VIX Explosion Overdue Or Something Far Less Sinister?

With markets at record levels, it's obvious that hedging activity is abound. "But the VIX was down this past week?" True... but down .17% when the S&P 500 (SPX) was up nearly .9% and with VIX options (VVIX) up nearly 5% on the week? Oh yea, folks are hedging! The VIX closed Friday's trading session at its lowest level since October 3, 2018, but managed to settle just above 12 in after hours. The VIX will naturally reset on Monday, and due to the lowered Friday bids of the prior trading week. With this in mind, don't get too excited if record highs in the S&P 500 continue alongside a rising VIX. This is a function of the VIX oscillating stochastic process, not abnormal for Monday's and despite what you may have heard in the past.

The 50 Cent mystery trader is back at it again. It looks like he/she was a VIX call buyer at the VIX Dec 18 expiration. The Strike Price is 23 for a total of 50,000 contracts at $0.50 Total open interest for the contracts at 23 equals 56,928.

The 50 Cent trader has made headlines over the last several years given the bets he/she makes that seem to highlight pending doom for markets and come with increasing volatility. The reality of the 50 Cent trader performance from these bets is something far less worthy of the headlines.

The history of the "mysterious VIX call buyer" headlines shows mostly losers, with a couple of big winners. Obviously, the last 50-Cent trade back in October proved a stinker, with the VIX, VIX futures and VIX ETPs moving ever-lower (Chart Sentiment Trader). It turns out, of the 9 trades publicized from the 50 Cent trader, only 3 were winners while 6 were stinkers. (Chart from SentimenTrader)

Again, this serves to highlight how the media sensationalizes such bearish market bets, when the results are far less noteworthy. This is not meant to discount the newly initiated 50 Cent trade, but rather to provide perspective. In keeping with the topic of hedging and the VIX complex, it should come as no surprise that Non-commercials’ net shorts rose to yet another record and for a 5th consecutive week, up by another 2,600 contracts.

Given the record short interest, again, ZeroHedge has made sure they hyperbolize the probabilities in their latest article titled "VIX Futures Hit New Record Short: Is a Historic Volatility Squeeze Coming?

In covering the subject matter and record-setting short VIX Futures positioning, they offer some thoughts from Goldman Sachs derivatives strategist, Rocky Fishman, who this past week writes that "to get a full picture of vol positioning, one has to look not only at VIX Futures but also VIX ETPs, which have become increasingly popular as hedges (perhaps not so much in February 2018, but we digress). Would you look at that, someone else finally offers what I've discussed at Finom Group (for who I am employed) for the last couple of weeks and earlier this year when short VIX Futures positioning was also at record levels. Alright, full disclosure, I am a consultant for Goldman Sachs London branch so... serves to figure that Goldman is now discussing the Vega disparity as you'll see below! But first let's take a brief look back at my notes to Finom Group members last week:

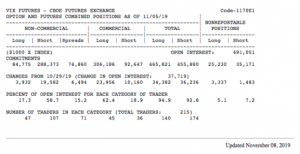

"From the COT Futures table above, reported as of November 8th, we can see the increase in short and long Futures positions compared to the previous week. The rows and columns are easily discernible from Non-commerical, Commercial, Total and Non-reportable. All we really care about are the first couple of rows and columns underneath to extrapolate value. It’s a fancy way to suggest one starts reading the columns at the top and work your way down in columns for each row."

- Example from COT table: Non-commercial’s increased VIX shorts by 15,650 contracts. From line two (Change from 10/29/19) simply subtract the short (19,582 – 3,932=15650) from the long contracts. If we do the same for the Commercials we take 23,956 – 10,160 = 13,796. The difference between the short and long Futures positioning across the total complex is just 1,854 net short Futures, which oddly enough is the average calendar day contract sales from individual VIX-ETPs. In other words, most of the short increase is being buffered with long exposure by the Commercial interest. It’s why VIX Term Structure is still carrying a rather unusually robust spread/roll yield.

"From the November/M1 Futures contract to spot VIX, there remains a greater than $2 spread/roll yield. For context, we would usually expect to see less than $1 roll yield with only 8 calendar days left in the November contract come Monday. The current price of the November contract suggest those long are not found believing that over the next 8 days, the VIX will remain at such low levels of the year. It’s a risky bet given the expiration date, but it doesn’t exonerate the probability of the VIX moderating higher. Additionally, and in the context of roll yield, there is presently a near $4 roll yield between the December contracts and spot VIX. Again, investors clearly believe the VIX will moderate higher in the future.

None of the aforementioned suggests the VIX will stay at these low levels or move higher. What we suggest is that the fear over the Non-commercial record short interest is nothing that has the ability to express what happened during Volmaggedon in 2018. And when we review long/shrot VIX-ETP Vega, the picture becomes that more clear as to why Volmaggedon is virtually an impossibility and why the long positioning is likely to cap VIX upside potential."

According to Fishman, the net vega position in VIX ETPs is now above $300mm vega, or roughly the equivalent of 300k VIX Futures: "This reflects conservative investor positioning since long VIX products can be used as a hedge."

And since derivative markets are zero-sum, the byproduct of long VIX ETP position (and corresponding long VIX Futures position from the “Commercial” group that likely includes ETP issuers) is a large short VIX futures position from the “Non-Commercial" group shown in the chart above, which Goldman sees as likely holding these shorts as part of relative value strategies.

"With the majority of VIX ETP assets in un-levered long strategies and very little activity in short ETPs, daily rebalancing of ETPs is not likely to materially exacerbate moves in volatility. "However, the constant shifting of exposure from the first VIX future to the second (currently from November to December) has the potential to be adding to VIX curve’s steepness." (More recent VIX Futures Term Structure Chart below)

The ZeroHedge article, with notes from Goldman Sachs, doesn't seem to portray the fear and hyperbole of doom that the publication usually offers readers. Ahhhh, but it's not quite finished yet.

"If Fishman is correct, there is "never point in worrying about record VIX net spec exposure ever, as every position merely represents an offset to an equally matched long position somewhere else. We know that's incorrect however, because the biggest one week surge on record in non-commercial specs took place during the February 2018 VIXplosion week, which confirms that not only were ETPs not perfectly hedged, but there was an epic VIX short squeeze which as many recall sent spot VIX into the 50s."

There it is, the fearful "false-finding" pervasion of ZeroHedge. Firstly, Rocky Fishman never said "never" in his notes. That's a ZeroHedge hyperbolic interjection. And clearly from the latest VIX-ETP Vega positioning and CoT report, the offsets are more than represented.

In fact, when we review the open interest within the totality of the VIX derivatives complex, we come to find the most probabilistic outcome over the next 30-days is as follows:

- VIX moves higher and finds underwater long hedges sold.

- VIX options and long VIX-ETP selling accompanied with SPX moving lower creates VIX headwind

- Sold hedges/VIX longs are found buying SPX/SPY thereafter

It's really all a rather beautifully orchestrated LONG SQUEEZE, if you follow the logic! Not a short squeeze at all. The end result is that volatility shorts will simply add to their short-VOL positions, rather than cover existing shorts.

And let's not forget their publication from October 2019 that highlighted a record short VIX Futures positioning and a possibility of the VIX heading to 65. Yep, 65 folks!

A rise in the VIX is not impossible, in fact its more probable the lower the VIX goes. But another Volmaggedon...? Based on positioning, this outcome is an impossibility without exogenous force factors at work. Don't let the agenda of ZeroHedge coerce you into thinking something greater is afoot by injecting a singular word, verb or adjective folks and if you desire to achieve more information on the Volatility trading complex, feel free to join me at finomgroup.com .