VMware Looks Undervalued

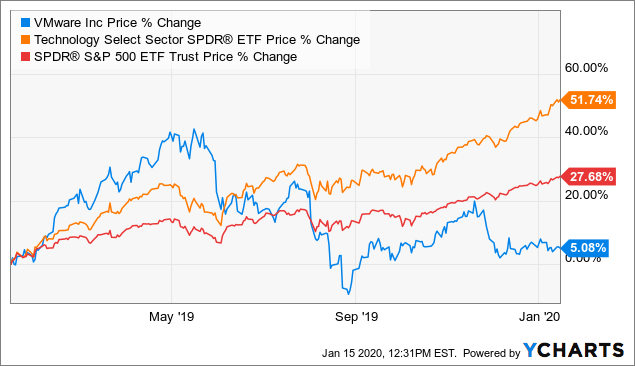

VMware (VMW) stock has delivered disappointing returns lately. The stock is up by only 5% in the past year, while the SPDR S&P 500 (SPY) gained almost 28% and the Technology Select Sector SPDR (XLK) surged by 52% in the same period.

(Click on image to enlarge)

Data by YCharts

VMware is facing competitive challenges in the years ahead, and this is arguably the main reason why the stock is under pressure. But the company is still delivering solid financial performance and above-average profitability levels. Importantly, valuation looks clearly attractive at current prices.

The stock market many times overreacts to uncertainty, and short-term risks can create long-term opportunities for investors.

A Fundamentally Sound Business

VMware is the top player in machine virtualization. The company is facing growing competitive pressure from providers of public cloud infrastructure and SaaS players, and this is a key uncertainty factor weighing on the stock price. Nevertheless, financial performance remains strong across the board.

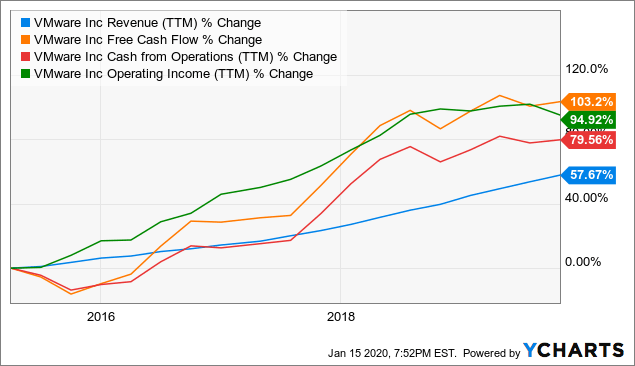

Looking at key metrics such as revenue, free cash flow, cash from operations, and operating income, the company has delivered solid numbers over the long term.

(Click on image to enlarge)

Data by YCharts

The company's financial report for the third quarter confirms that the business continues doing well, with both sales and earnings surpassing expectations.

- Revenue for the quarter was $2.46 billion, an increase of 12% versus the same quarter in the prior year.

- License revenue was $974 million, up by 10%.

- Total revenue plus sequential change in total unearned revenue excluding unearned revenue assumed in the acquisition of Carbon Black grew 12% year-over-year.

- Operating cash flow was $810 million.

- Free cash reached $760 million.

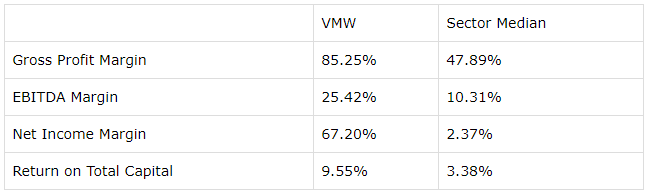

The technology sector is fertile ground for elevated profitability, and VMware is much more profitable than the average industry player. When comparing gross profit margin, EBITDA margin, net income margin, and return on total capital, VMware is far superior to the median player in the information technology sector.

