US Stock Market Weekly Update April 20- April 24, 2020

All of the major stock indexes fell this week ending on April 24, 2020, and a turmoil in the oil market was the main event to focus on, as on Monday, April 20, 2020, the oil futures contract for West Texas Intermediate crude oil, which was due to expire the following day, closed at -$37.63 per barrel, and was the first time that oil prices turned negative.

Key economic data released during the week showed a continuing weakness in the US job market. Another 4.4 million Americans filed jobless claims in the week ended April 18, and this made the five-week total to more than 26 million. Another $484 billion spending bill passed by the House of Representatives acted as a support for the investing sentiment, and the stock market now seems to weigh on bad news somehow like good news. What I mean is that the number of jobless claims marked the third consecutive week of declines, a trend we mentioned in our previous weekly update.

Another trend worth mentioning is that the VIX index on Friday, April 24, 2020, closed at 35.93-5.45 (-13.17%), and at the lowest level for the week. This is important because a sustained decline of the VIX index will make the stock market more investable.

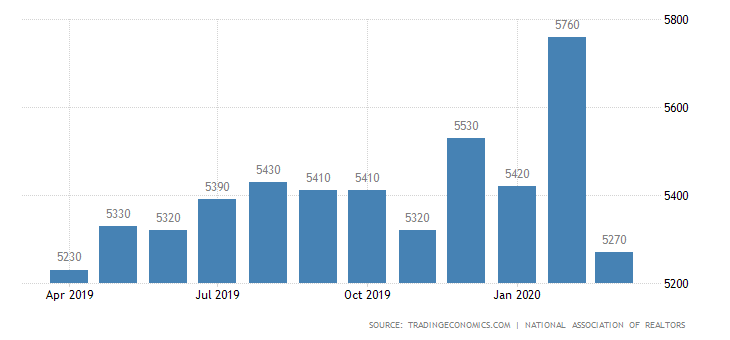

The United States Existing Home Sales

“Sales of previously owned houses in the US sank 8.5 percent from the previous month to a seasonally adjusted annual rate of 5.27 million units in March of 2020, slightly below market expectations of 5.3 million. It is the biggest drop since November of 2015 but the lowest rate since April of 2019 only. The data includes contracts signed in January and February before the coronavirus took a toll on the economy.”

Source: Trading Economics

On Tuesday, April 21, the USD Existing Home Sales for March 2020 came in at 5.27 million, missing the expectations of 5.30 million and having a decline of 8.5% as mentioned above. The housing market is another key financial market to monitor for the US economy and its growth. Why?

“Housing’s combined contribution to GDP generally averages 15-18%, and occurs in two basic ways:

Residential investment (averaging roughly 3-5% of GDP), which includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes, and brokers’ fees.

Consumption spending on housing services (averaging roughly 12-13% of GDP), which includes gross rents and utilities paid by renters, as well as owners’ imputed rents and utility payments.”

A contribution of about 15% to 18% to the GDP is especially important to monitor. Still, this large decline may be an outlier number due to the coronavirus. Any sustained trend decline to the housing market can only have an additional negative impact on the US GDP growth.

For the week of April 20– April 24, 2020, the major US stock market indexes closed as follows on Friday, April 24, 2020:

• Dow Jones Industrial Average: Close 23775.27, -1.93% for the week, -16.69% Year-to-date (DIA)

• S&P 500 Index: Close 2836.74, -1.32% for the week, -12.20% Year-to-date (SPY)

• NASDAQ: Close 8634.52, -0.18% for the week, - 3.77%, Year-to-date (QQQ)

• Russell 2000: Close 1233.05, +0.32% for the week, -26.10% Year-to-date (IWM)

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Inovio Pharma (INO) Close 14.59, 5-day change +76.63%

2. Antero Resources Corp (AR), Close 2.25, 5-day change +63.04%

3. Montage Resources Corp (MR), Close 6.09, 5-day change +60.26%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Pennsylvania Rl Estate Invt TR (PEI), Close 3.51, 5-day change -35.77%

2. Invesco Mortgage Capital Inc (IVR), Close 2.66, 5-day change -27.91%

3. Marlin Business Serv (MRLN), Close 5.50, 5-day change -26.37%

Economic events for the week April 27- May 1, 2020:

Important economic data for this week will be the first-quarter GDP estimate, the Federal Reserve rate announcement, and the manufacturing Purchasing Managers' Index. Also, it will be another week full of earnings reports, and this can add further volatility to the stock market.

Disclosure: I have no position in any stock mentioned