US Stocks Continued To Lead Global Risk-On Rally Last Week

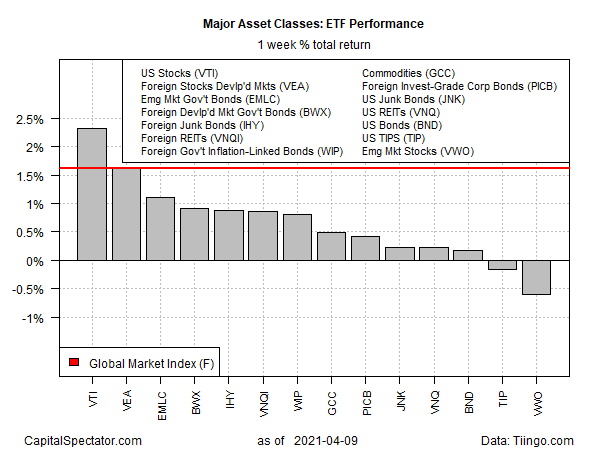

For a second week, American shares were the top performer for the major asset classes in last week’s risk-on rally, based on a set of proxy ETFs through Friday’s close (Apr. 9).

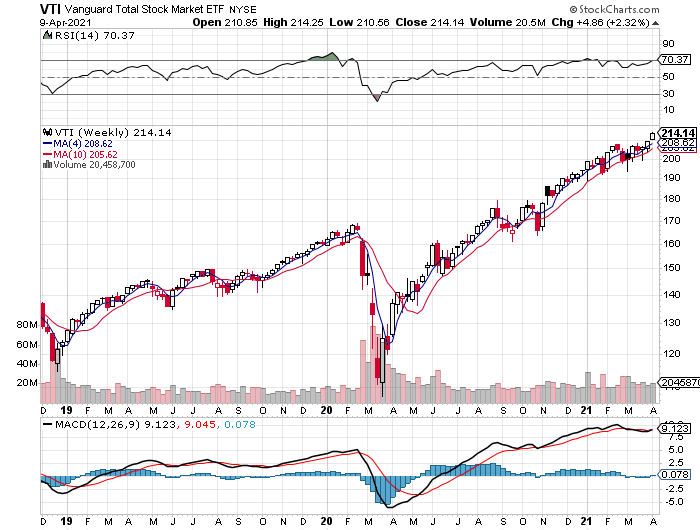

Vanguard Total US Stock Market (VTI) rose 2.3%, marking the third consecutive weekly gain for the fund. The increase lifted the ETF to another record high at the close of trading on Friday.

“There’s a certain amount of logic to markets right now,” opines Art Hogan, chief market strategist at National Securities. “It’s less about irrational exuberance in the overall market, less about the 1999-2000 levels, and more about what’s the driver. The driver is clearly an explosion in economic activity that likely will have some earnings growth in its wake.”

Nearly every market rallied last week. The exceptions: inflation-linked Treasuries and emerging markets stocks, the latter suffering the deepest setback. Vanguard Emerging Markets (VWO) slipped 0.6% last week as the ETF continues to churn in trading range that’s kept the fund in check over the past month or so.

The broad-based rally lifted the Global Markets Index (GMI.F) last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETF proxies, rose 1.6% — the third straight weekly advance for GMI.F.

Turning to the one-year trend for assets, US stocks are still the top performer for the major asset classes for this time window too. Vanguard Total US Stock Market (VTI) is up 56.1% on a total return basis over the past 12 months.

Note that one-year returns for global markets generally are unusually high at the moment because year-ago prices were dramatically depressed due to the coronavirus crash. Accordingly, trailing one-year results will remain temporarily elevated due to extreme year-over-year comparisons until last year’s markets collapse washes out of the annual comparisons.

All the major asset classes are posting one-year gains through last week’s close. The softest increase: investment-grade bonds in the US via Vanguard Total Bond Market (BND), which is up a slim 0.5% total return vs. the year-ago price (252 trading days.

GMI.F is currently posting a 39.5% rise for the past year.

Monitoring funds through a drawdown lens shows that US stocks are still posting the smallest decline from the previous peak for the major asset classes. Thanks to VTI’s rally to a record close last week, US equities enjoy a zero drawdown.

The deepest drawdown is still found in broadly defined commodities via GCC: the ETF, which equally weights a broad basket of commodities, is down 35.4% from its previous high.

GMI.F’s current drawdown is currently at 0%, thanks to last week’s rally that lifted the benchmark to a record high.

Disclosures: None.