WallStreetBets Across The World: The Past, The Present, And The Future

The subreddit forum that led the short squeeze of a professional hedge fund was well covered by various media digesting the origins of moderators, the short squeeze leaders, how the short squeezes work, the impact on Melvin Capital, and any other possible area. However, what the reporters have been missing is the global perspective of the event, and what was happening (or will happen in the future) with the global capital markets.

The Past: WSB in Asia

Total market cap: $10 trillion Average retail portfolio: $1,202 People investing in stocks: 167 million (12% of total population)

Retail share of capital market: 85%

It’s a little-known fact, but what has happened in the U.S. capital markets is not an entirely new thing in the world. Retail-led exponential bull-run was first populated in China, just as the democracy was (during the Qing dynasty in 1636).

However, the structural differences of the Chinese stock market with the American market are such that in China, it is effectively not possible to short a stock. Even though it’s possible for large mega-funds via OTC or privately organized deals, common investors or even small-sized funds typically can’t do that. Therefore, as opposed to developed capital markets with opportunities of Buy-Hold-Sell-Short, Chinese investors are left with Buy-Hold-Sell only.

Over the course of Chinese financial market development, many people were left with significant losses in stocks or other financial instruments, which led to only a few groups or most risk-seeking people trading financial instruments. Therefore, people typically refer to themselves as “leeks” (韭菜 – Jiǔcài) meaning that they have little to no power in the capital markets as opposed to professional funds. That has led the leftover group of traders and investors to be highly connected and establish a relatively closed community of people. There’s a very high chance that if you are a retail trader with a sizable portfolio, you probably going to know another trader on another end of China via one or another friend.

These groups obviously have their own KOLs (key opinion leaders) and whales whom many people try to follow in their actions.

Apart from the above, due to many historical scams and failures of companies in capital markets, before the Chinese government started taking serious steps to clean up the market, people have learned their lessons. The main of which can be summarized as “don’t invest into something you don’t know”. And most of the time people know the big names only (Alibaba, Tencent, Meituan, etc.), therefore when such a company goes listed – the above factors play together in tandem leading to a astronomic price increase over a relatively short period of time.

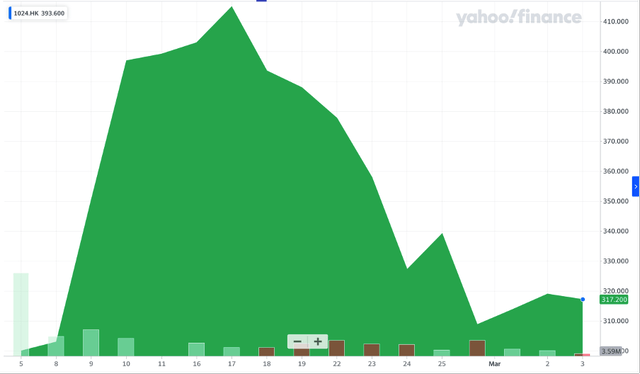

Fig.1: Shares of Chinese short video company Kuaishou ($KUASF) rose nearly 200% at the open on its debut in Hong Kong

Moreover, there are some groups of people within the overall trading community that are more organized and more interconnected. They are the ones who collectively hold enough wealth to be able to push the stocks up, and commonly referred as to the “Wendzhou Gang” that historically started from real estate market in Shanghai (when they would all together take a train from Shanghai to purchase all apartments they could find in Shanghai, and later to speculate on it), then moved to stocks, and most recently entered crypto markets as well.

Therefore, while one could wrongly assume that due to the population of China, there are more individual active and financially savvy traders, actually there are high chances that there are fewer of them in China as opposed to the USA, but the ones who actively engage in the market have much greater capital available to them (and yet they are not HNWI or UHNWI), therefore have the power to affect markets.

Therefore, to conclude, yes WSB is nothing new to Chinese people. However, yes, the methods used in China and the types of people engage are different.

The Present: WSB in the West

Total market cap: $50.8 trillion Average retail portfolio: $12,000 People investing in stocks: 54 million (16.5% of total population) Retail share of capital market: 25%

Due to the reason that the WSB with GME, AMC and others, was well described by many journalists, there’s not so much need to repeat what has been said before. However, we could briefly discuss what the event itself means in the social context.

On one hand, we have a relatively small group of MBA, CFA, and other flashy titled professionals who manage money for large institutions and international UHNWIs. It’s ironic at the same time that the employees of the funds can hardly be considered as HNWIs themselves, apart from a couple of MDs or VPs. On another hand, we have a large group of relatively “poor” people according to Wall Street standards, who yet represent the majority of low-to-middle class population. The people who lost hope in society, government and faithful world. These are the same people who are commonly ignored by the mainstream media, who are ignored by the major politicians serving the generously paying financial institutions, and people who either missed or participated in the rise of Bitcoin.

While WSB by no means an entirely American or Western community, the majority of people yet represent Western society.

For decades, people had no hope as they were forced to follow the rules of the “big boys” who were fortunate enough to attend prestigious MBAs, but the COVID-19 pandemic and Trump’s stimulus checks, together played their role. With the global virus many people lost their jobs, and without the near-coming economic recovery had no prospects but to bet their future on the capital markets, which were continually going up with Fed keeping pumping money into the markets.