(Click on image to enlarge)

Data source: Seeking Alpha Essential

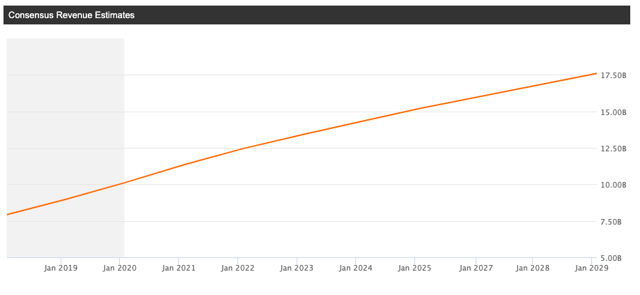

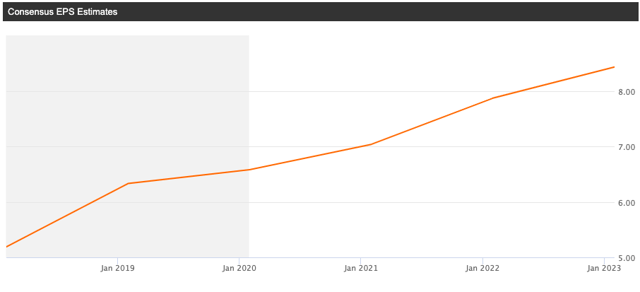

Wall Street analysts are well aware of the fact that the competitive landscape is evolving, and this is obviously incorporated into projections at this stage. But it's worth noting that both revenue and earnings are expected to continue growing at a healthy rate.

(Click on image to enlarge)

Source: Seeking Alpha Essential

(Click on image to enlarge)

Source: Seeking Alpha Essential

Attractive Valuation

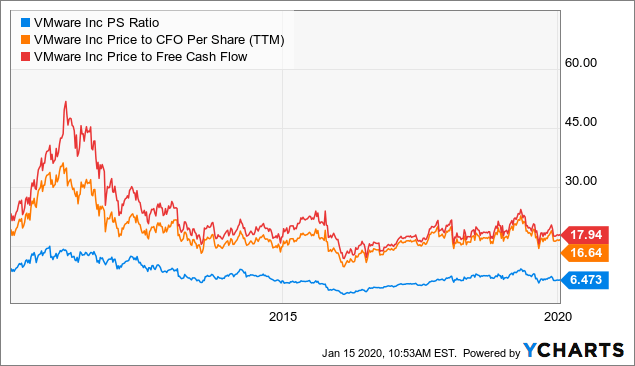

VMware is very reasonably valued for such a financially strong business. The company trades at an adjusted forward P/E ratio of 23, while the median stock in the sector carries an adjusted forward P/E ratio of 25. The forward price to free cash flow ratio is 16 for the company versus a median value of 21.5 in the sector.

When comparing how valuation ratios have evolved over the long term, VMware is priced near the low end of the valuation range over the past decade.

(Click on image to enlarge)

Data by YCharts

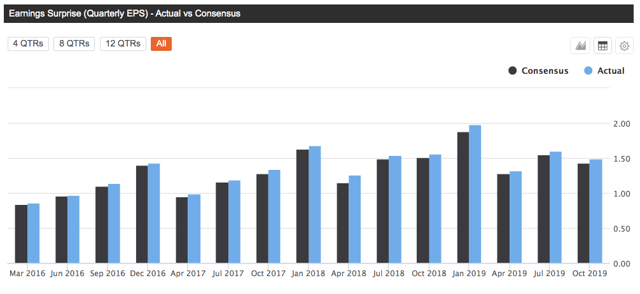

Valuation is always a dynamic concept. Forward-looking valuation ratios are reflecting a particular set of expectations about the company's earnings and cash flows in the future. If the company can consistently outperform those expectations, then the stock is ultimately cheaper than what the ratios are implying.

When you look at ratios such as forward price to earnings, expected earnings are the key input in this equation. If actual earnings turn out to be higher than expected, then the stock price needs to increase in order for the valuation to remain constant.

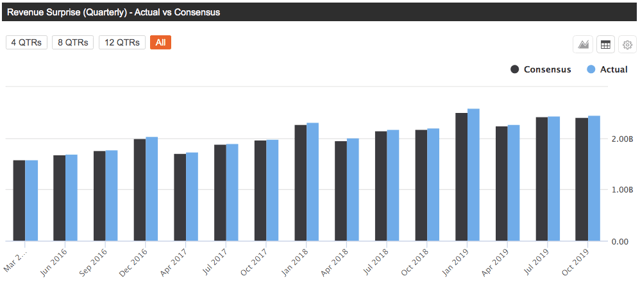

VMware has an impeccable track record of outperforming expectations in the long term. The company has delivered both earnings and sales figures above Wall Street expectations in each of the past 15 quarters in a row.

