US Stock Market Weekly Review June 1- June 5, 2020

The US stock market closed on Friday, June 5, 2020, with weekly gains for all major stock indexes, with an unexpected May jobs report being a financial catalyst driving stocks higher. The Nasdaq (QQQ) hit a new record, the S&P 500 (SPY) is near to breakeven for 2020 and the Dow (DIA) has significantly trimmed its losses on a year-to-date basis. In our previous weekly stock market update, we wrote that “we believe that now the stock market and many of the stocks are disconnected from the fundamentals and the severity of the negative economic impact the coronavirus crisis has on the real economy.” With oil prices, rising inflation will soon be an economic indicator to monitor, and the bond yields rise this week signals that the risk-on sentiment in investing is dominant for now. Small-cap stocks outperformed this week, a rotation in stocks that is also dominant for quite some time lately.

We still believe that corporate earnings and profitability are the key drivers along with the labor market for the direction of the US stock market. And that valuation of stocks is both distorted by the latest earnings and ignored at these price levels. What is also important to mention is that the real unemployment rate may be higher than reported.

“The unemployment rate fell to 13.3% in May, according to a Bureau of Labor Statistics report on Friday.

The agency admitted the real unemployment rate likely exceeds 16%.

That is due to an error in how furloughed workers were treated in the data sample. April’s unemployment rate would have been nearly 20% absent that same error.” Source: CNBC

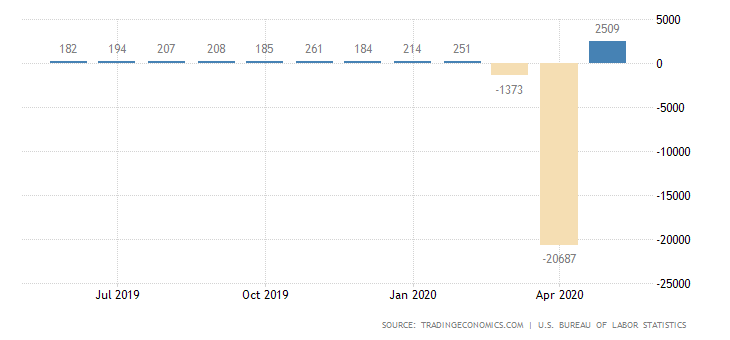

United States Non-Farm Payrolls

“The US economy unexpectedly added 2.5 million jobs in May, the most on record, beating expectations of an 8 million cut, and after declining by a record high of 20.7 million in April. Large employment increases occurred in leisure and hospitality, construction, education and health services, and retail trade while government employment continued to decline sharply. The change in total nonfarm payroll employment for March was revised down by 492,000 to -1.4 million, and the change for April was revised down by 150,000 to -20.7 million. Figures for May suggested the economic recovery in the US may happen much faster than initially expected. However, riots and looting during protests over the death of George Floyd can be a threat to the recovery as many states have declared the state of emergency and set curfews while mass protests could lead to the second wave of coronavirus cases.” Source: Trading Economics

For the week of June 1– June 5, 2020, the major US stock market indexes closed as follows on Friday, June 5, 2020:

• Dow Jones Industrial Average: Close 27110.98, +6.81% for the week, -5.0% Year-to-date

• S&P 500 Index: Close 3193.93, +4.91% for the week, -1.14% Year-to-date

• NASDAQ: Close 9814.08, +3.42% for the week, +9.38%, Year-to-date

• Russell 2000: Close 1507.15, +8.11% for the week, -9.67% Year-to-date (IWM)

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. American Intl Group Inc WT (AIG-WT) Close 2.50, 5-day change +177.78%

2. Amplify Energy Corp (AMPY), Close 2.24, 5-day change +103.64%

3. Tupperware Corp (TUP), Close 6.49, 5-day change +100.93%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Orasure Tech Inc (OSUR), Close 10.34, 5-day change -28.92%

2. Nextcure Inc (NXTC), Close 25.46, 5-day change -18.42%

3. Biomerica Inc (BMRA), Close 5.35, 5-day change -17.31%

Economic events for the week June 8- June 12, 2020:

Important economic data for this week will be inflation, the consumer sentiment, and the Federal Reserve rate decision. We do not expect any economic surprises by the Fed but the comments about the state of the economy, inflation, and the broader economic outlook, plus any unexpected further economic stimulus could move the stock market and the US dollar.

Sources:

Wall St. Journal; Barchart.com; FXStreet

Disclosure: I have no position in any stock mentioned