USDA August Crop Report - Despite Smaller US Bean Area, Bigger Corn And Wheat Crops Stun Markets

Market Analysis

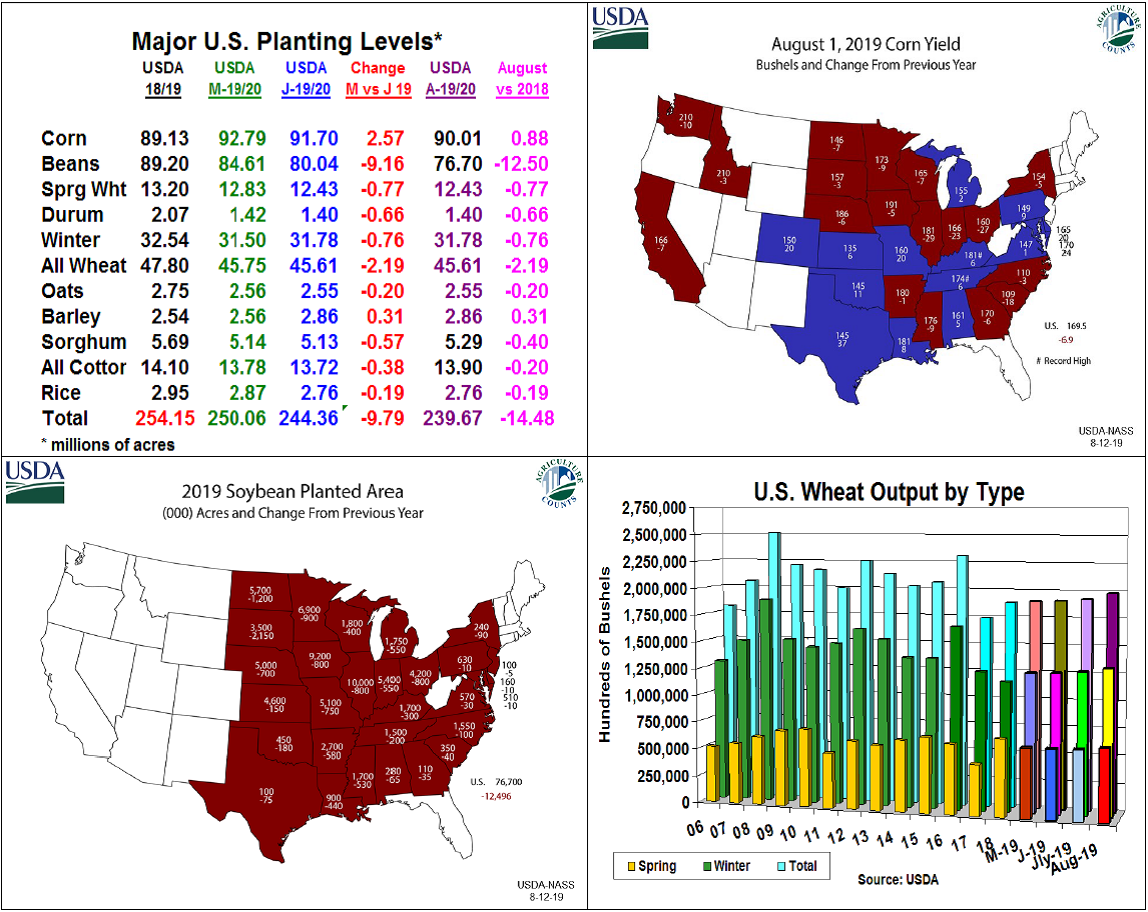

The USDA’s special resurvey of US corn & soybean acreage began this month’s unexpected data when more corn and less bean plantings were revealed vs. the trade average estimates. Adding to the negative atmosphere was this month’s 2% increase in the US corn yield fore-cast when unchanged to slightly lower was expected. Wheat’s 3.1% rise in 2019’s overall US output added to the cloud over grain prices on Monday. Overall, the US 8 major crops area was 4.69 million acres lower than June’s plantings at 239.7 million and the lowest seeding level since the mid-1990s Freedom to Farm legislation.

Corn’s 3.5 bu higher US yield to 169.5 per acre was Monday’s big surprise when it countered this month’s 1.7 million lower seedings at 90 million acres. The USDA cut IL, IN and OH’s yields sharply, but higher yearly yields in the SW and just a modest reduction in the WCB were behind Monday’s higher yield. Overall, August’s US corn output rose 26 million bu. vs the trade’s 680 million average lower crop. This larger output also boosted corn’s 2019/20 stocks by 170 million bu. to 2.18 billion.

In soybeans, this week’s 3.7 million lower seedings than June’s acreage level was the major price factor since the USDA left its yield estimate unchanged at 48.5 bu. this month. IL, IN and OH yields were cut sharply, but modest declines in the WCB and slightly higher SE yields this month countered the ECB. Lower seedings occurred in ECB, Delta, and the Dakotas while IA, NE, and MN were mostly unchanged. This month’s smaller plantings sliced US bean output by 165 million and 2019/20’s stocks by 40 million when the USDA cut exports by 100 million bu.

This month’s larger US wheat output was lead by high-er hard red & spring yields across US Plains. Overall, 2019’s winter wheat crop rose 35 million bu. to 1.326 billion while this month’s higher ND (+3 bu) and MT (+2) yields advanced spring’s crop by 24 million.

(Click on image to enlarge)

What’s Ahead

After this week’s price break, KC wheat and corn are at or near monthly lows. Given 2019’s erratic weather patterns in the Central US and the Northern Hemisphere hold sales for now. The upcoming ma-jor US crop tour that begins next week could provide some modest price recoveries. Utilize 12-20 cent corn and soybean rallies to clean up old-crop supplies and have 40% of your 2019 crops priced.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more