"We See Vulnerability": JPMorgan Estimates Up To $310 Billion In Forced Selling By Year-End

Earlier this week we reported that with month-end fast approaching, banks are starting to publish their estimates of what upcoming pension rebalancings will mean for stock and bond flows.

The first such forecast came from Goldman Sachs (GS), whose month-end pension rebalancing published on Wednesday estimated that a net $36 billion of equities to sell following a month of substantial outperformance of stocks vs bonds. Notably, according to Goldman, this is the fourth largest sell estimate on record going back to 2000, and ranks in the 96th percentile among all buy and sell estimates in absolute dollar-value.

Not to be outdone, JPMorgan (JPM), which has accumulated a track record of estimating rebalancing flows, writes that according to its own calculations, the $7 trillion universe of balanced mutual funds is on pace for a far greater month and quarter-end selling spree than the one estimates by Goldman --greater as much as 10x.

In response to client interest sparked by the Goldman report, JPM's Nick Panigirtzoglou writes that as we approach month-end, "the equity rebalancing flow question is resurfacing in our client conversations" to wit: "How much of equity rebalancing flow should we expect into month-end, i.e. into the end of November? And how much more rebalancing into quarter-end, i.e. into the end of December?"

To answer this question, the JPMorgan strategist look at the four key multi-asset investors that have either fixed allocation targets or tend to exhibit strong mean reversion in their asset allocation. These are - in addition to the defined benefit pension plans previously highlighted by Goldman - also mutual funds, such as 60:40 funds, the Norwegian sovereign/oil fund, i.e., The Norges Bank, and lastly the Japanese government pension plan, GPIF.

Balanced mutual funds including 60:40 funds, a close to $7 trillion AUM universe globally, tend to rebalance relatively more quickly on a monthly basis or so.

Assuming that this universe of balanced mutual funds, which tend to maintain a 60/40 equity/bond split, were fully rebalanced at the end of October, and by taking into account the MTD performance of global equities and bonds which has seen stocks drastically outperforming fixed-income by 10.45% (S&P total-return 10.50%, 10-year total-return 0.05%), JPM estimate around -$160 billion of negative equity rebalancing flow by balanced mutual funds globally into the end of November.

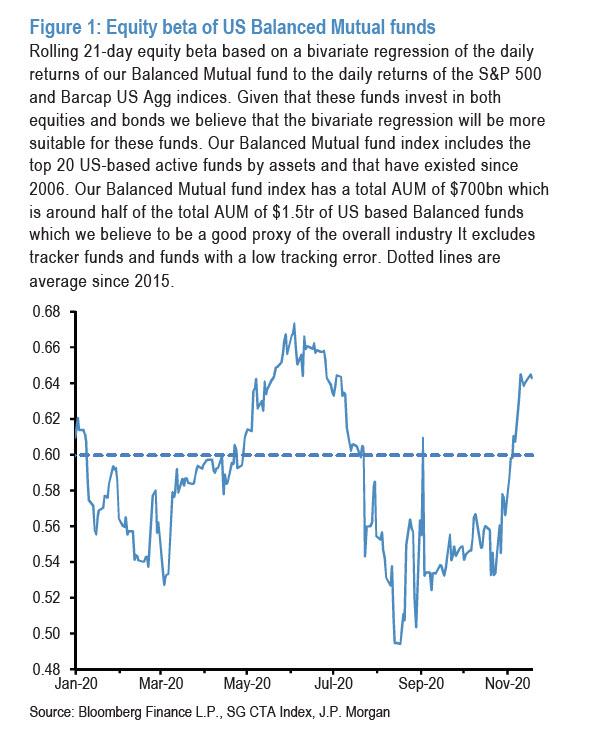

The bank caveats that this estimate could be wildly different if its assumption that balance funds were, in fact, not fully rebalanced at the end of October. And, as it further notes, its equity beta as shown in the chart below suggests that this was likely not true and that US balanced mutual funds in particular have been rather underweight equities during October.

However, this was offset by the moves at the start of the month, when the beta of US balanced mutual funds rose steeply at the beginning of November, rising to well above the neutral or average line by the middle of the month, as balanced mutual funds appear to have boosted their equity exposures over the first two weeks of November.

According to Panigirtzoglou, "if the picture in Figure 1 is a true reflection of how balanced mutual funds have been positioned in recent weeks, then there would be some vulnerability in equity markets in the near term from balanced mutual funds having to sell equities to revert to their 60:40 equity:bond target allocation, either by the end of November or by the end of December at the latest."

There's more: according to JPM, the equity rebalancing flow is likely to also be an issue into year or quarter-end, i.e. the end of December, especially if equity markets continue to grind higher into December. This is because of likely negative pending rebalancing by entities that tend to rebalance on a quarterly basis. Some estimates:

- US defined benefit pension plans are a big $7.5 trillion AUM universe. They tend to rebalance more slowly over 1-2 quarters or so. Assuming they were fully rebalanced at the end of September, and by taking into account the QTD performance of US equities and bonds, JPM believes that the pending equity rebalancing flow by US defined benefit pension plans into the current quarter-end is negative at around -$110 billion.

- By doing the same calculation for Norges Bank, a $1.2 trillion AUM entity, the bank estimates that the pending equity rebalancing flow by Norges Bank into the current quarter-end is likely negative at around $15 billion.

- A similar calculation for the giant Japanese government pension plan, GPIF, a $1.5 trillion AUM entity, JPM estimates that the pending equity rebalancing flow by GPIF into the current quarter-end is likely negative at around -$25 billion.

In all, Panigirtzoglou echoes Goldman's month/quarter end year-end selling concerns, writing that he sees "some vulnerability in equity markets in the near term from balanced mutual funds, a $7 trillion universe, having to sell around $160 billion of equities globally to revert to their target 60:40 allocation either by the end of November or by the end of December at the latest."

And should the market rally continue into December, JPM concludes that it could give rise to an additional $150 billion of forced equity selling into the end of December - a total of more than $300 billion - by pension fund entities that tend to rebalance on a quarterly basis.

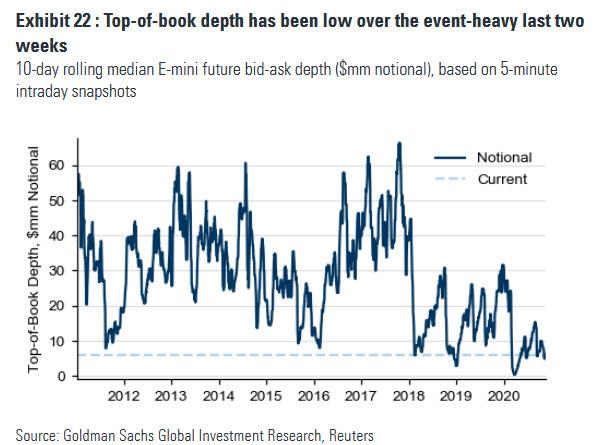

In short, nearly a trillion dollars worth of stock selling by rebalancing funds may be on deck, begging the question: when will traders start frontrunning this potentially massive wall of money which could hit just as market liquidity is at record lows, resulting in an outsized move to the downside if this culminates in a liquidation frenzy.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more