USDA February Crop & S&D Updates

Market Analysis

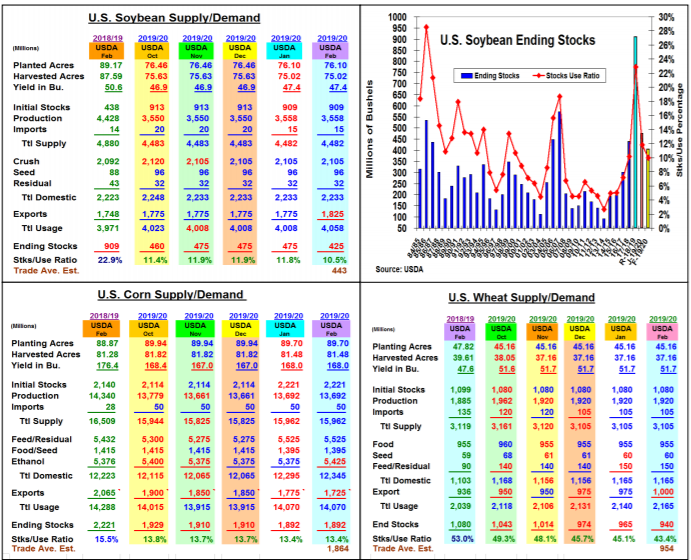

February’s USDA world crop and US supply/demand reports had some revisions. However, the cloud of the Chinese coronavirus health problem seems to have limited the market’s reaction to the lower than the trade’s US expectations. Despite lower US ending stocks, soybeans early strength quickly diminished and wheat’s lower 2019/20 stocks didn’t provide any support as fund liquidation weaken this pit’s values. Corn’s unchanged stocks were slightly above the trade average level, but it stayed above recent lows. Of note, Brazil’s higher soybean crop & the potential for larger S. American crops may have influenced the market’s post-report action, too.

In soybeans, the USDA did increase US exports by 50 million bu. to1.825 billion. With no change in US crush, this dropped US bean stocks to 425 million vs. the trade average of 443 million bu. Interestingly, this adjustment shaved soybeans stocks below 2017/18’s 438 million level and cut this year’s stocks-to-use ratio to 10%. The USDA raised its Brazilian soybean crop forecast by 2 mmt to 125 mmt, which was above the trade average. Given the recent rains, this wasn’t very surprising, but it kept buyers sidelined. The USDA did leave Argentina’s bean estimate at 53 mmt.

Corn’s unchanged US old-crop stocks were a bit a surprise. The USDA did slice 50 million bu. in exports, but they also upped corn’s ethanol demand by 50 million bu. After a slow start, this year’s domestic biofuel demand has been robust in the past 2 months. Some optimism about Chinese ethanol and DDG demand may have been a factor too. No change in S America’s corn crop outlooks were made this month and world’s ending stocks were shaved by 1 mmt.

The World Board also upped US wheat’s export forecast by 25 million to 1.0 billion bu This clipped US stocks to 940 million bu., the lowest level since 2014/15 US crop year’s 753 million ending stocks. No crop changes in the world’s major wheat producers were made this month.

(Click on image to enlarge)

What’s Ahead

With many hoping for more old-crop demand from the recent US/China deal, the trade will now focus on the upcoming Ag Outlook Forum. We’ll update our 2020/21 ideas ahead of the USDA’s S&D numbers on Feb 20 & 21, which should include their Chinese demand ideas. Utilize March rallies to price 10% of your corn & beans at $3.88-90 & $9.00-10 and 15% of your new crop output at $4.00-05 & $9.35.