US September Crop/S&D Report - Smaller Corn & Bean Crops, But Warming Trade Talk Rally Prices

Market Analysis

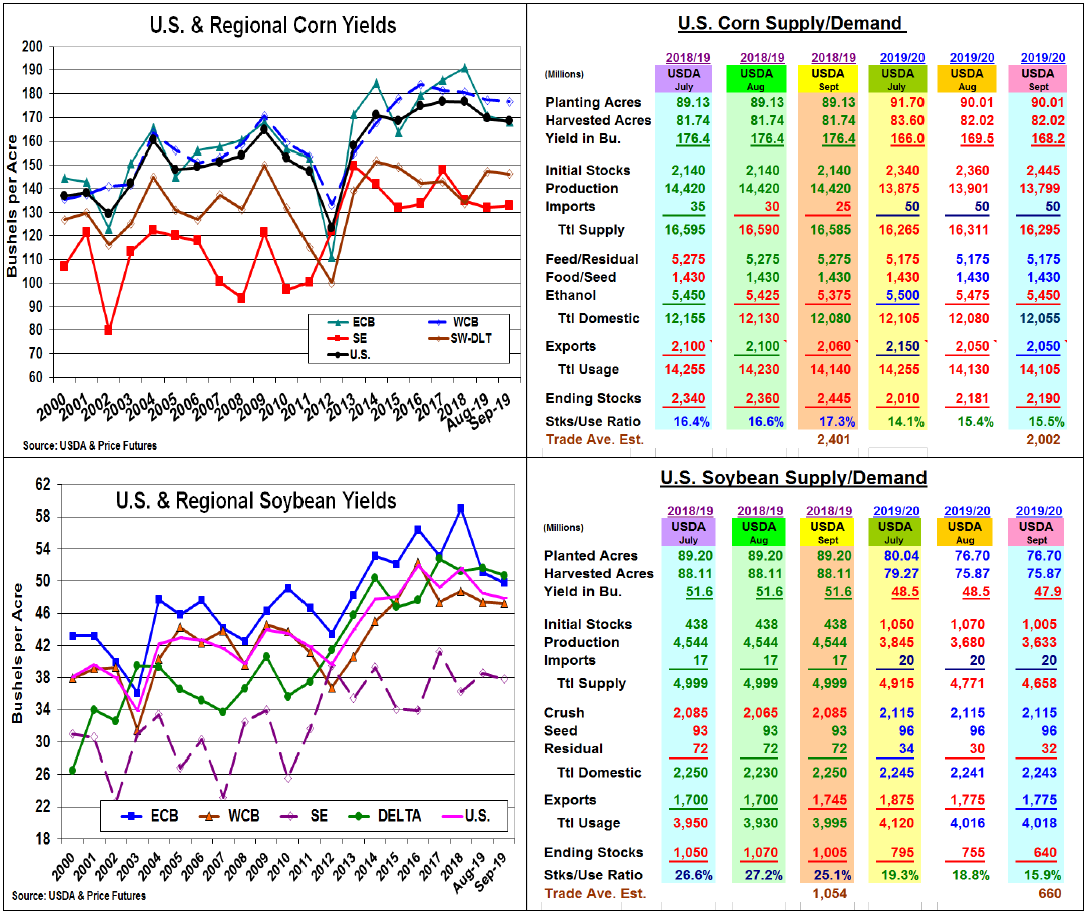

This month’s USDA production estimates were less than August's surprising levels but were higher than the trade’s expectations. Despite this situation, prices rallied on Thursday. Moderating gestures from both China (dropped some import tariffs) and the US (postponing its Oct 1 tariffs to Oct 15) ahead of upcoming trade talks began firming values overnight. Rumors of possible Chinese purchases were also stoked when this week’s US export sales had a 10,900 MT Chinese pork purchase. This lead to a late morning wire service report of a 600,000-ton soy-bean sale to China keeping this oilseed firm into its close. Optimism about the upcoming US/China trade talks leading to some type of agreement was the major factor in yesterday’s performance along with expectations of further US corn and soybean yield reductions on upcoming crop reports.

September’s US corn output was placed at 13.8 billion bu., down 102 million bu. from August. Nationally, corn’s yield was down 1.3 bu to 167.2 bu, but it was still 1 bu. over the trade’s average estimate. Regionally, the ECB’s yields slipped the most by 2.2 bu. while the Delta/SW (-1 bu.) and the WCB (0.5 bu.) were off slightly. The USDA also sliced old-crop demand from ethanol (50 mil bu.) and exports (40 mil) which compensated for this month’s smaller crop. This left corn’s 2019/20 stocks virtual-ly unchanged at 2.19 bil bu.

Soybeans modest 0.6 bu. lower yield to 47.9 bu. was also 0.7 bu. higher than the average. Overall, the US crop was projected at 3.633 billion, down 47 million vs. the trade’s 100 million bu. decline. The E Midwest also had the largest regional yield drop of 1.3 bu. while the Delta (0.9 bu.) & SE (0.7 bu.) had smaller yields. The W Midwest (0.1 bu) limited this month’s US decline. Late season O/C export & crush jumps (+80 mil bu) helped cut bean’s N/C stocks to 640 mil bu.(20 million below expectations)

With no US wheat output update until the Small Grain Report on 9/30, the USDA left its US balance sheet unchanged. Australia's crop was cut 2 mmt to 19 mmt while September’s world wheat stocks increased only 1 mmt this month.

(Click on image to enlarge)

What’s Ahead

The USDA’s modest yield reduction approach is surprising given 2019’s record late maturity of crops. This has led to the lowest Sept ear count & the 2nd lowest pod count since 2013. This could limit many fields seasonal increase in these numbers given weather remaining important for the 4-5 weeks. Given the erratic US/China trade talks, move Nov sales to 50% on $8.99-$9.10 strength.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more