(Click on image to enlarge)

Source: Seeking Alpha Essential

(Click on image to enlarge)

Source: Seeking Alpha Essential

It's not easy to find companies that can outperform expectations with such a level of consistency over the long term, and this speaks well about management and its ability to deliver.

Valuation should be interpreted in a broad context, and investors should always incorporate other return drivers when assessing valuation levels. A company that generates strong profitability and consistently beats expectations deserves a higher valuation than a business with below-average profitability and underperforming expectations.

However, it is not easy to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

VMware has a PowerFactors above 80, so the stock is in the top quintile of companies in the US stock markets based on financial quality, valuation, fundamental momentum, and relative strength together.

An algorithm such as PowerFactors is built on current data based on past financial performance and expectations about future performance. This has some important limitations, especially when it comes to a company such as VMware.

At the end of the day, returns for the stock will depend on the cash flows that the business can produce in the future. The algorithm is saying that VMware is attractively priced based on current assumptions. But if the company fails to meet those assumptions, then the stock can be expected to deliver disappointing returns.

This is why backtested data for these kinds of models should always be taken with a grain of salt. The backtested data shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the long term, but this does not tell us much about how a specific company such as VMware is going to perform in a particular year.

In other words, the main strength of the algorithm is that it provides a quantifiable approach based on objective data to make investment decisions supported by evidence as opposed to opinions. However, the main weakness is that the algorithm does not consider the particular characteristics and the fundamental risks of different businesses when analyzing the data.

Risk And Reward Going Forward

The fact that Dell (DELL) owns over 80% of VMware is a considerable risk factor for investors since there is always the possibility that this could have a negative impact on incentives. For example, dividend policy or other capital allocation decisions could be implemented based on the needs of the major shareholder as opposed to focusing on the most efficient use of shareholder capital for VMware and its investors.

VMware is also prone to acquisitions, the company has made 43 acquisitions over time, including the recent purchases of Carbon Black and Pivotal for $2.1 billion and $2.7 billion respectively. The company is being strategically smart with these moves, but there is always the possibility of overpaying, and integration risk is a key factor to keep in mind.

From a business perspective, competition from cloud companies is generating lots of concerns around VMware and new technologies such as Kubernetes provide an additional source of risk. Operating in such a dynamic industry can be a double-edged sword, the opportunities for growth are particularly attractive, but the risk of technological disruption cannot be underestimated.

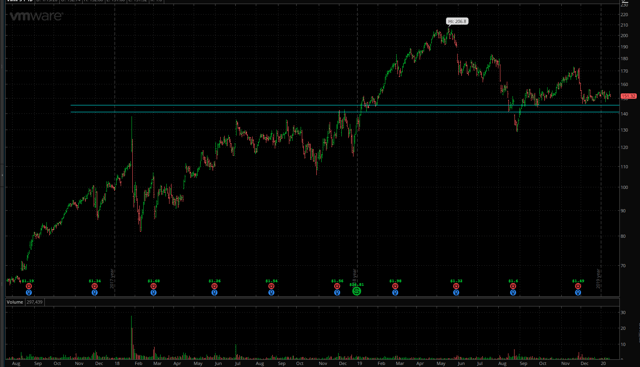

In times when the stock market is making all-time highs and tech stocks are also outperforming the market, shares of VMware are still trading at price levels first reached in January of 2019, and almost 27% below their highs of the year.

(Click on image to enlarge)

Source: ToS

VMware is facing some very real challenges in the middle term, but those challenges are already reflected in investors' expectations and in the stock price. Besides, the company is generating solid financial performance while also trading at remarkably attractive valuation levels.

For long-term investors who are willing to tolerate the short-term uncertainty, VMware stock could be an attractive opportunity at current prices.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more