Vaxart: Slightly Cautious, Mostly Bullish

When we think of the major threats to our national security, the first to come to mind are nuclear proliferation, rogue states and global terrorism. But another kind of threat lurks beyond our shores, one from nature, not humans - an avian flu pandemic. ~ Barack Obama

The major reason Vaxart (VXRT) appreciated a massive 470% from $0.50 to $.2.34 within 30 days can be attributed to the buzz surrounding the COVID-19 pandemic – but don’t be fooled by that. Another reason was the aggressive exercise price of $2.50 per share fixed for the company’s forthcoming public offering of $10 million, the proceeds of which will be used in its product development and clinical trials.

Well, VXRT is not just about the COVID-19 hype and aggressive pricing – the company has plenty of substance. I am cautiously optimistic and bullish on this stock, and here’re the reasons why.

(Note that the stock got listed on Nasdaq in Sep 2019, and my analysis is based on available data, recent news, and events)

Product Pipeline

– Let’s start with the hot topic first – COVID-19. On Mar 18, 2020, VXRT entered into an agreement with Emergent BioSolutions (EBS), to develop and manufacture VXRT’s experimental oral vaccine candidate for COVID-19. Though Phase 1 trials are scheduled in H2 2020, the news propelled the stock to $2.34. My take on this whole COVID-19 vaccine development is that the market will be flooded with producers all of a sudden and, therefore, consider this news to be moderately bullish from the long-term POV.

– VXRT’s oral vaccine for norovirus (a contagious virus that causes vomiting/diarrhea) has passed its Phase 1 trials and its Phase 2/Dosage Confirmation Study will be initiated in 2020 on age group 18–64. The test may even expand to include the age group 65+. And if the FDA concurs, VXRT will initiate Phase 3 trials on Age group 18+ in 2020.

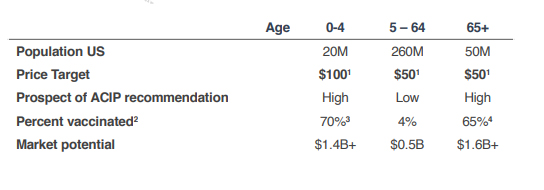

Image Source: Vaxart Presentation

The market potential for the norovirus vaccine is $2.1 billion for age groups 5–64 and 65+, for which the vaccination rates are poor. The company can also benefit to some extent from the age group 0–4, market which is worth $1.4 billion.

– The company’s H1 influenza vaccine oral tablet (VXA-A1.1) was compared to Fluzone, an injectable Quadrivalent Influenza Vaccine (QIV) in a study published by The Lancet on Jan 21, 2020. The study concluded that “orally administered VXA-A1.1 was well tolerated and generated protective immunity against virus shedding, similar to a licensed intramuscular IIV (inactivated influenza vaccine). These results represent a major step forward in developing a safe and effective oral influenza vaccine.”

– VXRT is also developing a universal flu vaccine in collaboration with Janssen. The vaccine will be tested in a pre-clinical challenge model in the first half of 2020 – the results are not far away.

The Global Vaccines Market

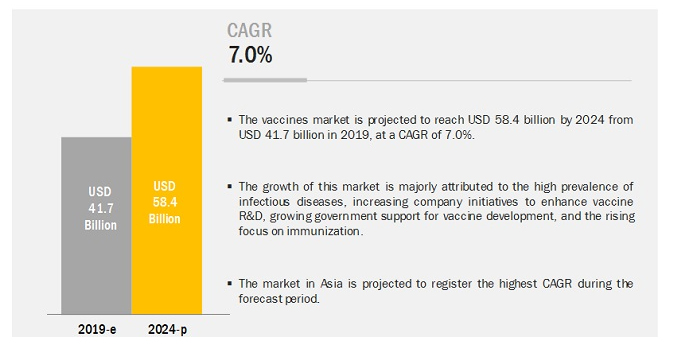

The global vaccines market is estimated to touch $58.4 billion by 2024 from $41.7 billion in 2019, growing at a CAGR of 7.0%.

Image Source: Markets & Markets

My guesstimate is that growth should pick up for flu vaccines because of the COVID-19 scare. The virus has roiled the global economy and self-quarantined people. It is natural to expect that humans will be more careful in the future. I also anticipate every government to support vaccine development going forward.

Financials

It’s too early to analyze VXRT’s financials and peg the valuations. The company’s cash flows are driven by stock offerings and as reported earlier in this post, the company is planning one more.

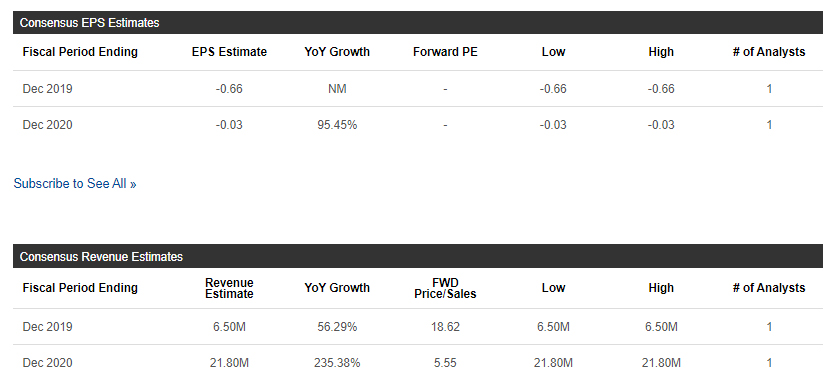

An analyst tracking the company has estimated that VXRT will report a 235% jump in year-over-year revenues in 2020 and slash its year-over-year negative EPS from (–) $0.66 in 2019 to (–) $0.03 in 2020, recording a 95% jump.

Image Source: Seeking Alpha

Summing Up

I am bullish on VXRT because:

(a) Its product pipeline is strong and is progressing well. The company’s H1 influenza vaccine oral tablet even trumped over Sanofi’s Fluzone. The norovirus vaccine is likely to be commercialized in 2021 and it is the company’s key asset.

(b) The vaccine market can experience exponential growth because of the COVID-19 scare. Note that this company should not be chased because of the COVID-19 hype.

(c) The market potential for VXRT’s norovirus is huge, especially in the 5 years and above age groups.

(d) Though the COVID-19 vaccine market will see a lot of competition, VXRT’s venture can help its brand image (it’s already helped the stock price).

The year 2020 is an important one for the company; the results of the trials will be exciting to see. In my opinion, the company has solid long-term potential and I would buy VXRT on a dip or slowly in a SIP.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more

I'm bullish on $VXRT

470%??? Holy Moly.