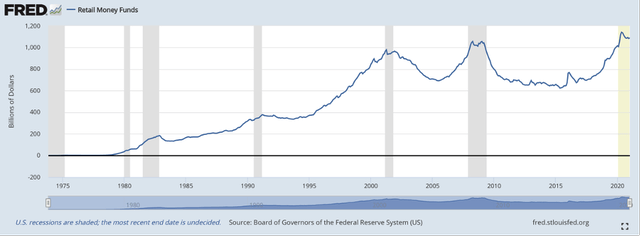

Fig.2: Retail money funds are at historical high levels surpassing the previous crisis levels

While many WSB participants are clearly more financially savvy than the “average Joe”, they simply had no idea of the power they collectively were holding. Therefore, with the stimulus checks, no hope left, markets kept raising, and Keith Gill clearly explaining the possible process of short squeeze led us to where we are now…

Now, once the people “tasted the blood“, they will not give up anymore. Given the reactions from the brokers, and other fund managers, the situation just got worse – all of them are on the radars of common people now. All of them participated in financial crimes against people and society. And all of them had betrayed the hopes of common people. Therefore, GME was among the first most notable examples in the West, but will not be the last.

The Future: WSB in Russia

Total market cap: $576 billion Average retail portfolio: $1,183 People investing in stocks: 7.6 million (5.3% of total population) Retail share of capital market: 1.6%

Russian stock market is among the most mysterious ones for outsiders. While most of the people heard of blue chips such as Gazprom, Rosneft, Sberbank, etc. the majority of Russian stocks remain unknown to outside investors.

Russian market, same with the other markets had seen “WSB”-like events (even though not short squeezes, but rather Pump & Dumps (P&D)) multiple times over its history of growth.

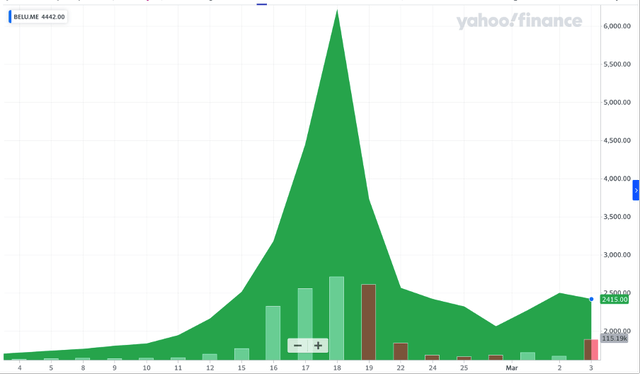

Fig.3: Stocks of Beluga (BELU) – one of the top vodka brands in Russia suddenly raising during February 2021, without any apparent event, market or sentiment change

However, none of the events had even a relatively comparable resonance to WSB, neither from the capital side, neither from media attention. That is mainly explained by the unique structural differences of Russian stocks market, which goes beyond of what is commonly read in “other Russian stocks market research” reports.

To start with, Russian stock market is 17x times smaller than the Chinese one, and 88x times smaller than the American one. What else is on the surface is the average portfolio size of Russian traders amounting to $1.1k, which is a sizable amount for the average Russian citizen, but isn’t so for others. And by the way, this metric is highly skewed for Russian market, as according to the Central Bank of Russia over 75% of retail market participants have assets of around RUB 10,000, which represents CNY 869 – lower than the official poverty line in China, and less than the minimum weekly wage in the U.S.

However, what is not mentioned in the common market reports is that due to the cultural differences Russian investors are more individualistic, therefore, it’s way harder for them to collectively accumulate sizable amount of money to move medium-to-large cap stocks, as the Chinese investors do.

But even more “terrifying truth” (for anyone unfamiliar with Russian stocks) is that it’s an “insider market”. That means, that while clearly in any kind of market insiders have a competitive advantage compared to outsiders, in the U.S. there’s SEC which tries to prevent inside trading and heavily penalizes anyone benefiting from it. In China, there’s CCP with financial regulators who do take the best measures to ensure the wellbeing of general public and markets, therefore, also heavily penalize insiders unfaithfully benefiting from their own advantages. In Russia, well… It’s Russia :) If you were to speak to any experienced trader from Russian stock market, you would learn that banks (i.e. major brokers) commonly inform their own top employees of stocks that senior executives (commonly HNWIs) or large clients will be buying, and the employees would collectively buy it. While anyone who is “not in” will be left behind the screen observing stocks soaring up, and wrongfully also trying to join the move, later to discover that s/he is left with illiquid stocks already at the bottom of just another P&D. While officials, regulators and institutionalized market participants will clearly reject such acquisitions, anyone who traded for over a year would confirm that such practice does exist in the market.

This situation has led many retail traders to get as angry (if not more) with the market, as the WSB is with Wall Street. However, due to the limited capital available people left with no hope for repeating the WSB story. Even though, many have raised the possibility of repeating WSB in Russia across Russian forums (such as here: Сила SMART-LAB). Due to that, recently Russians started turning to the Western markets with the hope of joining the Western movements (sorry China, but Russians hardly can register in WeChat, apart from language barriers, that’s why they don’t try to join rallies in Chinese stocks :)

However, the WSB gave great hope to Russian traders, and with that in mind, all people in Russia will remember WSB, and will clearly expect any kind of whale or local “Robinhood” (not the broker one) who would direct them and help to repeat the American history.

Final Thoughts

WallStreetBets was clearly neither the first one, neither the last one to benefit from market inefficiencies created by the “mainstream” institutions. However, WSB and the success due to the group of “average Joe” in taking down the financial giants inspired many others across different parts of the world. While some of them will try to do that sooner rather than later, others will take their time to accumulate the required capital and wait for the market-wide sign. But what is clear, WallStreetBets is a global symbolic phenomenon that marked that Wall Street is not alone in the room, and as they call them in Russia – “hamsters” (to describe noob retail investors) actually have the ability to kill the whales.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.