Used Car Prices Offer Brief Respite After Plunging Below Forecasts Last Month

Over the last few months we detailed how used car prices were set to cripple what little interest in new cars remains, how dealers are scrambling to desperately offer incentives, and how ships full of vehicles are being turned away at port cities due to a lack of space and inventory glut.

Today, it's looking like the market is seeing a much needed respite, even though it may be temporary.

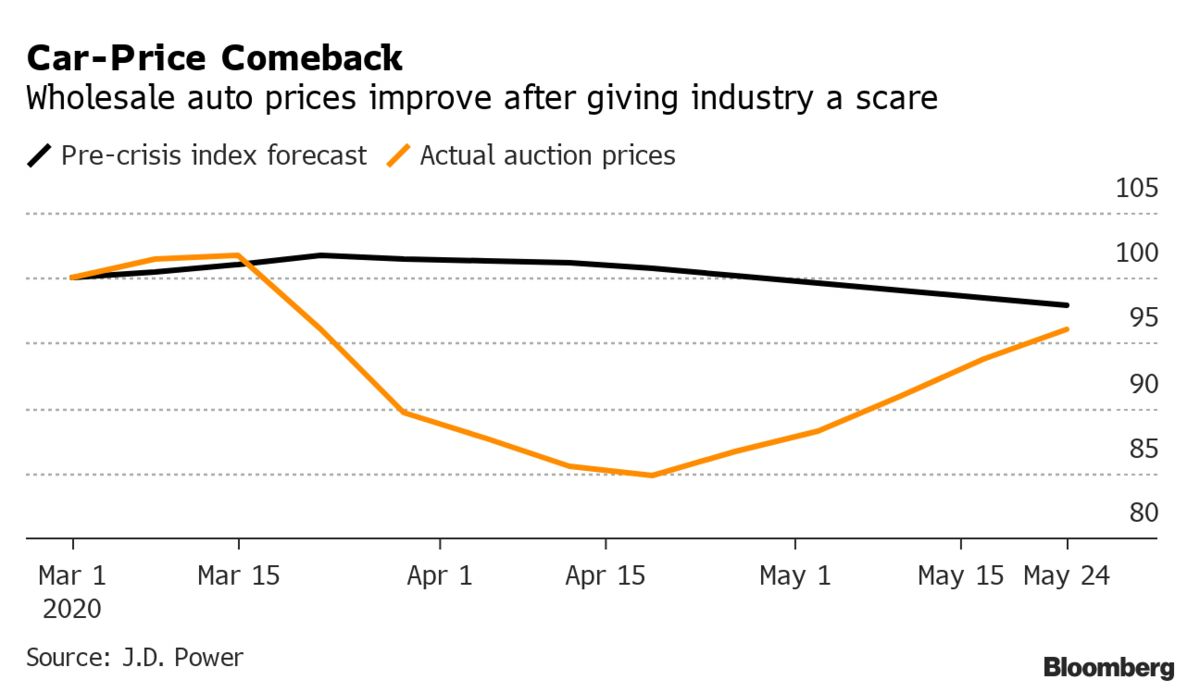

Used car prices are bouncing back from last month's low and approaching forecasts that were made prior to the pandemic. In fact, J.D. Power's weekly wholesale auction price index is now only down 1.9% from where it was expected prior to the virus.

Car auctions around the country were shutting down last month, and many in the industry had warned about the potential for prices to collapse as a result, according to Bloomberg. We had pointed out worries about used car pricing weeks ago, noting the pressure that a drop in pricing could put on manufacturers and rental car companies.

In fact, since then, Hertz (HTZ) filed for bankruptcy, while desperately trying to unload some of its rental car inventory.

As we reported previously, earlier last week Hertz dumped a bunch of Corvette Z06s on to the used car market, in what experts said was a great deal for buyers. And, more used car deals are starting to roll out on Hertz’s website after the company's bankruptcy filing announcement. As caught by Jalopnik, here’s a 2020 BMW 740i for $52,949 and only 8,595 miles on the odometer, more than $10 thousand below Blue Book value for cars in the same area.

We also pointed out how GM (GM), Ford (F), and others were set to lose billions as a result of a crash in used car prices. Mid-month April data from Manheim showed that the used vehicle value index had fallen 11.8% for the first 15 days of April, a decline on a record setting pace, according to Bloomberg.

Auto companies had only been expecting a 5% to 7% drop in used car prices. We also reported weeks ago that GM was only bracing for a 4% drop in prices, and that a further drop could put extreme financial stress on the company.

For example, Joel Levington, a credit analyst with Bloomberg Intelligence said last month: "GM assumed a 4% decline in residual values this year. If the 10% drop Manheim has seen recently persists, depreciation expense could counter the $1.9 billion that GM Financial earned in pretax profit last year."

Whether the respite in prices is temporary or permanent likely depends on how long the country can stay open again. With more legs in showrooms and business as usual at used car auctions, the market may continue to see a bid (albeit a stressed one, due to the financial shape of the U.S. consumer).

However, if the virus begins to spread again and the country is again placed on lockdown, automakers and used car sellers could be heading for round two of the very same hellish scenario they first experienced in April.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more