Volatility, Inflation Fears Drag Dow Lower

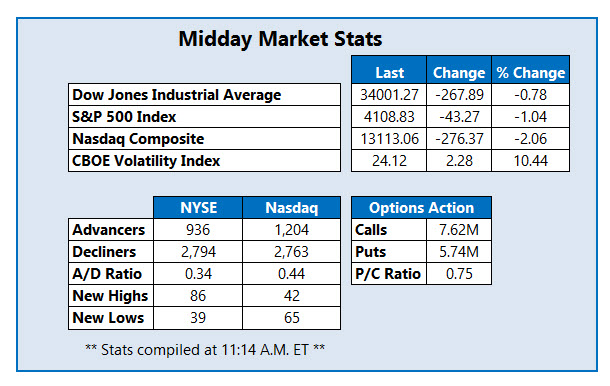

Even more pressure is being applied to stocks today, with the Dow Jones Industrial Average (DJI) last seen down over 267 points midday. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are feeling the heat, too, as the former drops back below Tuesday's bottom -- a level investors have been keeping an eye on.

Big Tech's prolonged selloff is combining with a surprising pop in inflation data, and it's crippling Wall Street. April's Consumer Price Index (CPI) rose 4.2%, marking the number's speediest leap since 2008. This massive market selloff is stoking Wall Street's "fear gauge" -- the Cboe Volatility Index (VIX). The index set for its first close above the 24 mark since March 9. .

One stock seeing an uptick in option activity today is Occidental Petroleum Corporation (NYSE: OXY). The stock is surging, up 6.4% at $26.10 at last check, attempting to erase Tuesday's negative post-earnings 7.9% bear gap even after its first-quarter results topped forecasts. The 100-day moving average caught most of yesterday's dip, though OXY is still well below its pre-earnings close. At last check, 40,000 calls and 4,443 puts have been exchanged so far today -- four times the intraday average. The May 30 call is the most popular, followed closely by the weekly 5/14 26-strike call.

One of the better performers on the New York Stock Exchange (NYSE) today is RA Medical Systems Inc (NYSE: RMED). The medical device company reported losses of $2.48 per share and said it enrolled 20 subjects in its atherectomy pivotal clinical study since mic-March, bringing its total enrolled subjects to 50. At last check, RMED was up 76.7% to trade at $5.82, toppling pressure at its 30-day moving average and pacing for its highest close since March.

An earnings report is moving Array Technologies Inc (Nasdaq: ARRY), too, though Wall Street has not had such a favorable reaction. The security is one of the worst Nasdaq performers today, off 34.2% at $16.41 at last check, after the company's first-quarter profits missed analysts estimates. Array Technologies also warned that a continual increase in supply costs could negatively impact its current-quarter margins. The word of caution elicited several bear notes from analysts, including Simmons Energy, which slashed its rating to "neutral" from "overweight," and cut its price target to $27 from $53. The security is trading at its lowest level on record, and is now off 61.6% for the year.