US Oil Inventory Surprises To The Downside

Energy

Crude oil inventory and supply forecasts: The weekly data from the American Petroleum Institute (API) supported oil prices yesterday. The API reported a fall of 541Mbbls for US crude oil inventory over the last week; quite different from the 1.5MMbbls of inventory-build that the market was expecting. Cushing inventory was reported to have fallen by 1.2MMbbls. Gasoline and distillate inventory were seen increasing by 2.3MMbbls and 0.9MMbbls respectively. Official and more widely followed EIA data is scheduled to be released later today. Meanwhile, in the recently released Short-Term Energy Outlook, the EIA increased its crude oil production forecasts from 12.26MMbbls/d to 12.29MMbbls/d for 2019, and from 13.17MMbbls/d to 13.29MMbbls/d for 2020. The incremental growth forecasts are somewhat at odds with the market expectations as drilling activity has been slowing down recently and oil companies were seen cutting on exploration budgets to cope with the demand slowdown and low prices.

Coal supply disruption: Thermal coal prices in the Chinese market have been strengthening recently due to increased winter demand and some supply disruptions from Australia. The rail network at Hunter Valley in Australia, which connects coal mines to the Waratah and Newcastle ports, has been closed since the beginning of the week due to wildfires. Both the ports have an export capacity of around 210mt pa (both thermal and met coal) and supply disruptions to these shipping terminals could create shortages in Japanese and Chinese market where the majority of the Australian coal is exported to.

Metals

Iron ore quality premium: the price spread between 66% and 62% iron ore has been strengthening recently as demand for higher quality iron ore improves due to upcoming winter cuts. BBG data shows that premium for 66% IO fines over the 62% IO fines increased to US$8.1/t yesterday compared to an average of US$2.7/t in October 2019 and a bottom of negative US$2/t made in late July 2019. China has released the clean-air plans for 2019/20 earlier in the week which targets restrictions on steel capacity in the region. Subsequently, steel mills have been increasing demand for higher quality iron ore to maintain steel production with curtailed capacity. On the supply side, the Australian Pilbara Ports Authority disclosed that iron ore shipment to China dropped by 0.7% MoM in October whilst earlier Vale has also trimmed its iron ore sales guidance for the year.

Base metals prices: Base metals prices fell across the board on Wednesday after trade deal hopes were dashed. Zinc saw the biggest loss today though time spreads still look tight. Short term demand outlook from China appears bleak as the market is worried about further potential weakness from galvanizers impacted by steel mills' curtailment in the coming heating season.

For copper, the market focus continues to be on-demand concerns given that there has been a lack of positive indicators lately; Tuesday's report on strikes in Chile has not had a meaningful impact on the supply. On the positive side, LME COTR data (a week lag) reported earlier that net bullish bets had grown last week particularly in aluminum where it increased to the highest level year-to-date. In large part, this reflects investors' improved risk appetite; however, whether this trend can hold this week remains in doubt.

Agriculture

Cocoa prices: Cocoa prices in the US have gained around 7% in the week so far on concerns over tightening supplies; cocoa prices have now increased to a more than 1-year high of US$2,675/t. Dec/Mar spread for cocoa futures have tightened from US$10/t of contango a week ago to US$20/t of backwardation currently, which reflects that the demand for cocoa in the spot market has been stronger. Increasing bullish bets on cocoa, low stockpiles in exchange warehouses and US$400/t of premium charged by West African suppliers have been tightening the physical market.

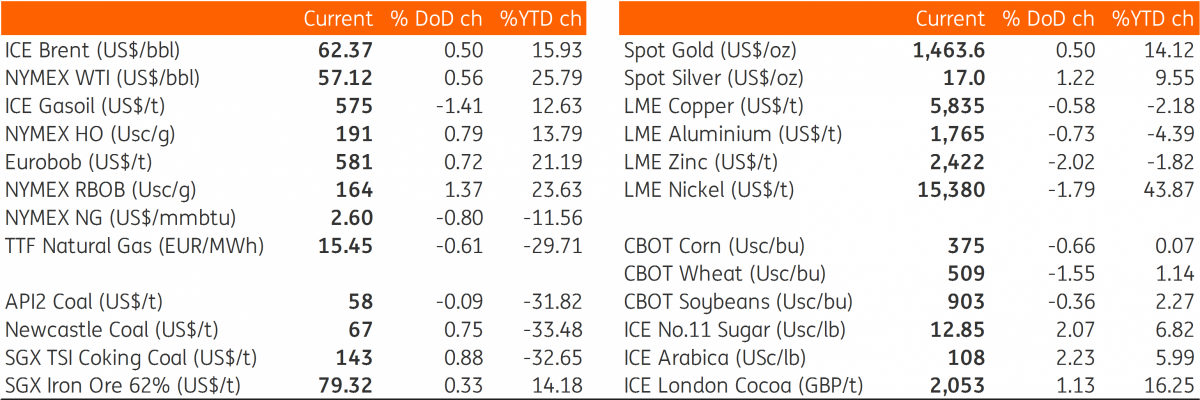

Daily price update

(Click on image to enlarge)

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more