ZIV/MYRS – How To Go On After The Crash

I have been asked in several emails on how to go on with existing ZIV positions, so here is a short note for our subscribers which still hold MYRS/ZIV positions.

As you know underlying to ZIV are short positions of the VIX Futures month 4-7. So ZIV moves are about the same as the moves of the medium price of these Futures.

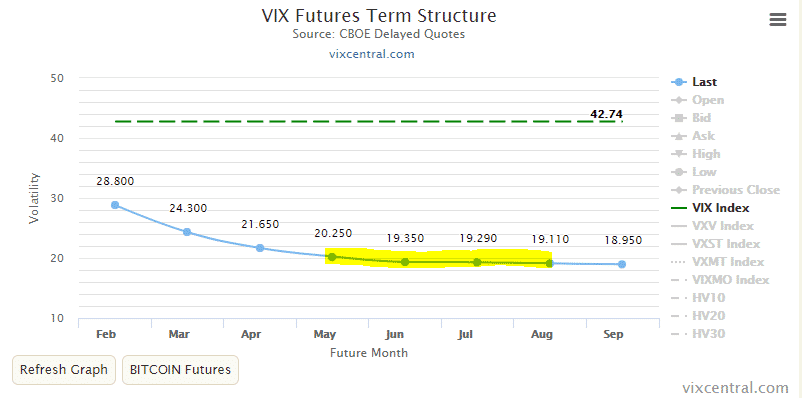

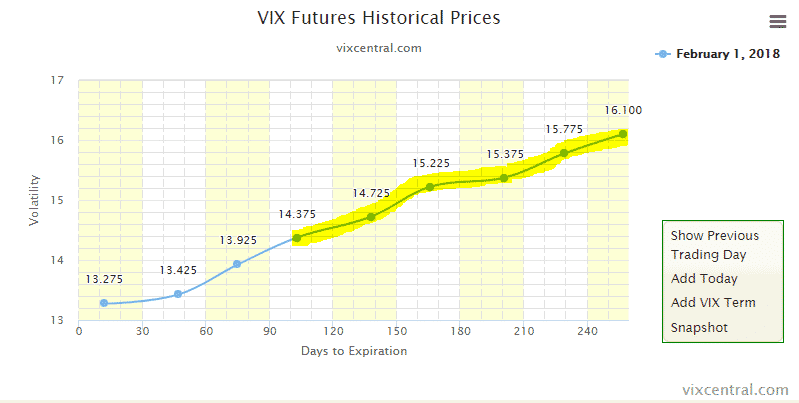

As you can see in the above VIX term-structure chart, the medium price for this Futures is about 19.50$. On February 1st, this medium price was about 14.70$, so its up about 4.80$ which should translate in a 30% drop of ZIV. Today’s price of 19.5$ however is still quite low, and this price can well go to the region of 25$. If the correction continues or markets go sideways with high volatility, then ZIV can further go down quite a lot.

This said I would not recommend to invest in ZIV at the moment. We also already said this in our last monthly strategy post.

However if you are not afraid and still want to profit from the volatility spike and if you can trade VIX Futures, then the much safer way is to buy VIX calendar spreads. For this you would for example sell the VIX May Future and buy the September VIX Future. The price for such a spread is – 1.30$. This way you only invest in the price difference of the Futures and if these go up to 25$ you will probability not notice much as the September Future will make up the losses of the May Future.

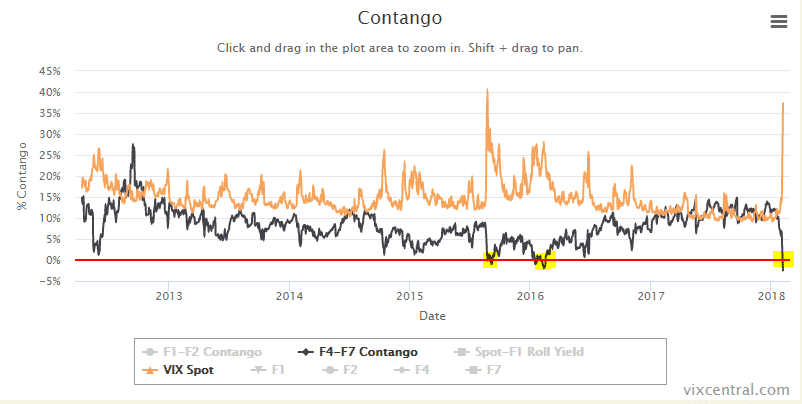

This VIX Future spread price of -1.30$ is a very rare occasion. Normally the curve is in contango which means that the further out a VIX future is, the more expensive it is.

We only had 3 similar occasions within the last 10 years where the mid-term VIX structure inverted. This was in 2011, 2015 and 2016 and the situation remained like this only only a few days.

Going back to February 1. this Future spread had a price of 1.725$ which means that you can make about 3$ if the slope goes again to the normal contango situation.

Sure you can also lose something because the slope can become more negative than 1.3$ but the risk of a generally rising volatility is much smaller as for a normal ZIV position.

Be aware that trading VIX Futures is only something for experienced investors. Because they expire, you will need to roll these Futures every month.

For all other investors, I would recommend to wait until volatility of these mid-term futures which make up ZIV go higher to at least 23 and then you can invest more in ZIV.