75 |

73.75 |

|

DIOD |

TECHNOLOGY |

80 |

82.5 |

SIG |

Bermuda |

75 |

78.75 |

|

EXAC |

HEALTHCARE |

80 |

71.25 |

SNP |

China |

75 |

75 |

|

GBX |

SERVICES |

80 |

78.75 |

TEO |

Argentina |

75 |

78.75 |

|

GDP |

BASIC MATERIALS |

80 |

80 |

TSM |

Taiwan |

75 |

73.75 |

|

IRWD |

HEALTHCARE |

80 |

78.75 |

TU |

Canada |

75 |

72.5 |

|

KTOS |

TECHNOLOGY |

80 |

83.75 |

|

|

|

|

|

LG |

UTILITIES |

80 |

80 |

|

|

|

|

|

MRTN |

SERVICES |

80 |

78.75 |

|

|

|

|

|

MTOR |

CONSUMER GOODS |

80 |

82.5 |

|

|

|

|

|

NLS |

CONSUMER GOODS |

80 |

82.5 |

|

|

|

|

|

ORB |

INDUSTRIAL GOODS |

80 |

66.25 |

|

|

|

|

|

PERY |

CONSUMER GOODS |

80 |

82.5 |

|

|

|

|

|

PMC |

SERVICES |

80 |

82.5 |

|

|

|

|

|

SAIA |

SERVICES |

80 |

82.5 |

|

|

|

|

|

SQNM |

HEALTHCARE |

80 |

78.75 |

|

|

|

|

|

STFC |

FINANCIALS |

80 |

72.5 |

|

|

|

|

None.